Well now, gather ’round, folks! Hyperliquid has just pulled off a bounce that would make a cat jealous, springing back into its range after a little charade of a downward tumble. In this here breakdown, we’ll take a gander at what levels are worth our attention next, and where this wild ride might be headed if the momentum keeps on truckin’.

Hyperliquid (HYPE) has recently shown signs of a bullish reversal, like a rooster crowing at dawn, after a brief dip below its range low. With a confirmed reclaim and a clean bullish retest, the current price structure suggests that higher prices are on the horizon, like a pot of gold at the end of a rainbow. As long as that pesky deviation low holds firm, traders ought to keep their peepers peeled on this setup as it builds bullish momentum like a steam engine on a roll.

Key Points:

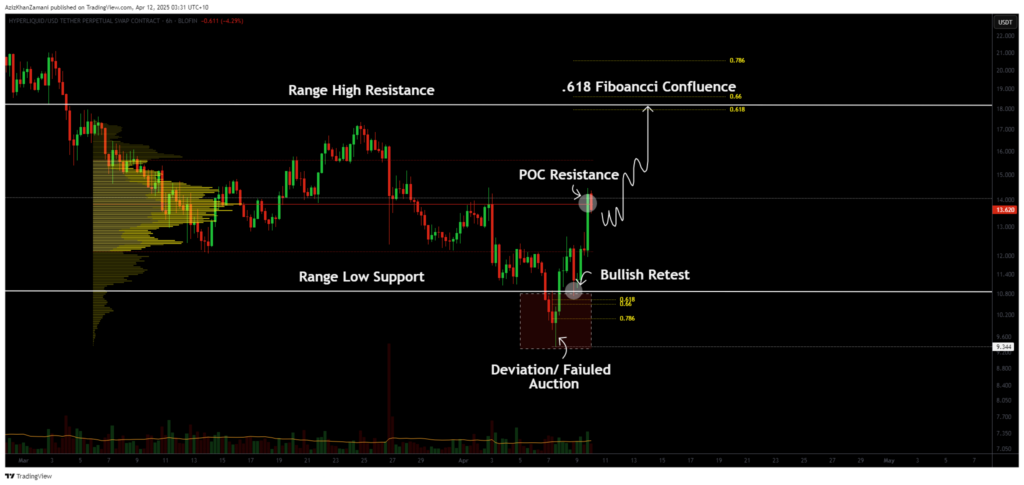

- Price dipped below $9.34 before reclaiming the range — a failed auction signal, bless its heart!

- Bullish retest of the range low aligned with the 0.618 Fibonacci retracement — a fancy term for a well-respected area among traders.

- Current consolidation could lead to a breakout toward $18.50 — the range high, where dreams and dollars collide!

Deviation of the range low

Hyperliquid established a key swing low at $9.34 before quickly reclaiming the previous trading range. This price action formed what is considered a deviation or failed auction, a signal that sellers were unable to push the market lower and were instead trapped beneath the range, like a cat in a bathtub.

The reclaim was not just emotional but technical, with a precise bullish retest of the range low that aligned perfectly with the 0.618 Fibonacci retracement level — a well-respected area of interest among technical traders, akin to a favorite fishing hole.

Following this reclaim, two consecutive bullish engulfing candles confirmed renewed momentum, pushing price back into the point of control — the zone where the highest volume has been traded within this range. This shows that market participants are stepping back in with conviction, like a dog returning to its favorite bone.

Now, price action finds itself consolidating in the middle of the range, forming a textbook bull flag or shallow pullback pattern. If this resolves upward, it could provide a springboard toward the next major resistance zone, like a frog leaping for the lily pad.

The next upside target lies at $18.50, the top of the range and another 0.618 Fibonacci resistance level. As long as the deviation low at $9.34 holds, this structure remains firmly bullish. However, traders should watch closely: any breakdown below that level could invalidate the setup and spark a downside move, like a balloon losing air.

For now, the bullish scenario remains valid. This setup offers a strong opportunity for short-term swing traders, but only with proper confirmation. Wait for a breakout above local resistance with strong volume support before entering. Patience in such setups often leads to better trade entries and reduced risk exposure, much like waiting for the right moment to catch a fish.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-11 21:33