I’ve always had this recurring dream where I sit in a car dealership, quietly judging the financial literacy of everyone around me while trying not to spill my coffee. It’s usually during moments like these that I remember why dividends exist: to remind shareholders that at least someone cares about us besides our mothers. Ford Motor Company (F) flashes a 5%-plus dividend yield at you like a neon sign saying, “Look at me! I’m responsible!” And, in a vacuum, that would be impressive.

But, as anyone who’s ever tried to assemble IKEA furniture without crying can attest, one impressive number rarely tells the whole story. Enter General Motors (GM), whose dividend yield barely scrapes 1%-which on paper makes it seem like the sad kid at the financial buffet. Except that GM has been quietly buying back its shares like a teenager hoarding candy in the closet, which, when tallied together with its modest dividend, suddenly makes it the overachiever at the table.

Ford’s Commitment (and Its Quirks)

I do tip my hat to Ford. They’re committed to handing over 40% to 50% of adjusted free cash flow to shareholders. Last year, that translated to about $3 billion in dividends. They even sprinkle in supplemental dividends, like a dessert at the end of a slightly dry financial meal. In 2025, they’ll deliver $0.60 per share in regular dividends, plus a first-quarter supplemental of $0.15 per share. The Ford family, with their controlling stake, collects their slice too-about $55 million-keeping their interests charmingly aligned with ours. I imagine them at a Thanksgiving table, passing gravy and dividends in equal measure.

It’s comforting, in a vague sort of way, that when Ford’s board decides on payouts, the people holding the special voting shares are likely thinking, “Don’t screw this up.” But comfort is a fleeting thing, like realizing your latte is actually a decaf.

GM: The Quiet Overachiever

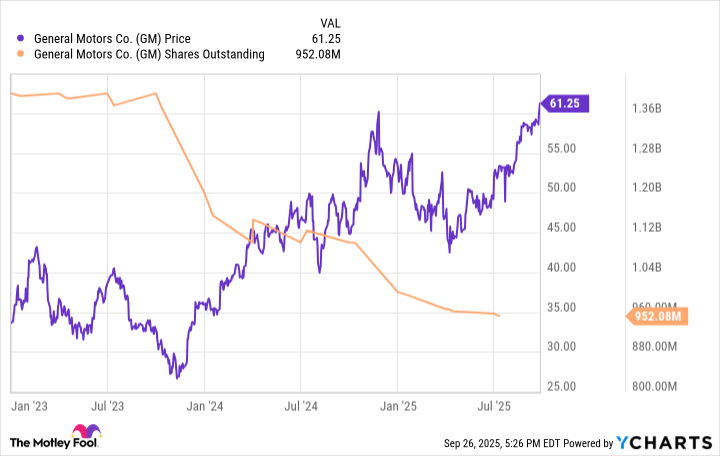

Meanwhile, GM’s stock has quietly marched upwards. Not with the flamboyance of Ford, but with the quiet satisfaction of a kid who found $20 under the couch cushion. Their total yield-which combines dividends and the effects of share repurchases-paints a much more flattering picture. Total yield is the sort of thing you whisper to your more financially nerdy friends, like a secret code: GM’s total yield hits a remarkable 14.29% when accounting for buybacks, compared with Ford’s more modest 6.85%.

The mechanism is simple: buybacks reduce the number of outstanding shares, boosting the value of each remaining slice. GM spent over $16 billion doing just that, quietly inflating shareholder value while most people were distracted by shiny SUVs.

What It All Means

Choosing between dividends and buybacks is like debating whether it’s better to receive chocolate or a cash bonus at work-both have their virtues, and both leave you feeling a little smug. Investors often fixate on the dazzling 5% dividend, forgetting that there’s a subtler, more powerful force at work with GM’s strategy. Total yield gives the full story: a reminder that sometimes, the quiet kid with the glasses ends up winning the science fair while everyone else is busy posing for pictures.

So, when you’re next sipping your coffee, staring at stock charts, and quietly judging your neighbors’ portfolio choices, remember: dividends are just one piece of the puzzle. Total yield shows who’s really winning the shareholder game, even if it’s with a wink and a nudge rather than a neon sign. 🏎️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-30 17:42