As an analyst with extensive experience in digital assets and institutional investing, I find Coinbase Institutional’s offerings for large-scale investors quite impressive. Their focus on security, advanced trading services, comprehensive research, and regulatory compliance makes them a trusted partner for institutions looking to engage in the digital asset market.

As a crypto investor, I’m always on the lookout for reliable platforms that cater to the unique needs of institutional investors like hedge funds, family offices, endowments, and other large-scale financial entities. That’s where Coinbase Institutional comes in. This division of Coinbase goes above and beyond by providing top-notch services specifically designed for us.

Furthermore, Coinbase Institutional provides thorough research and analysis for their clients’ investment needs. They offer staking features, allowing institutions to earn returns on their digital assets. Plus, they provide prime brokerage services with lending, margin trading, and customized financing options. Emphasizing regulatory adherence, Coinbase Institutional strictly follows regulations to ensure a dependable and secure platform for institutional involvement in the digital asset market.

On the 15th of May, 2024, Research Analyst David Han from Coinbase Institutional shared an enlightening report named “Monthly Ethereum Outlook: Our Anticipations.”

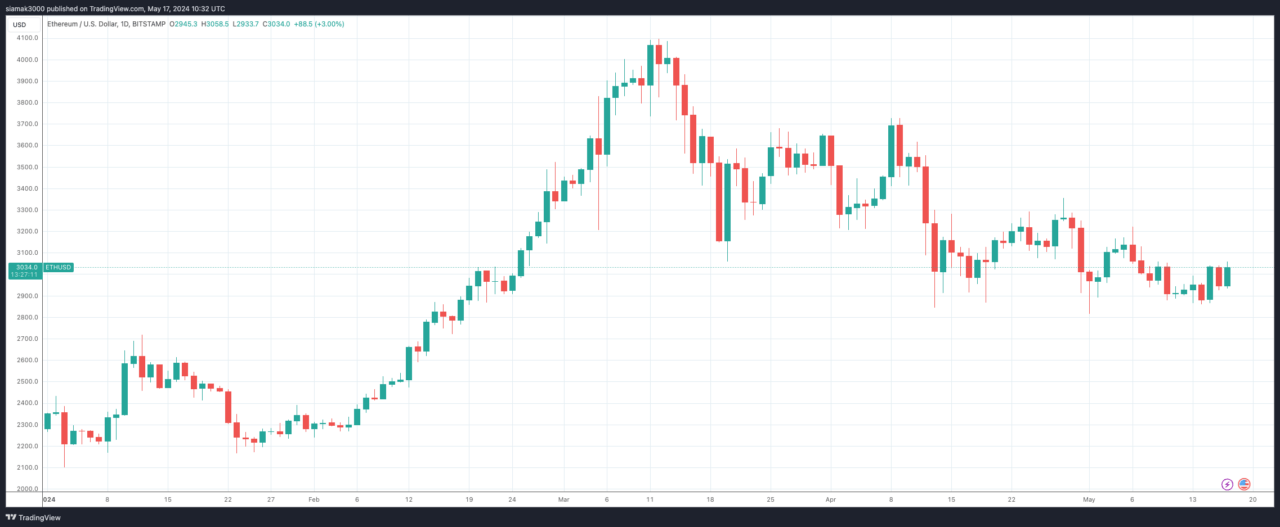

I, as a crypto investor, acknowledge that Ethereum hasn’t lived up to expectations this year, but I’m optimistic about its future. I firmly believe that Ethereum is poised for a rally later in the cycle due to its robust fundamentals. The technology behind Ethereum boasts strong persistent demand drivers and offers distinct advantages when it comes to scaling.

Han emphasizes that Ethereum’s historical price trends reveal its twofold story as both a “digital asset for value storage” and a “technological token.” According to him, this unique characteristic enhances Ethereum’s robustness and allure within the cryptocurrency sphere. Moreover, unlike some other digital currencies, Ethereum does not experience significant pressure from the supply side, such as token releases or miner disposals. Instead, the expansion in staking and Layer 2 (L2) solutions has resulted in increasing and strengthening absorbers for ETH liquidity, a development that Han considers to be a favorable sign.

Han underscores Ethereum’s pivotal position in the decentralized finance (DeFi) sector. He is convinced that Ethereum’s leadership in DeFi will persist given the extensive use of the Ethereum Virtual Machine (EVM) and continuous advancements in Layer 2 solutions. These progressions keep Ethereum as the core element of DeFi, offering a robust base for future expansion.

One significant aspect of Han’s analysis revolves around the potential consequences of US-listed Spot ETH Exchange-Traded Funds (ETFs). Han posits that there might be a miscalculation regarding both the approval timeline and probability by the market. In the event of SEC approval, these ETFs could substantially enhance Ethereum’s standing in the marketplace, resulting in favorable price trends.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All 6 ‘Final Destination’ Movies in Order

- 10 Shows Like ‘MobLand’ You Have to Binge

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2024-05-17 13:48