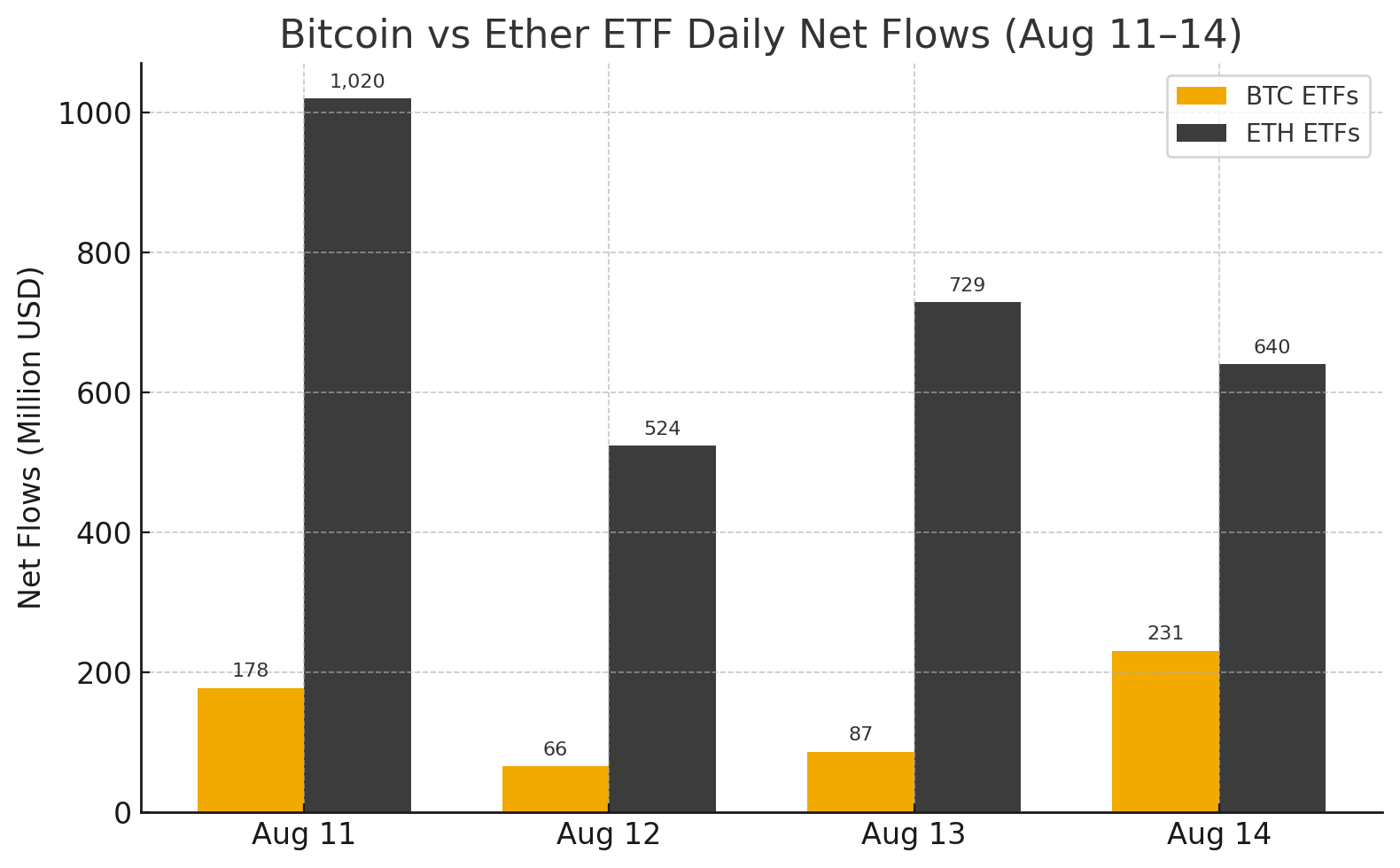

So, it turns out that ether exchange-traded funds (ETFs) are the overachievers of the crypto world, raking in a jaw-dropping $640 million in inflows. That’s right, folks, eight days in a row of green! Meanwhile, bitcoin ETFs are like that kid in gym class who keeps trying to impress the coach, managing a seventh straight day of gains with a mere $231 million, despite some major funds throwing tantrums and pulling out their lunch money. The trading volumes are so high, I half-expect to see them on a reality show about hoarders.

Ether ETFs: The Overachievers of the Crypto Playground

Crypto ETF momentum is hotter than a summer sidewalk in August. On Thursday, August 14, ether ETFs decided to flex their muscles, banking another $639.61 million. That’s right, they’re on an inflow streak that would make even the most dedicated gym-goer jealous. Meanwhile, bitcoin ETFs are just trying to keep their heads above water, eking out $230.93 million to stretch their own run to seven days, all while heavy selling pressure looms like a dark cloud over a picnic.

In the ether corner, we have Blackrock’s ETHA leading the charge with a whopping $519.68 million. Fidelity’s FETH is trailing behind like a loyal puppy at $56.94 million. Grayscale’s Ether Mini Trust added a respectable $60.73 million, while Invesco’s QETH limped in with a mere $2.26 million. For three days straight, not a single ether ETF has seen outflows. It’s like they’re the popular kids at school, and everyone wants to be their friend. Turnover was a staggering $4.22 billion, keeping net assets steady at $29.22 billion. I can almost hear the cash registers singing.

Now, let’s take a peek at the bitcoin side of things. Blackrock’s IBIT is the star of the show, pulling in a staggering $523.74 million. Grayscale’s Bitcoin Mini Trust is like the kid who shows up to the party with a bag of chips, contributing a paltry $7.32 million. But wait! Gains are being challenged by sizable exits, like a bad breakup. Ark 21shares’ ARKB shed $149.92 million, Fidelity’s FBTC lost $113.47 million, and Bitwise’s BITB saw $30.87 million leave faster than a cat at a dog show. Vaneck’s HODL also recorded a $5.85 million exit, because why not?

Even so, IBIT’s haul was strong enough to keep the day in the green. Trading activity hit a fresh record at $6.20 billion, though total net assets dipped to $153.43 billion. It’s like watching a soap opera where the characters just can’t catch a break.

With eight straight days of ETH inflows, record-high volumes, and BTC trying to stay afloat amidst the chaos, the ETF race is heating up faster than a microwave burrito. Buckle up, folks!

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

2025-08-15 18:11