On an otherwise unremarkable Wednesday morning, Redwire Corporation’s stock (RDW), a modest player in the orbital infrastructure game, dropped a stunning 11.9% by 9:55 a.m. ET. You might be wondering, “What happened?”-because, well, nothing really happened. Or perhaps it did, but not in the traditional sense of a “bad” news kind of way.

In fact, just two days ago, Redwire’s press releases were overflowing with the kind of “good news” that only an ambitious PR department could hope for: they announced a partnership with industrial titan Honeywell (HON), diving into the hot new world of quantum key distribution. A clever pivot from just being a space company to a quantum computing player. Not a bad move, eh? Who wouldn’t want a piece of that?

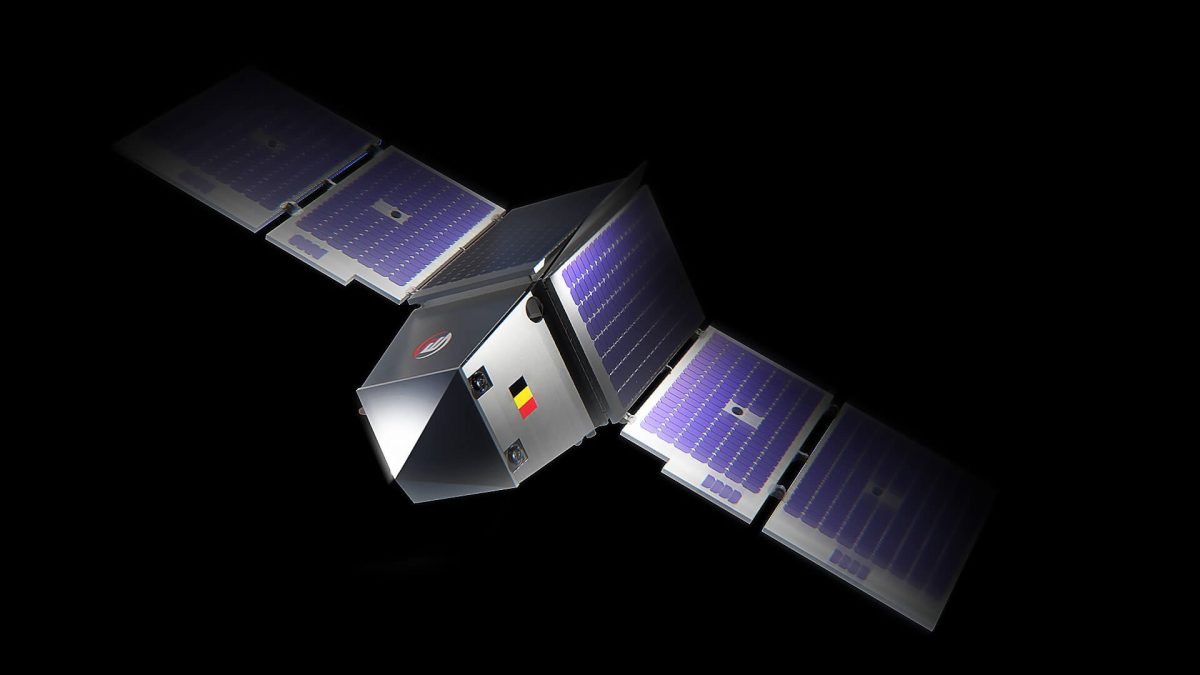

And if you thought that was all, hold onto your hat: the very next day, Redwire unveiled another partnership, this time with European aerospace juggernaut Thales-Alenia. This one was a little sexier-a contract to develop a spacecraft for the European Space Agency’s Skimsat mission, which plans to launch a small satellite into very low Earth orbit. You could say Redwire’s Phantom spacecraft is going to become the guinea pig for this daring adventure. The kind of spectacle that fills headlines. At least for a moment.

The Case of the Sudden Crash

So, what happened after this burst of glowing announcements? Well, the stock crashed-without a discernible reason. Ah, the stock market: where good news can sometimes be a harbinger of trouble. Perhaps it’s the mysterious art of speculation that holds sway here, or maybe it’s a more pedestrian reality: these partnerships, promising as they may be, did not offer any concrete details on revenue or immediate financial benefits. No promises of profits, no whispers of imminent success.

To add another layer of complexity, the analysts (always with their calculators) are pointing out that Redwire might not be in the profit game until 2027. Now, that’s a long wait for any investor-though not one without precedent. It’s not like this hasn’t happened before, and it won’t be the last time. The problem with being an investor is that you must become intimately familiar with the seductive, yet often elusive, dance of patience and the grim realities of delayed rewards.

So, what does this all mean for the average trader? Is this the moment to jump ship? Or perhaps a rare buying opportunity, where a little chaos creates room for a lot of future growth? It’s hard to say. The truth is, unless you’ve got a stomach for the long haul, Redwire’s trajectory is less about space travel and more about the complicated journey of corporate ambition. And in the meantime, the stock will continue its dance between enthusiasm and skepticism, leaving many investors to ponder whether they’re watching a rocket launch or simply another crash landing.

But, as we know, nothing in trading is ever simple. Where there’s smoke, there’s often fire-or at the very least, the scent of roasting marshmallows over a well-constructed illusion. Choose wisely, my friends. And remember, sometimes the most solid advice is: don’t panic. And if you do, just make sure your parachute is in order.

🌪️

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-09-17 18:17