In the grand tapestry of markets, where men of intellect and fools alike grasp at straws, Bitcoin finds itself in a peculiar predicament. It is not the whispering winds of spot ETFs that hold it captive, but rather the silent, relentless march of derivatives-those shadowy titans that do most of the work while we busy ourselves with trivial pursuits. Ah, the irony! The supposed “market forces” are but puppets, dancing on strings pulled by unseen hands, as futures trading-those modern sorcerers-continue their heavy lifting, even as their activity wanes like a forgotten candle.

Darkfost, a sage among analysts, proclaims that the volume of futures has halved since late November. From a staggering $123 billion per day to a modest $63 billion-such is the fickle nature of markets, where fortunes are won and lost in the blink of an eye. Yet, even in this decline, the futures remain colossal, twenty times greater than the modest ETF flows ($3.4 billion), and ten times the humble spot market volumes ($6 billion). Truly, size matters, or so they say, until it doesn’t-except when it does, and we pretend to understand.

The Big Joke: Futures Are the Real Bosses, Not ETFs

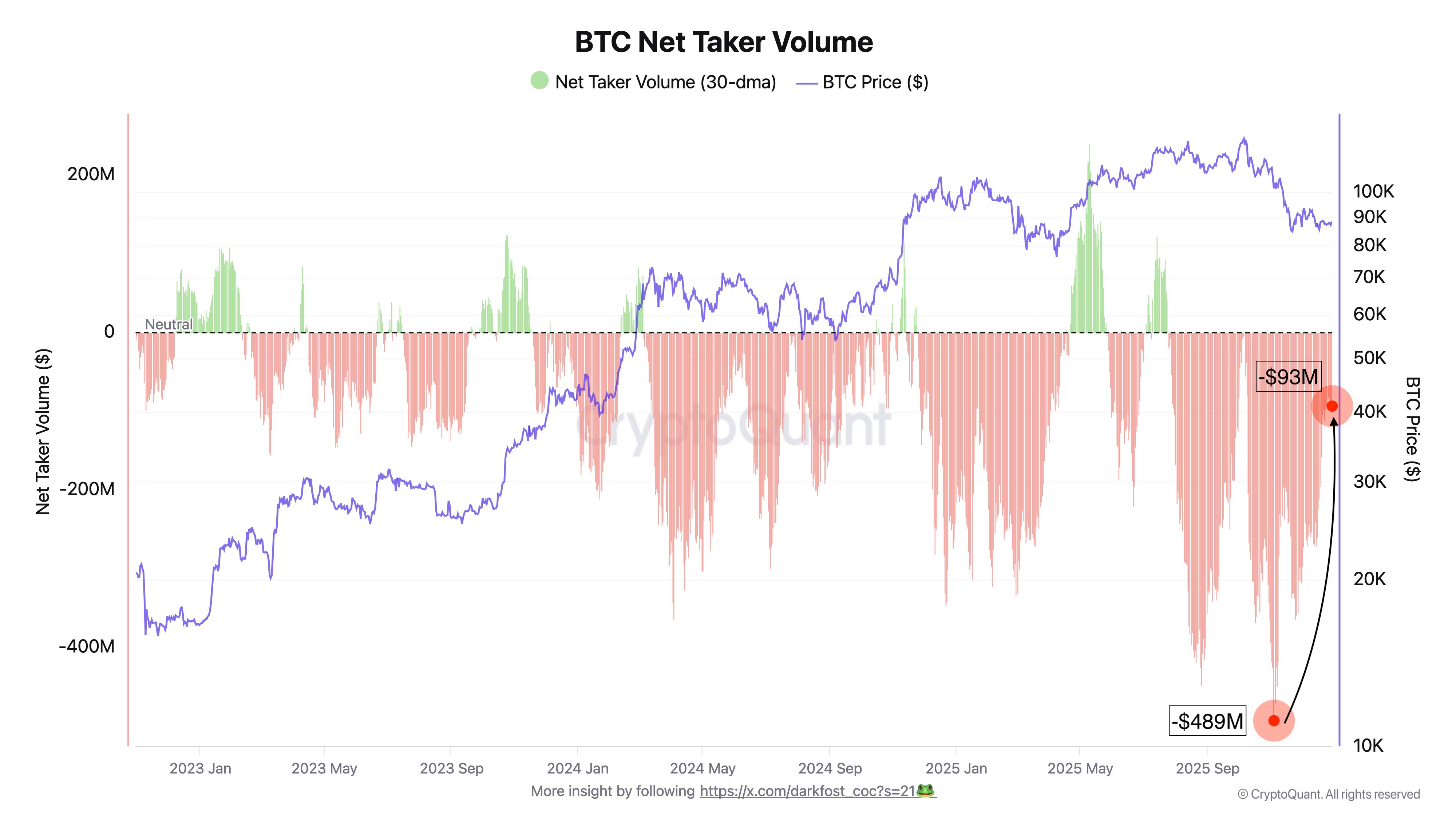

While well-meaning commentators point fingers at ETF outflows, the truth is far more entertaining. Futures markets, those grand puppeteers, hold sway over Bitcoin’s fate. Darkfost notes that despite the ebb in futures activity, it’s still the dominant force-like a giant elephant in the room sporting a tiny tutu. The net taker volume, a clever metric for predicting market mood, has long shown that when it turns negative, Bitcoin is on a downhill slide. And lo, since July, this negative bias has persisted-an unchanging, monotonous refrain, punctuated only by brief moments of false hope in October when Bitcoin briefly peaked, only to be dragged back into the shadows by relentless selling.

Recently, however, a glimmer of hope appears. The relentless tide of futures-driven sell-off has eased, with net taker volume improving from -$489 million to -$93 million. A positive sign, perhaps, like finding a dollar in an old coat pocket-yet the market remains a weakling, longing for more liquidity to break free from its shackles. ETF and spot volumes are mere whispers in the wind, insufficient to free Bitcoin from its current cage of consolidation. The joke continues: size matters, but only if liquidity joins the party.

The Demand Debacle: The Real Comedy of Errors

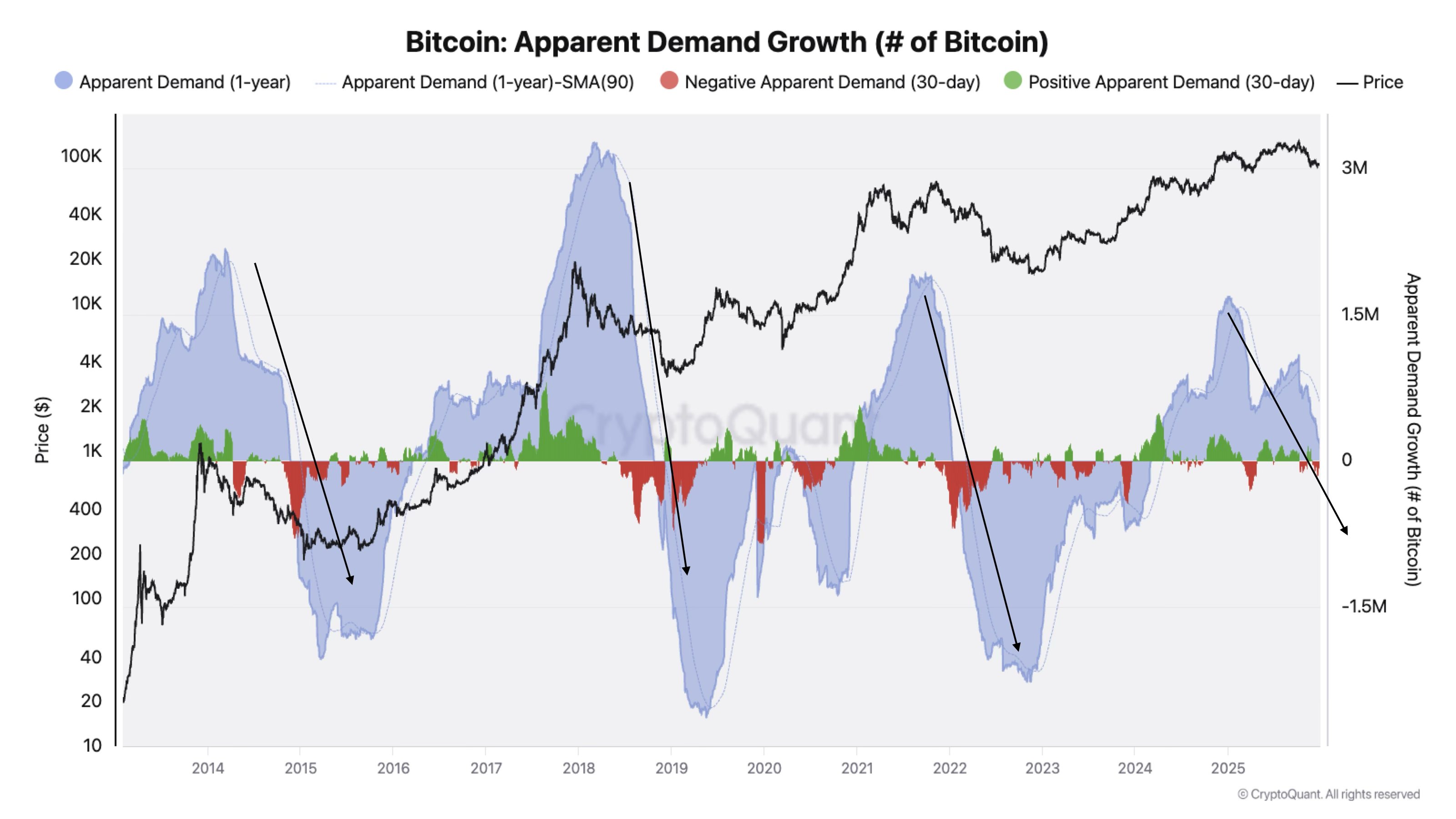

Julio Moreno, a scholar of market forces, chimes in with a broader perspective, shifting the focus from the mundane stories told by charts to the more compelling saga of demand. Demand, that elusive beast, is retreating, retreating so rapidly that it threatens to turn negative-an existential threat for the brave traders who cling to hope. His words echo a chilling truth: Bitcoin’s demand is contracting faster than the patience of a smartphone addict waiting for signal.

Meanwhile, long-term holders-those so-called ‘wise men’-are supposed to be pillars of stability. Yet, their selling persists, a relentless, almost robotic, campaign. Yesterday’s reports claim that about 10,700 BTC moved into the safe haven of long-term holdings. But analyst CryptoVizArt suggests that this is no sudden turn to accumulation, merely a cooldown-a pause, akin to a poet’s sigh after composing a masterpiece of despair. The rhythm remains unchanged; only the tempo has slowed.

Darkfost, ever the skeptic, reminds us that these sellers never truly disappear-they simply hide behind the curtains, waiting for the opportune moment to strike again. The supply change, that mysterious measure, indicates that for now, the distribution has ceased-like a playwright pausing before the final act, setting the stage for yet another performance of market folly.

And thus, Bitcoin remains-an eternal prisoner, at least for now, trading at $87,972-caught in a web of illusions, greed, and the grandest comedy of all: that we think we understand it.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Games That Faced Bans in Countries Over Political Themes

- The Most Anticipated Anime of 2026

- Most Famous Richards in the World

- Top 20 Educational Video Games

2026-01-02 01:41