As a seasoned crypto investor who has weathered the ups and downs of this volatile market since its inception, I must admit that the current resistance Bitcoin is facing at $100,000 doesn’t surprise me one bit. The market always seems to find a way to keep us on our toes!

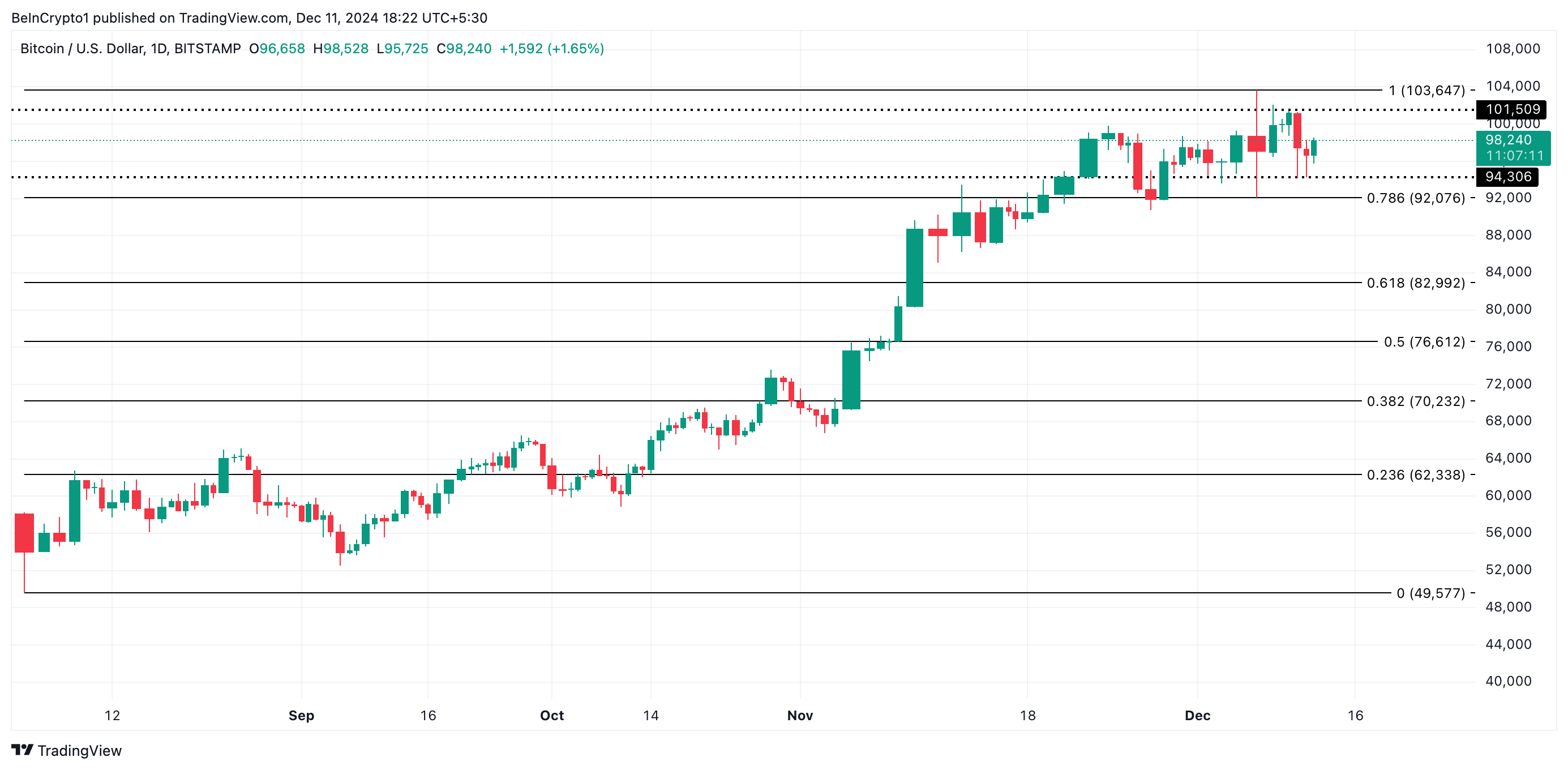

Bitcoin’s price has trended within a narrow range since it hit a new all-time high of $103,647 on December 5. It has since faced resistance at $101,509 and found support at $94,306.

At present, the primary cryptocurrency hovers near $98,000, and it might encounter difficulty surpassing the $100,000 threshold temporarily. This examination aims to uncover the factors contributing to this price barrier.

Bitcoin Long-Term Holders Book Gains

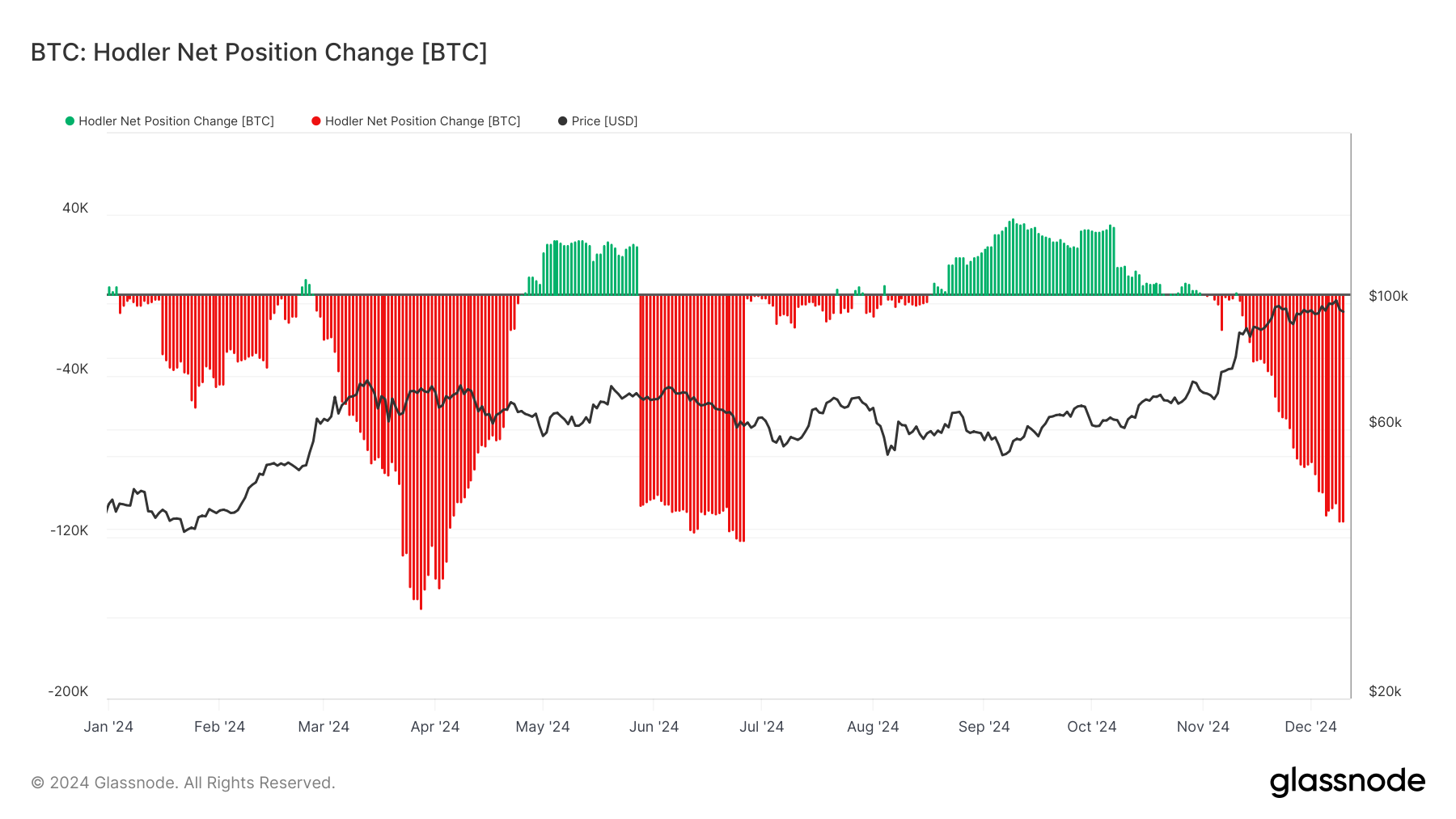

The decrease in BTC‘s Hodler Net Position Change indicates that its long-term investors (LTHs) have been actively disposing of their assets, which could be a factor in the current price stability. As per Glassnode data, the metric dropped to a five-month minimum of -112,471 BTC on November 10.

The Hodler Net Position Change monitors the monthly shift in Bitcoin owned by long-term investors. When this figure is positive, it means these investors are buying more coins, which can be interpreted as accumulation. Conversely, if the Hodler Net Position Change is negative, long-term holders appear to be selling off their coins, signaling potential profit-taking.

Furthermore, the reduction in the holding period of these investors’ Bitcoins indicates their tendency to cash out profits. As reported by IntoTheBlock, within the last month, Long-Term Holders (LTHs) have decreased their Bitcoin holding duration slightly, by approximately 0.06%.

Prolonged ownership of a cryptocurrency reduces the urge to sell, boosts its rarity in the market, and typically indicates optimism about its future price increase. Conversely, shorter ownership durations can amplify market activity and selling pressure, suggesting doubts or an emphasis on immediate profits.

BTC Price Prediction: All Lies With the LTHs

Currently, Bitcoin is being traded at approximately $98,240 per unit. Should selling activity increase significantly, it might challenge the support level around $94,306. If this level fails to maintain stability, we could witness a potential drop towards $92,076.

Instead, an increase in buying from long-term investors might fuel a surge past $100,000, aiming to reach the previous peak of $103,647.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-12 01:10