The scene is set: A courtroom, hushed like a back-alley dive bar, and in the middle of it, a story as old as dirt-corporations and their game of survival. Apple (AAPL), that polished, ever-so-glamorous tech giant, just caught a break. The federal judge, who’d probably seen more than his share of corporate games, delivered his verdict on Google’s stranglehold over the market. Google’s monopoly? Still breathing. Apple’s share? A fat check just waiting to be cashed.

Google’s reign over Chrome and Android? Untouched. The judge, however, had the nerve to introduce a new player into the game: artificial intelligence. Seems the world of search engines has gotten crowded with the rise of chatbots and smarter browsers. The legal gunslinger decided that Google, for all its troubles, wouldn’t have to break up its consumer kingdom just yet.

So what does this mean for Apple, sitting pretty in its Cupertino mansion? Well, it means Google gets to keep paying Apple that hefty $20 billion-a-year fee to make Google Search the default on iPhones. No exclusivity deals going forward, though. It’s a sweet gig. A licensing deal that’s worth more than a used car dealership in a desert town. Apple just pocketed a big win, but is it enough to turn the tide?

Apple’s Golden Goose: Fed and Alive

Apple’s stock was up 3.8% the day after the court decision, but let’s not get carried away. That $20 billion payment from Google has been padding Apple’s pockets for years. It’s the kind of deal that makes corporate lawyers pop champagne. The payment keeps Google’s search engine top of the pile, but if you’re wondering where that sweet cash comes from, it’s from the same well that’s kept the iPhone humming for a decade.

Now, the winds of change are blowing. AI competitors, hungry and fast, are eating away at Google’s monopoly. OpenAI’s valuation is skyrocketing, and Alphabet’s market cap is feeling the pressure. The judge, with a hint of weariness, decided that the status quo wasn’t worth shattering. But here’s the rub: Apple’s deal is a money fountain, and it’s all tied to a shaky, ever-changing future where AI and tech giants are in a race to the top.

Apple’s Struggle: The Soft Underbelly

So, is this a blessing for Apple, or just a delay of the inevitable? A reprieve for a business that’s struggling to find its way. The iPhone’s glory days are long gone, and Apple’s been scrambling for an AI solution that can match the likes of OpenAI or Alphabet. But here’s the kicker: Apple’s not quite cutting it. They’re losing AI talent faster than a gambler loses his shirt in Vegas, and if you’re an investor waiting for that next big product, you’re in for a disappointment. They’re talking about AI-powered search, a new Siri-might as well be throwing darts at a board.

The Bitter Truth: Apple Stock is Still a Bad Bet

Here’s the hard truth: Apple has traded its fast-growth shoes for slippers. It’s a company that once sprinted ahead, but now it’s running in place. The iPhone’s future is a shadow of what it used to be, and the new avenues it’s exploring-like AI-are still a half-baked idea. Revenue? A sluggish 3.6% growth over the last three years. Meanwhile, Alphabet’s been busy creating the future with its AI and seeing growth of 32%. It’s not a race. It’s a slow-motion car crash for Apple.

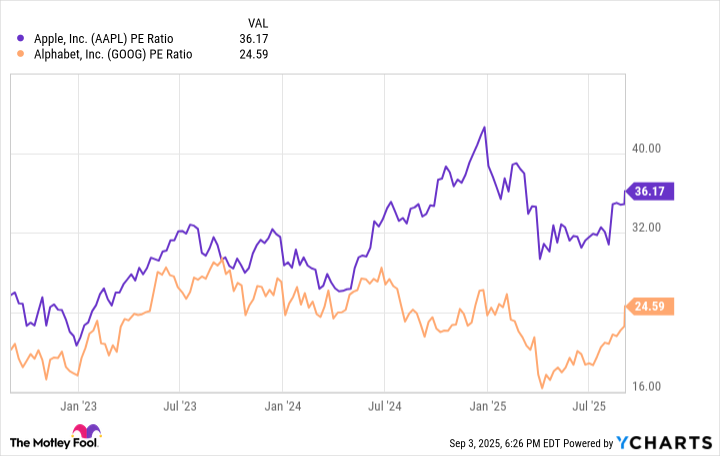

Now, let’s talk numbers. Apple’s stock price is inflated, living in a bubble that’s as fragile as a teardrop on a dusty road. Its P/E ratio sits at a lofty 36, compared to Alphabet’s 25. The difference? Alphabet is growing, and Apple is, well, waiting for the future to knock on its door. If you’re looking for the better bet in tech, you’ll find it elsewhere. Apple’s a good business, sure. But at this price? Not a chance. It’s a stock for suckers. And you’re better off staying away unless you’re interested in paying top dollar for a company stuck in neutral.

In the end, Apple dodged a bullet, but it might be a while before it shoots straight again. In the meantime, the market’s not doing it any favors. 📉

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-05 13:36