In the vast and bewildering cosmos of artificial intelligence stocks, where fortunes rise and fall like waves on a particularly indecisive ocean, one name stands out with the kind of improbable reliability that makes you wonder if it might secretly be running on quantum mechanics: Alphabet (GOOG) (GOOGL). It’s not just another stock; it’s a cosmic anomaly wrapped in shareholder reports and quarterly earnings calls.

Now, let me pause here for a moment to explain something about investor psychology-or, as I prefer to call it, “the art of collectively losing your mind over numbers.” Investors, much like hitchhikers stranded on interstellar highways, are prone to panic when faced with uncertainty. And yet, amidst this galactic swirl of fear and excitement, Alphabet remains curiously undervalued-a fact so absurdly counterintuitive that it deserves its own footnote. (Imagine finding a perfectly functional spaceship in a dumpster behind a space station cafeteria. That’s what we’re dealing with here.)

Alphabet: A Multiverse of Growth Engines

Alphabet, the parent company of Google and several other ventures that sound like they were named by someone flipping through a sci-fi novel at random, has managed to defy the doomsayers who predicted the imminent collapse of Google Search under the weight of generative AI. This prediction, while initially plausible, now seems as likely as discovering that Earth was actually created by a committee of hyper-intelligent pandas. Google didn’t just survive-it adapted. The integration of generative AI into search results isn’t just clever; it’s downright Darwinian. Survival of the fittest algorithms, indeed.

To illustrate how irrational markets can be, consider this: Despite whispers of obsolescence, Google Search revenue grew by 12% year-over-year in Q2, reaching $54.2 billion. For context, that’s roughly equivalent to the GDP of a small country-or, more relatably, the amount of money required to build a Death Star out of Legos. Bearish arguments against Alphabet have evaporated faster than ice cream on a supernova, leaving investors free to marvel at the rest of the empire.

Take Google Cloud, for instance-a division whose growth trajectory resembles the plot of a Hollywood blockbuster about plucky underdogs saving the universe. Cloud computing demand is surging, driven largely by companies too lazy or cash-strapped to maintain their own data centers. (Think of it as outsourcing your existential dread to someone else’s server farm.) Recent high-profile clients include OpenAI and Meta Platforms, both of which chose Google Cloud over competitors. Why? Perhaps because they realized Alphabet wasn’t trying to sell them snake oil disguised as machine learning models. Or perhaps because their procurement teams had excellent taste in branding. Either way, Google Cloud’s Q2 revenue soared 32% year-over-year to $13.6 billion, with operating margins leaping from 11% to 21%. If this doesn’t scream “buy now,” then nothing will short of a divine intervention involving Warren Buffett singing karaoke.

And then there’s Waymo, Alphabet’s self-driving car project, which continues to expand even though management hasn’t disclosed specific financial details. One imagines the accounting department locked in a room somewhere, frantically trying to calculate whether autonomous vehicles should be classified as assets or liabilities. Meanwhile, Alphabet’s overall Q2 performance dazzled analysts, with revenue up 14% and diluted earnings per share climbing 22%. Not bad for a company supposedly teetering on the brink of irrelevance.

A Bargain in a Universe of Overpriced Stars

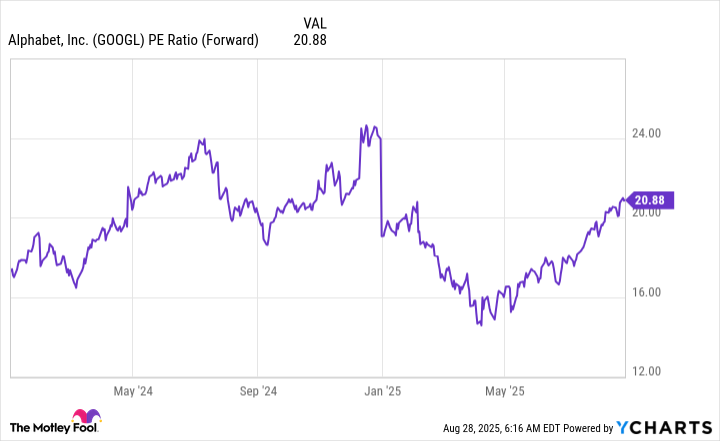

If you’re wondering why Alphabet trades at less than 21 times forward earnings-compared to peers hovering in the high 20s or low 30s-you’re not alone. It’s almost as puzzling as why humans insist on using email signatures that contain inspirational quotes. (Seriously, who needs daily reminders to “believe in yourself” from someone named Chad?) Even the S&P 500 looks expensive next to Alphabet, trading at 23.7 times forward earnings.

Here’s the kicker: Alphabet’s profits are growing faster than those of many of its rivals, yet it languishes at a discount due to fears of disruption by AI. Disruption! By the very technology it helped pioneer! It’s like worrying that a lighthouse will get lost during a storm. With such glaring discrepancies between price and value, buying Alphabet feels less like investing and more like stumbling across a treasure chest buried in plain sight.

In conclusion, dear reader, the universe is vast, chaotic, and occasionally nonsensical-but every now and then, it hands you a gift wrapped in logic and labeled “opportunity.” Alphabet is precisely that kind of gift. So go ahead, load up on shares while the market remains hilariously oblivious. After all, if you don’t seize the chance to invest in a company this extraordinary, future historians may write books speculating about what exactly went wrong with human decision-making in the 21st century. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2025-09-02 13:11