In a universe where the only constant is change (and perhaps the occasional existential crisis), we find ourselves staring down the barrel of more than 80,000 Bitcoin options contracts, worth a staggering $8.36 billion. And just for good measure, let’s throw in 603,400 Ethereum contracts, which are worth a mere $1.94 billion. Yes, you heard that right—it’s like a cosmic game of Monopoly, but with real money and fewer plastic hotels. 🏨

Now, Bitcoin’s maximum pain price is a delightful $98,000, while Ethereum is hanging out at $3,300. Traders and analysts are watching the price action with the same intensity as a cat watching a laser pointer—fascinated yet utterly confused. 😺

Bitcoin’s Potential Price Movement

Bitcoin has bounced back from a brief dip after the Federal Open Market Committee (FOMC) meeting, where it flirted with the idea of dropping below $100,000 before deciding that was a terrible idea. Now it’s stabilizing between $104,000 and $106,000, like a tightrope walker who just realized they forgot to look down. The highest open interest strike price for Bitcoin options is a jaw-dropping $120,000, with another $1.65 billion at the $110,000 mark. It’s as if traders are collectively saying, “To the moon!” 🚀

As the options expiry looms like a dark cloud over a picnic, Bitcoin’s price may experience more twists and turns than a soap opera plot. Historically, large-scale expirations have led to price swings that could make a rollercoaster look like a kiddie ride. 🎢

Ethereum’s Market Outlook

Ethereum, meanwhile, has been playing hopscotch around $3,200 after a brief flirtation with $3,000 earlier this week. With a put-to-call ratio of 0.43, the outlook is bullish, but let’s not forget that nearly 603,400 contracts are set to expire today, which could send the market into a tizzy. On-chain indicators, like the Ethereum MVRV ratio, suggest a potential price correction, adding yet another layer of uncertainty—like trying to assemble IKEA furniture without the instructions. 🛠️

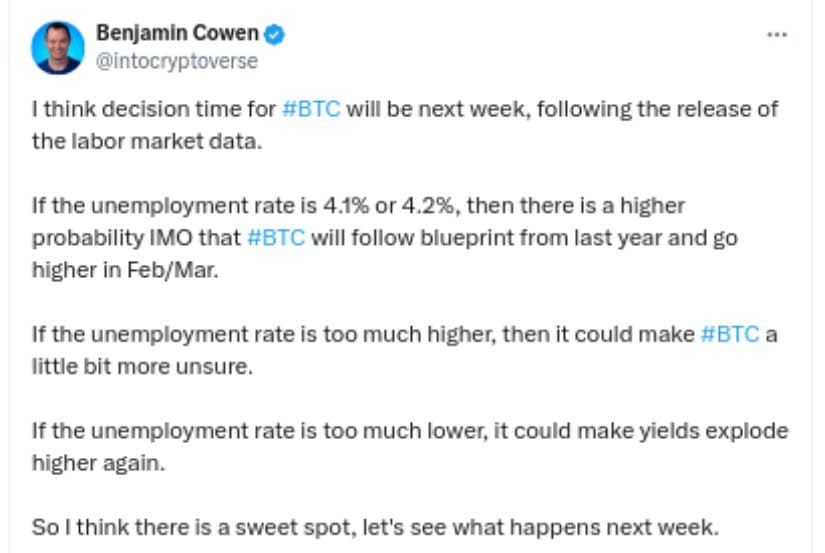

Investors are also keeping an eye on macroeconomic factors, because why not add a little more chaos to the mix? The upcoming U.S. Personal Consumption Expenditures (PCE) index report is expected to have a minor impact on cryptocurrency volatility, but the real drama will unfold with next week’s U.S. labor market data release. It’s like waiting for the next season of your favorite show—will it be a cliffhanger or a happy ending? 📺

Crypto analyst Benjamin Cowen has pointed out that the unemployment rate will be a key factor in determining Bitcoin’s direction. If it reaches 4.1% or 4.2%, Bitcoin could follow its past performance with gains in February and March. But if it goes higher, we might be in for a bumpy ride. 🎢

Bitcoin’s current trading price of around $104,500 suggests a relatively stable stance post-FOMC, but the looming options expiration could shift market dynamics faster than you can say “cryptocurrency.” Ethereum, up 1.67% at $3,244, is also subject to potential price swings as traders navigate today’s expiration event. 🌀

Historically, options expirations tend to cause temporary volatility, followed by a stabilization period as traders reposition. The max pain theory suggests that prices may gravitate toward levels where most options expire worthless, causing losses for option buyers while benefiting sellers. It’s a classic tale of survival of the fittest, or at least the fittest with the best spreadsheets. 📊

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-01 16:51