A little over a year ago, Nvidia (NVDA) stood on the precipice of something big. The juggernaut of artificial intelligence (AI) chips, a titan of technology, was unveiling Blackwell, a new architecture that CEO Jensen Huang described as facing “insane” demand. For the first time, the fruits of Blackwell’s labor-its monetary yield-would be reflected in Nvidia’s books in the final quarter of 2024.

Blackwell was to be the first step in Nvidia’s newfound cadence: annual chip and platform updates. And true to form, Blackwell has driven Nvidia’s earnings upward like a storm chasing the horizon. The data center revenue from Blackwell surged 17% in the latest quarter. And Nvidia’s stock? It too has followed the wind’s course, climbing 40% in 2025 alone. But then the question naturally arises-where will Nvidia be in two years, 24 months after Blackwell’s thunderous debut?

Nvidia’s Unfolding Path in AI

Before we answer that question, it’s worth reflecting on Nvidia’s evolution in the AI realm. Once upon a time, it was a company primarily known for gaming graphics processing units (GPUs). But as is often the case in the world of technology, what begins as a niche innovation soon bursts open to broader possibilities. Nvidia recognized this and, like a craftsman seeing the potential of his tools, devised the CUDA parallel computing platform-a revolutionary way of using GPUs for tasks far beyond gaming.

When the AI revolution arrived, Nvidia didn’t hesitate. It pivoted with calculated precision, positioning itself as the leader in the AI chip market. The result? Double and triple-digit growth in revenue, with profit margins consistently exceeding 70%. Nvidia’s dominance in this space has been anything but an accident. It’s been a concerted effort, a sustained drive to innovate and meet the insatiable demands of an industry on the brink of transformation.

To ensure this dominance continues, Nvidia committed to regular innovation. It promised to update its chips yearly. Blackwell was the first step, followed by the launch of Blackwell Ultra a few months ago. And what comes next? The Vera Rubin system, which will hit the market late next year.

From Platform to Platform

All these platforms work in unison, a seamless orchestra of innovation. Customers don’t have to wait for the latest system. They can simply hop on the existing Nvidia architecture and, when the time comes, upgrade with minimal hassle. But, as we’ve seen, the demand for these systems-especially from the giants of the tech world-is massive. In the race for supremacy in AI, companies are eager to get their hands on the best tools, no matter the cost.

So where will Nvidia be 24 months after Blackwell’s release? The early signs are promising. Revenue is expected to keep growing in the double digits, and analysts are predicting a 33% jump in Nvidia’s earnings next year. With the launch of Rubin on the horizon, it’s likely demand for Nvidia’s systems will intensify as companies continue scrambling to harness cutting-edge AI technology.

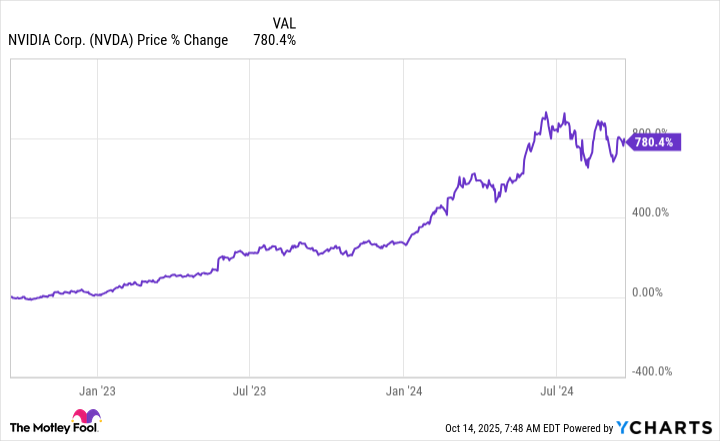

But what about Nvidia’s stock? History offers some illuminating clues. Let’s turn the clock back a little. Nvidia’s major platform launches happen roughly every two years. In May 2020, the Ampere platform launched, followed by Hopper in September 2022. In the two years following both of these releases, Nvidia’s stock skyrocketed. Ampere saw a 120% increase, while Hopper saw an astonishing 700% climb.

What History Says

History, as it often does, tells us a lot. If Nvidia’s trajectory mirrors the past, we can expect its stock to shoot up in the triple digits in the two years following Blackwell’s launch. With the first quarter of Blackwell revenue having ended on January 26, 2025, Nvidia’s stock has already climbed about 30%. But there’s still plenty of time for more sales to pour in, and who knows? Nvidia’s shares could well mirror the past and see a massive leap by early 2027.

To put it into perspective: a 100% increase from January 2025 would push Nvidia’s stock to $284, putting its market cap at a staggering $6.9 trillion by the start of 2027. In fact, I recently predicted that Nvidia could very well reach $10 trillion in market value by the end of this decade.

But of course, we must temper our enthusiasm with caution. The winds of the market can shift unexpectedly. Geopolitical instability, a downturn in tech spending, or unforeseen challenges could derail Nvidia’s ascent. However, if these risks do not materialize, history’s patterns will likely hold true. And Nvidia’s stock might find itself soaring to new heights, a testament to the company’s relentless drive and its strategic vision.

We stand at the crossroads of progress. Here’s hoping history proves itself right. 💡

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-18 21:42