This year has been exceptionally prosperous for The Coca-Cola Company (KO). It emerged as the preferred investment when tariff alterations were declared, and it’s shown remarkable strength in the face of adversity.

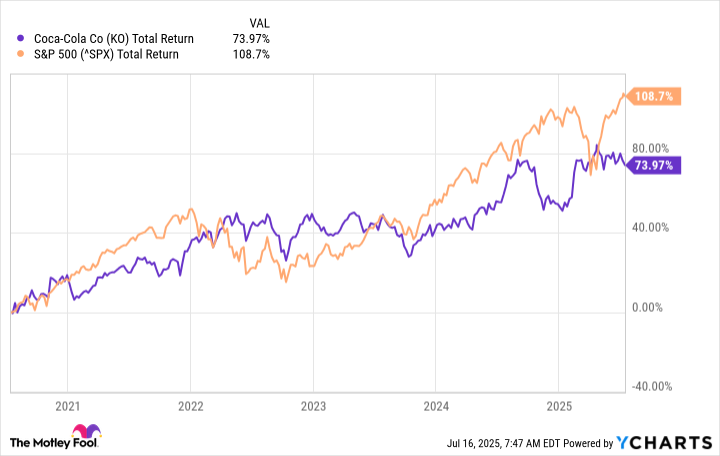

Looking at Coca-Cola’s recent success and widespread influence, it might seem that the company consistently outperforms the market. However, this is actually a misconception. While there have been some exceptions in the last three decades, Coca-Cola’s stock has generally underperformed compared to the S&P 500 (^GSPC) over the past five years, even taking into account its strong growth this year.

Let’s examine if the company can continue its success or slip back into being an underperformer in the coming five years, shall we?

Have you had a Coke today?

For more than a hundred years, Coca-Cola has been standing strong and widely recognized across the globe, making it one of Warren Buffett’s preferred stock picks. As the leading beverage corporation globally, it boasts approximately $47 billion in annual sales and is present in about 6 out of every 100 shopping carts worldwide, featuring a Coca-Cola product inside.

Despite its size and widespread popularity, it has faced challenging periods, notably a significant decline in sales a few years back. However, it has shown resilience and experienced growth over the past few years. Not long ago, it managed to exceed its prior sales records.

Today, Coca-Cola’s stock is widely favored due to several factors, with its ability to hold strong under challenging circumstances being one of them. In the first quarter of 2025, although net revenue dipped by 2% compared to the previous year, organic revenue, a key performance indicator for the company, experienced an impressive growth of 6%. This metric takes into account factors like acquisitions, currency fluctuations, and other variables, providing a more precise reflection of the business’s health.

In this tough environment, I’ve noticed our operational margin has significantly grown, moving from 32.4% to a robust 33.8%. These figures certainly speak volumes about our resilience and adaptability.

Under most economic conditions, Coca-Cola’s stock often performs better than average. This is because it’s widely viewed as a “secure investment” due to investors’ confidence that the company can handle economic difficulties. The market is also optimistic about Coca-Cola’s robust reaction to tariff adjustments. Since a significant portion of its production is local and it manufactures concentrate for U.S. products within the country, the company has shown resilience in dealing with such changes.

Potential negative influences might arise, which could potentially harm the company. Coca-Cola has managed to increase some prices to counter rising expenses, however, there is a limit to this price increase in the short term.

Over a longer period, it’s expected that the company will keep rising. It’s probable that inflation will ease, interest rates will decrease, and consumers will start spending more. This scenario could enhance Coca-Cola’s potential for growth in the coming five years.

The company anticipates a steady increase in organic revenue between 4% and 6% over the long term, and also expects a similar growth rate of 6% to 8% for its organic operating income.

More beverages, brands, and scale

To achieve its goals, the company follows a strategy of purchasing other well-known brands and introducing fresh products. This expansion is primarily financed by robust sales from its established core brands. Notably, some of their latest acquisitions are Costa coffee and Fairlife dairy products. The firm claims that these acquired brands have accounted for approximately 25% of its Earnings Per Share (EPS) growth since 2016.

In my observation, this company boasts a 14% share in the commercial beverage market across developed nations, an impressive figure in any industry. Yet, there’s a substantial 86% left untouched, indicating ample room for growth. In developing countries, home to 80% of the global population, their presence is relatively small at 7%. Interestingly, 70% of the world’s populace doesn’t consume commercial beverages at all, suggesting vast opportunities for this company as they expand their brand into new, untapped markets.

The storied dividend

The business prioritizes profit and cash accumulation, with leaders believing that their ‘thrifty mentality’ fosters innovation and an efficient workforce. This financial abundance enables them to enhance their existing beverages, experiment with new ones, boost dividends, and augment shareholder worth.

Coca-Cola, known as a longstanding Dividend Champion, has consistently increased its dividends every year for an impressive 63-year stretch, which is seldom achieved by other corporations. Over the next five years and beyond, it’s likely that this trend will continue.

Is it still possible for Coca-Cola to outperform the market? The difference between their performance and the S&P 500 is shrinking as the latter rises, leading investors to consider shifting away from secure stocks. Nevertheless, Coca-Cola finds itself in a stronger position now compared to a few years ago.

While I don’t anticipate Coca-Cola stock outperforming the market over the next five years, there’s always a chance that could happen. Nevertheless, its safety and dividend make it an appealing option for many investors, as having such investments in their portfolios is essential.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Opendoor’s Stock Takes a Nose Dive (Again)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-07-20 03:07