Berkshire Hathaway (BRK.A) (BRK.B), that name which rings with the sound of steadfast capital and unyielding fortune, is indeed a peculiar one. A titan of commerce in our age, its roots lie in a humble, faltering clothing business. In a moment that must have seemed, even to the uninitiated, a lamentable misstep, Warren Buffett, with his characteristic blend of aversion and foresight, purchased this failing entity. In time, that same acquisition, marked by the demise of its original purpose, came to symbolize one of his notable errors-a singular failure amidst a long parade of victories.

However, such failures are often but the prelude to triumph, and as one cannot help but observe, Berkshire Hathaway has transformed itself, through sheer perseverance and calculated risk, into a juggernaut. Yet, looming on the horizon, there is a change that is as inevitable as the turning of the seasons-one that will alter the course of this mighty ship.

What does Berkshire Hathaway do?

Ah, the question is deceptively simple, yet profound. Berkshire Hathaway, at its heart, is a conglomerate-a collection of disparate businesses bound together under the seemingly indifferent hand of an old man whose eyes have seen the ebb and flow of countless markets. At the close of 2024, it counted 189 subsidiary companies. And yet, within that number, a curious harmony exists, for it is not the sheer size of the enterprise that impresses but the diversity of its holdings.

At its core are insurance businesses, whose primary currency is not goods or services, but the mysterious “float.” This float, as the business world calls it, is the sum of premiums received in advance, which lie dormant, awaiting the time when payouts must be made. While this might sound like the pursuit of risk, the truly astute-like Buffett-know that the float can be a potent engine for wealth, invested and left to grow until the fateful day when its destiny must be fulfilled.

One cannot, however, ignore the portfolio that Berkshire has carefully assembled over decades: Coca-Cola, American Express, Chevron. These, along with many others, stand like monuments to Buffett’s uncanny ability to find value where others see none. And in this great collection, Berkshire resembles not a mere corporation, but a mutual fund-one in which the investor is aligned with a man whose name has become synonymous with sagacity. To own a piece of Berkshire Hathaway is, in essence, to place one’s faith in the hands of Warren Buffett, whose touch, over the years, has turned a modest sum into a fortune.

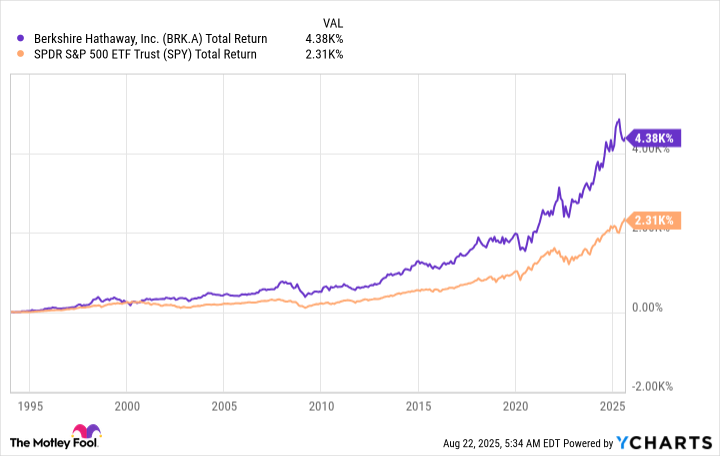

And yet, as we see from the accompanying chart, this path has not always been without its fluctuations, its uneasy periods of transition, moments that reflect the very nature of markets themselves-capricious, unpredictable, yet ultimately rewarding to those who dare to remain faithful.

Things are about to change at Berkshire Hathaway

But change, that ever-present force, is nigh. In the waning months of 2025, Warren Buffett-who has so expertly navigated the treacherous waters of capitalism-will retire from the position of CEO, passing the reins to Greg Abel. This transition, though expected, evokes a sense of inevitable transformation. For, as with all great institutions, the departure of one figurehead-especially one as iconic as Buffett-leaves behind a vacuum, an unsettled feeling, as though the ship sails on, but with its course altered by the absence of the hand that once steered it.

But, let us not dwell too heavily on this impending loss. After all, Buffett will remain as chairman of the board, ever watchful from his lofty perch. And so, Greg Abel, though he takes on the mantle of leadership, will continue to be, in a sense, an employee-his actions forever shaped by the lessons imparted by the Oracle of Omaha himself. And if, perchance, Abel falters, there is little doubt that the guiding hand of Buffett will be there to offer counsel, as it has for many years.

It is worth noting that Abel, having spent more than two decades at Berkshire, is not some unknown quantity, some stranger to the realm of high finance. His approach will undoubtedly bear the imprint of Buffett’s wisdom. But even the most faithful pupil must eventually make their own mark, and it seems clear that Abel’s tenure will be marked by subtle shifts in strategy, if not in the overall direction.

Different, but not that different

For the dividend hunter, the prospect of change is not one to be feared. Yes, the mantle of leadership is shifting, but it is not so dramatic a change as to upend the core principles that have made Berkshire Hathaway a bastion of stability and growth. Investors need not tremble, for the company’s foundation is solid, its approach to investments remains sound, and the principles that guide it will not vanish overnight. Yet, one cannot help but feel that, much like the seasons themselves, there will be a shift-a quiet transformation that, while imperceptible in its early stages, will eventually come to define the future of Berkshire Hathaway.

The passage of time is unrelenting, as it always has been. And though the company may not become an entirely different entity, the touch of a new hand on the wheel will leave its mark. Indeed, as we observe the unfolding of this story, let us remember that nothing truly remains unchanged for long. Even the most steadfast institutions must bend and sway with the winds of time. And so, in one year’s time, Berkshire Hathaway will still stand as a monument to wealth and investment, but perhaps with a slight adjustment in its posture-a subtle shift that only time, and the discerning eye, will fully appreciate. 🌿

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Here Are All the Movies & TV Shows Coming to Paramount+ and Apple TV+ This Week, Including ‘The Family Plan 2’

- Top 15 Insanely Popular Android Games

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-24 22:15