Markets, those great and mysterious beasts, continue their endless waltz. Today, they bring us the curious case of XLM-a token that seems to have taken a masterclass in emotional turbulence from a moody poet.

Ah, what you must know, dear reader:

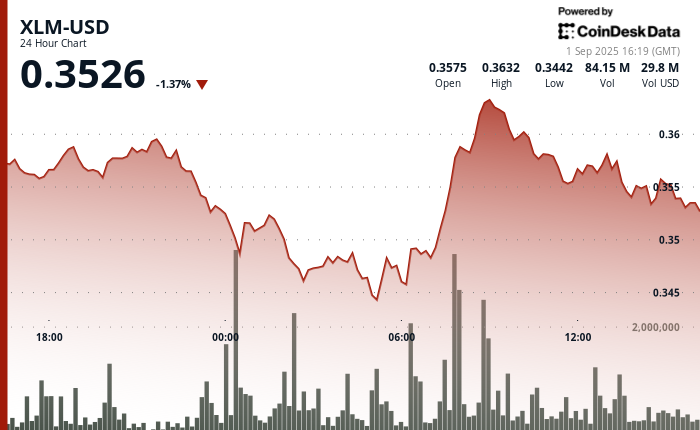

- XLM decided it would rather be unpredictable than boring, plunging and soaring between $0.34 and $0.36 within 24 hours. Imagine a seesaw, but one where everyone is screaming about volume spikes exceeding 70 million units. 🎢📉

- Bithumb, ever the dramatic host, will suspend deposits on Sept. 3 as Stellar undergoes “critical network upgrades.” Meanwhile, Ripple’s bank pilots are busy making blockchain look respectable again-adding just a pinch of peer pressure for Stellar. 😅

- Stellar, however, is not sitting idle. It’s expanding into Africa like an ambitious traveler, pushing mobile money integrations across Nigeria, Kenya, and Ghana. Analysts dream big dreams of $0.62-$0.95 targets while XLM flirts with short-term chaos. 🌍✨

Oh, how Stellar’s native token endured its little drama! For 24 hours, it traded in a cruelly tight 5% range between $0.34 and $0.36. The day began calmly enough-perhaps too calmly-but then came the late-evening selloff. Like a sudden storm, it knocked poor XLM from its lofty perch at $0.36 down to $0.34. How poetic! 🌩️💔

Trading volume surged past 57 million units at midnight, testing support levels around the $0.34-$0.35 zone. Buyers, those eternal optimists, stepped back in early morning, lifting XLM briefly back to $0.36. One might call it institutional accumulation or simply stubbornness. Volumes swelled to 70 million units during this hopeful phase. But alas, price action stalled, creating a range-bound structure that whispers promises of future breakouts-or breakdowns. By the final hour, bearish momentum regained control, slipping XLM by 1%. Ah, the cruelty of markets! ⏳🐻

Intraday data revealed a particularly chaotic moment between 13:45 and 13:46 when over 1.28 million tokens changed hands at the day’s low. Recovery attempts? They fizzled faster than champagne bubbles. And the lack of activity in the final minute suggested trading had ground to a halt-like a clock whose battery has finally died. ⏰📉

But wait, there’s more! Fundamental developments added layers to this tragicomic tale. South Korea’s Bithumb announced it will suspend XLM deposits on Sept. 3 due to Stellar’s network upgrades-a temporary disruption that sounds almost surgical in nature. All this while Ripple’s pilot tests with banks bolster confidence in blockchain payments, adding pressure on Stellar to keep up. Truly, competition makes strange bedfellows. 🛠️💼

Volume Spikes: The Plot Thickens

- A mere $0.02 trading range became a battleground-a 5% spread between $0.34 support and $0.36 resistance. Dramatic, isn’t it? 🎭

- The midnight selloff generated a 57-million-unit volume spike, suggesting heavy institutional selling. Perhaps someone panicked after reading Tolstoy. 📚💸

- Morning recovery surged to $0.36 on 70 million volume, hinting at an accumulation phase. Greed or genius? You decide. 🤔📈

- Resistance confirmed at $0.36; support established around $0.34-$0.35. Predictable yet thrilling, no? 🔒📊

- Final-hour recovery attempts failed as bearish momentum accelerated. A fitting end to our tale of volatility. 🐾❄️

And so, dear reader, we leave you with this reflection: In the world of cryptocurrencies, every dip and rally feels like a chapter from a novel by Chekhov himself-full of hope, despair, irony, and emojis. What happens next? Only time will tell. Or perhaps another wild trading session. 😉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- Where to Change Hair Color in Where Winds Meet

- Brent Oil Forecast

2025-09-01 20:27