![]()

Many years later, in a world haunted by forbidden algorithms and silenced by the hum of unseen servers, old investors would remember the morning a slender beam of San José sun slipped through a server farm’s dust-laden louvres, as if the light itself were anxiously checking the ticker symbol “NVDA” for signs of life. Nvidia, already growing in legend, had not yet overturned the order of the silicon earth, nor conquered the dreams of empires twitching behind the red lanterns of Shanghai. But even then, something in the air—ozone or anticipation—smelled suspiciously like destiny.

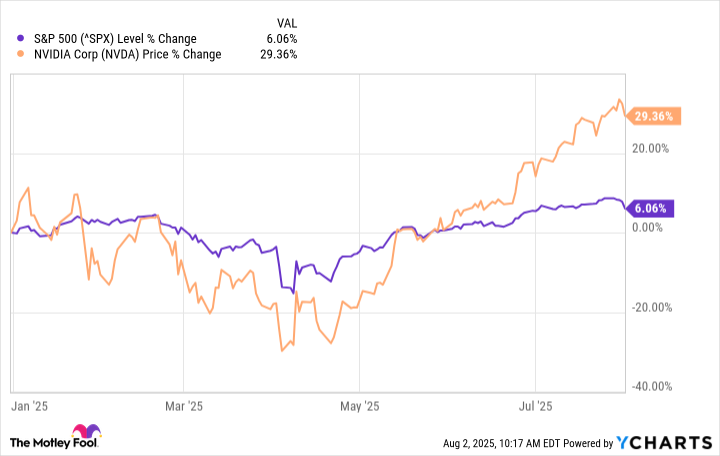

It was in the year of phantom valuations and feverish portfolio appraisals that Nvidia, once a humble peddler of gaming chips and adolescent dreams, became the lodestone of artificial intelligence. Share prices soared to a height that made sensible elders mutter stories about the Dutch tulip panic. The air was thick with possibility and, unavoidably, the metallic tang of risk. Feverish speculation whirled around the company, whose sales ratios—56 times trailing, if you care for such numerics—gleamed with improbable triumph, while the S&P 500 watched on in envious resignation, like an old dog left out of a card game.

To question if Nvidia was “still a buy” was, in this mythic marketplace, akin to asking if rain would come to Macondo: both inevitability and heresy, depending on whom you asked.

Through the Bamboo Curtain: A Revenue Stream Revived

News arrived—carried on the whispering, encrypted wires—that regulators had changed their minds, or perhaps surrendered to fatigue, and permitted fresh shipments of Nvidia’s H20 processors into the great expanse of China. Until then, chips destined for Shanghai had languished, like unsold carnival masks, in warehouses heavy with the scent of unrealized profit.

Just weeks before, this same stream had been dammed by decrees and fear. $5.5 billion in unsellable stock was written off with the dry resignation of an old priest closing up an empty church. But the opening of the sluice gates rewrote the prophesied disaster. Wall Street’s seers now spun tales of $5 billion in Chinese revenue arriving within two short quarters, and $30 billion, perhaps more, by the time today’s chips are as obsolete as Morse code.

How Nvidia Became the Cathedral of Computing

The transformation of Nvidia from a purveyor of adolescent amusements to the Vatican of AI infrastructure must be counted among the strangest passages in the annals of corporate metamorphosis. Once, their chips pushed pixels through shoot-’em-up fantasies; now, they carry the neural aspirations of civilization itself. From $3 billion in data center revenue in 2020, Nvidia’s fortunes ballooned to more than $115 billion in mere five years—a growth so ferocious it could alarm even the most distant ancestors, if they cared for such things.

The bottleneck is no longer demand, but the physical world itself—factories limited by the stubborn physics of lithography and the human patience for delay. Cloud titans—Microsoft, Amazon, Alphabet, those architects of digital Babel—clamor for graphics units as if each new shipment could stave off death itself. Executives confess offhand, in tones somewhere between awe and exhaustion, that they would “take every chip Nvidia can send.” Supply tightness, far from an ailment, has become a strange, shimmering blessing.

Meanwhile, a whisper runs through the datacenters: no longer is glory won only in training models, those early rites of AI adolescence. The inference—where the models, at last, sing in real time—grows to eclipse all former pursuits. As generative AI bursts from drawing rooms to factories and fields, every new deployment lays another brick in Nvidia’s gilded roadway.

Machinations and Shadows: The Rivals Gather on the Plains

In the heat haze beyond the citadel, the rival armies muster. AMD, ever the restless twin, polishes its MI300 series under the spectral glow of white-hot ambition. The hyperscalers—those cloud gods—tinker with in-house silicon, whispering of revolt. Yet the secret to Nvidia’s power is not so easily duplicated: the entire symphony of hardware, the intricate choreography of drivers and code, and, above all, the stubborn inertia of old systems.

Developers, having bound their fates to Nvidia’s Compute Unified Device Architecture platform, face the prospect of migration with the same dread their grandmothers reserved for hurricanes. Cost, complexity, and the simple human affection for the familiar forestall any mass exodus. Meanwhile, hidden in the interstices between chips, Nvidia’s NVLink and InfiniBand networking gear—descendants of the Mellanox union—are the sinews behind the muscle, binding disparate processors into one sonorous engine. To call Nvidia a parts vendor is to call the cathedral a pile of stones.

The Price of Prophecy: Value Amid Visions

Nvidia’s stock, perched at 56 times trailing earnings, has become the subject of heated kitchen debates and dreamy monologues alike. Here is a price not given but conjured, like rain or gold, justified less by precedent than by narrative force. The numbers, for all their pale power, tell their own enchanted tale: $130.5 billion revenue in 2025, a 114% leap over the previous year, gross margins blooming to 75%.

To ask if such a company deserves a premium is to misunderstand how markets and miracles work. The investor’s more subtle task is to weigh whether hope’s price has grown too rich for its promise. The sudden blessing of Chinese trade—unexpected manna—tilts the scales again, and the specter of new growth in areas like automotive autonomy, robotics, and edge computing beckons like yet-unplundered cities beyond the horizon.

With each passing fiscal, Nvidia unveils a new map: Blackwell, Rubin, beyond—each architecture rendering the previous epoch quaint, outdated, another archaeological layer upon which the cathedral is built higher. The competition is persistent, inventive, occasionally threatening, but for now, Nvidia’s procession remains unbroken.

Early Oracles or Fading Echoes?

The question for those standing beneath the arcades of speculation remains as vexing—and as old—as the urge to invest itself: Is the AI epoch sunrise or sunset? Does one wager among the first row of dreamers, or in the echo of spent celebrations? The omens tilt towards dawn: China’s reopening, cash registers still starved of enough GPUs, and the relentless unfolding of Nvidia’s roadmap out to 2027. Every new deployment—each with a whimsical name and untold ambition—seems to stretch the frontier.

Doubt, of course, patrols the margins: global tempests, rivals in search of thunder, and the ancient curse of market cycles. Yet, as this chapter is still being written by machines that sometimes dream of their own mythologies, the investor—ever superstitious, ever hopeful—gets to bet not just on Nvidia’s ingenuity, but on whether the rest of humanity can keep pace with its ambitions.

🐦

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The Weight of Choice: Chipotle and Dutch Bros

- 9 Video Games That Reshaped Our Moral Lens

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-05 04:13