In a world where every week is more theatrical than the last, we find ourselves in the midst of another grand performance. The Federal Reserve, in all its stately splendor, decided to keep interest rates as steady as a Victorian gentleman’s monocle, much to the chagrin of our modern-day monarch, President Trump. 🎩

Before the grand reveal, Bitcoin, that most capricious of divas, had already made a dramatic recovery from its recent plunge below the $115,000 mark, gracefully pirouetting back into its familiar trading range between $117,000 and $119,000. It seemed to dance along these lines for days, neither rising to new heights nor sinking into despair, much like a lady at a ball waiting for her prince. 💃

Then, just as the curtain was about to rise on the Federal Reserve’s meeting, the US GDP report for Q2 made a surprise appearance, revealing a robust economic growth of 3%. President Trump, never one to miss a cue, promptly urged Fed Chair Jerome Powell to cut the rates. Alas, the Fed remained unmoved, like a statue in a garden, indifferent to the rain of tariffs that soon followed. 🌧️

The Fed’s decision to leave rates unchanged, for the fifth time in a row, sent Bitcoin into a brief swoon, slipping from nearly $119,000 to under $116,000. Yet, by Thursday, it had recovered its composure and was once again flirting with the upper boundary of its trading range. However, the bears, emboldened by Trump’s tariffs, struck again, sending Bitcoin tumbling to a three-week low of $114,000. 🐻

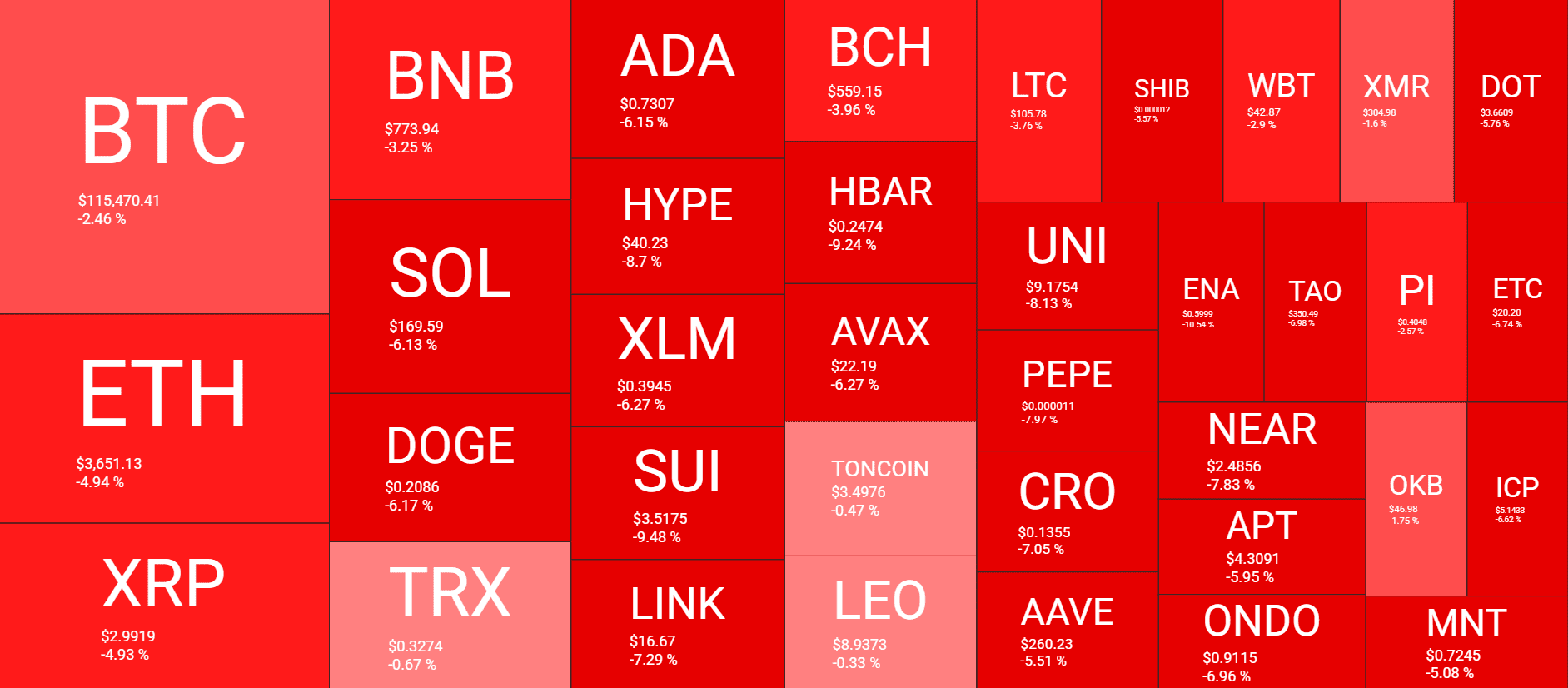

Despite the turmoil, Bitcoin managed to close the month at around $115,000, a respectable performance given the week’s events. The altcoins, however, were not so fortunate, with many seeing price declines of up to 10%, a true tragedy in the world of digital assets. 😢

Market Data

Market Cap: $3.83T | 24H Vol: $180B | BTC Dominance: 60%

BTC: $115,350 (-2.5%) | ETH: $3,646 (-4.8%) | XRP: $2.98 (-4.8%)

This Week’s Crypto Headlines You Can’t Miss

Trump Administration Unveils Crypto Strategy But Omits Bitcoin (BTC) Reserve Plan. The White House, in its latest act of political theater, released a Digital Asset report that touched upon various aspects of the crypto world, but curiously omitted any mention of a strategic Bitcoin reserve. One wonders if this is a case of deliberate oversight or simply a matter of taste. 🤔

Ethereum Turns 10: What Will Define the Next Decade? This week, Ethereum celebrated its tenth birthday, a milestone that invites reflection on its past triumphs and future prospects. From its humble beginnings to becoming a cornerstone of the blockchain ecosystem, Ethereum’s journey has been nothing short of spectacular. 🎉

Ethereum ETF Inflows Soar in July, Outpacing Last 11 Months Combined. The spotlight remains on Ethereum, whose spot ETH ETFs have seen unprecedented inflows in July, surpassing the total of the previous 11 months. This surge in investment underscores the growing confidence in the asset’s potential. 📈

Strategy Tops IPO Charts in 2025 With $2.52B Raise—More Bitcoin Bought. In a move that could only be described as audacious, the company led by Michael Saylor raised over $2.5 billion through an IPO and promptly used a significant portion of the funds to buy 21,021 BTC. One can only imagine the conversations at the board meetings. 🤑

Bitcoin Whales Seize 68% of Supply After Adding 218,570 BTC. As retail investors began to part with their Bitcoin holdings, the whales, ever the opportunists, swooped in to claim a larger share of the pie. They now hold 68% of the total supply, a testament to the old adage that in times of crisis, the strong grow stronger. 🐳

Altseason in Full Swing? These CryptoQuant Charts Point to Yes. The debate over whether the current market conditions signal the beginning of an altcoin season continues to rage. CryptoQuant, in its role as the oracle of the crypto world, suggests that the altseason has indeed begun, backed by a series of compelling charts. 📊

Charts

This week, we delve into the price analysis of Ethereum, Ripple, Cardano, Solana, and HYPE. Click here for the complete breakdown. 🔍

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-01 16:53