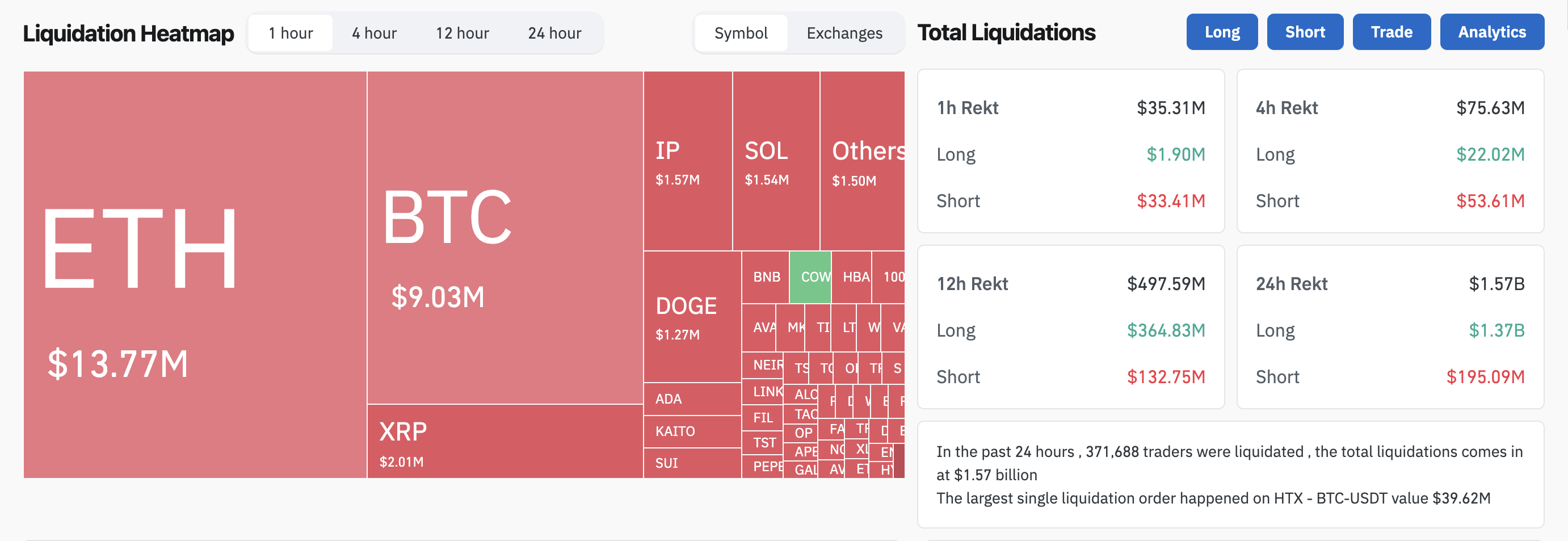

Oh boy, crypto liquidations are hitting the roof at $1.5 billion in just 24 hours! It’s like the market is having a panic attack. This is the third time in February that we’ve seen liquidations exceed the billion mark. Talk about a roller coaster ride! 🎢

But hey, don’t start crying into your crypto wallets just yet. Analysts are saying that even if the worst predictions come true, crypto could still bounce back stronger by mid-2025. So, chin up, buttercup! 🌟

Flash Crashes and Liquidations on the Rise

Rumors of a bear market are flying around like wildfire in the crypto world. Bitcoin ETFs are hemorrhaging funds, and it’s putting a serious damper on Bitcoin’s price. It’s like a horror movie, but with more numbers and less blood. 🧟♂️

But if you take a broader look, it’s not just Bitcoin taking a hit. The entire crypto market is feeling the pain, with over $1.5 billion in total liquidations in the last 24 hours:

Bitcoin, the big kahuna of crypto, is linked to a massive ETF market, but it’s not the biggest loser today. That honor goes to Ethereum, which is getting hit hard in the aftermath of last week’s Bybit hack. It’s like a double whammy! 💥

Bitcoin dipped below $90,000 today, the first time in three months. And the ETF outflows are showing that institutional investors are bailing like it’s the end of the world. 🚀

Meanwhile, Ethereum is leading the liquidation parade, thanks to the Bybit hack fallout. Today’s crash is just another chapter in the book of frequent flash crashes. It’s like the market is having a midlife crisis every other day. 🤯

In 2025, we’ve already seen four major crashes in a 24-hour window, each driven by different macroeconomic factors. It’s like a never-ending game of whack-a-mole. 🐹

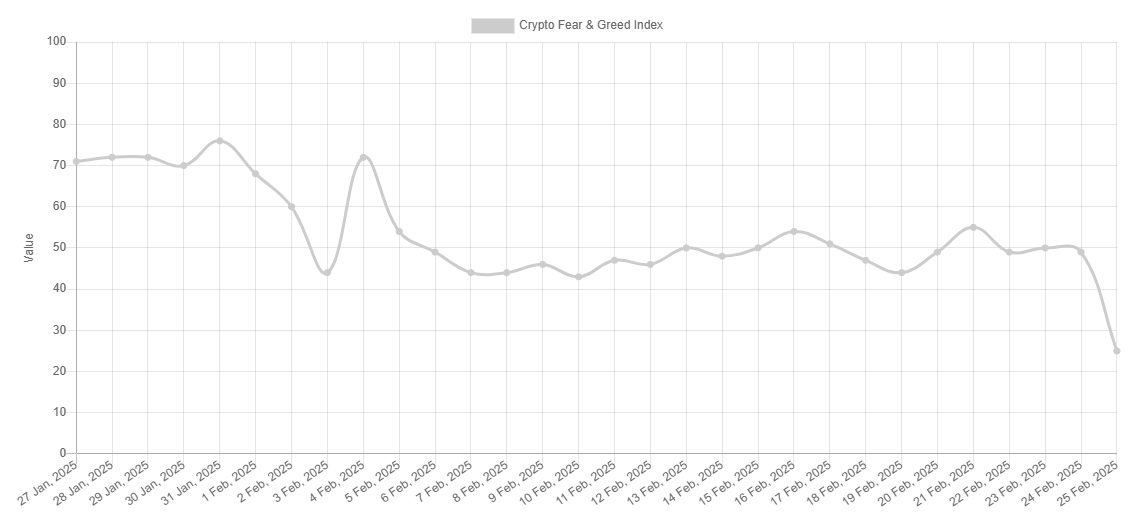

While the market has quickly recovered each time, the frequency of these liquidations is starting to raise some eyebrows. It’s a clear sign that market sentiment is changing faster than a chameleon. 🦎

If you look at the fear and greed index from the past three months, the volatility in market sentiment is painfully obvious. And right now, the market sentiment is at its lowest point in 2025. It’s like the market is having a bad hair day. 🤔

But not everyone is ready to throw in the towel. Binance CEO Richard Teng is telling everyone to keep their cool. He says these developments are just a tactical retreat, not a full-blown reversal.

“Price movements often overshadow what’s happening beneath the surface, but the fundamental drivers of crypto growth remain firmly intact. Market corrections can feel unsettling, but they are also moments when experienced investors position themselves for the next bull trend. For those focused on the bigger picture, volatility presents an opportunity,” the Binance CEO claimed.

In other words, Teng is reminding everyone that this industry is cyclical. We’ve seen crashes before, and we’ll see them again. It’s like the crypto version of Groundhog Day. 🐾

All the leading crypto projects are taking a hit. Solana’s price is at a four-month low, and XRP is at its lowest point since December. But the industry’s foundations are still strong. The crypto industry’s political movement is still on the rise, and institutional investors are still showing a lot of interest. Binance, for one, is seeing a steady growth in new users. 📈

So, when the dust settles after these liquidations, the crypto community might find itself in a better position to pursue even larger gains. It’s like after a storm, the sun always comes out. ☀️

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Oblivion Remastered: How to get and cure Vampirism

- ‘We’re All Sort Of Waiting’: Chris Hemsworth Sheds Light On Thor’s Possible Future In The MCU During SDCC 2024

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

2025-02-26 03:03