Right. So, silver. It’s been… a month. A volatile month. Honestly, it feels a bit like dating – thrilling highs, terrifying dips, and the constant fear of being left holding the bag. But despite all the drama, it’s still up double digits year-to-date. Which, you know, is something. And Wheaton Precious Metals (WPM +4.01%)? They’re up 11.4% this year, and a frankly astonishing 98% over the last twelve months. Ninety-eight percent! I mean, I haven’t seen returns like that since… well, since I accidentally bought a limited-edition Beanie Baby in 1998. (Don’t ask.)

Which naturally leads to the question: is the party over? Is this one of those moments where you should cash out and book a one-way ticket to Bali? The stock’s price-to-earnings ratio of 59 certainly makes it look expensive. It’s like that dress you saw online – gorgeous, but probably won’t fit, and you’ll end up sending it back. Compared to the S&P 500 average of 29.6, it’s… well, it’s a bit of a stretch.

But here’s the thing. I’ve been digging, and I think Wheaton might actually be cheaper than it appears. Cheaper than it was a year ago, even, before it went on its little (okay, massive) rally. It’s a bit like finding a five-pound note in an old coat pocket – a delightful surprise.

Putting Wheaton Precious Metals’ valuation in context

The key to understanding Wheaton is their business model. They don’t actually mine anything. It’s a bit like being a venture capitalist for shiny things. They provide financing to mining projects, and in return, they get the right to buy a portion of the future output at a heavily discounted price. It’s genius, really. Like discovering you can get a discount on avocados if you buy them in bulk.

For example, that deal with Waterton Copper in 2023? They’re getting hundreds of thousands of ounces of silver from the Mineral Park Mine in Arizona for a whopping 82% discount to the spot price. Eighty-two percent! It’s like finding a designer handbag on sale. And the Blackwater mine in Canada? They can buy up to 18 million ounces of future silver production at the same discount. It’s all very… lucrative.

Obviously, a company that has rights to buy troves of gold and silver at discounts of up to 82% is going to outperform the precious metals market over time. It’s just… logical. As of early 2026, Wheaton Precious Metals has outperformed both gold and silver over one-year, three-year, five-year, and ten-year periods. Which is… reassuring. It’s nice to be on the winning side for once.

So, investors are willing to pay a premium for shares during this historic precious metals rally. Makes sense. But how big of a premium is justified? The P/E ratio is a starting point, but it only looks at current earnings. It’s a snapshot, not a movie.

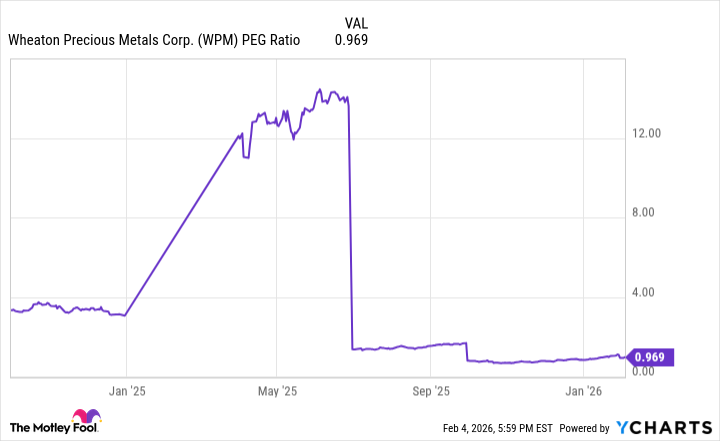

That’s why I look at the price-to-earnings-growth (PEG) ratio. It divides the P/E ratio by the rate of growth in earnings per share. It gives you a better idea of whether the earnings are growing fast enough to justify the price. It’s like assessing whether a potential partner is worth the effort.

Here’s how the stock’s PEG ratio has been trending over the last twelve months:

As you can see, it plummeted in mid-2025 when the company announced that Q2 net income had more than doubled. Shares rallied, but not by 100%. Which, surprisingly, made the stock cheaper by this metric. It’s like finding a twenty-pound note in your pocket when you thought you only had a tenner.

Today, the PEG ratio is below 1, which is considered desirable. Whether to buy shares probably depends on where you think gold and silver are headed. And honestly, who knows? But there are three reasons to think that silver, incredibly, may still have upside in 2026 and beyond. Although, let’s be honest, I’m probably just telling myself that to justify my slightly irrational fondness for shiny things.

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24. Will become disciplined long-term investor: Unlikely.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-07 19:53