As a seasoned cryptocurrency investor who has been through multiple market cycles, I must say that the predictions for 2025 sound quite promising. The potential approval of Bitcoin ETFs globally, especially under President Trump’s administration, could indeed accelerate institutional adoption and drive the price of Bitcoin to new heights.

2024 is drawing to a close, and overall, it’s been a fairly positive year for our ecosystem. However, as we look forward to 2025, what can we anticipate for the cryptocurrency market?

This is a pressing question that investors might have. In this analysis, BeInCrypto discusses insights from renowned analysts about the year ahead. While some predict the bull market will gain momentum, others urge caution. Here’s a breakdown of the top forecasts and key signals from critical indicators.

Analyst Expection Bitcoin Rally to Persist, but First…

According to Benjamin Cowen, a crypto analyst and founder of IntoTheCryptoverse, there’s a possibility that Bitcoin (BTC) might experience a correction at the beginning of 2025. This prediction is based on Bitcoin’s historical behavior following previous halving years. Therefore, Cowen recommends that market participants mentally prepare themselves for a possible price drop.

As a crypto investor looking back at the past two market cycles, I’ve noticed that Bitcoin often experiences a correction in January following the post-halving year. Therefore, it might be wise to mentally prepare for a potential correction around January 2025. This insight comes from Cowen’s analysis on the pattern.

Contrary to many expectations suggesting Bitcoin’s price might surge to $120,000 within the first month, this research presents an opposing view. At present, Bitcoin is being traded at approximately $97,970, and it has already reached a record high of $108,268 this year, marking a 112% increase in its value since the start of the year.

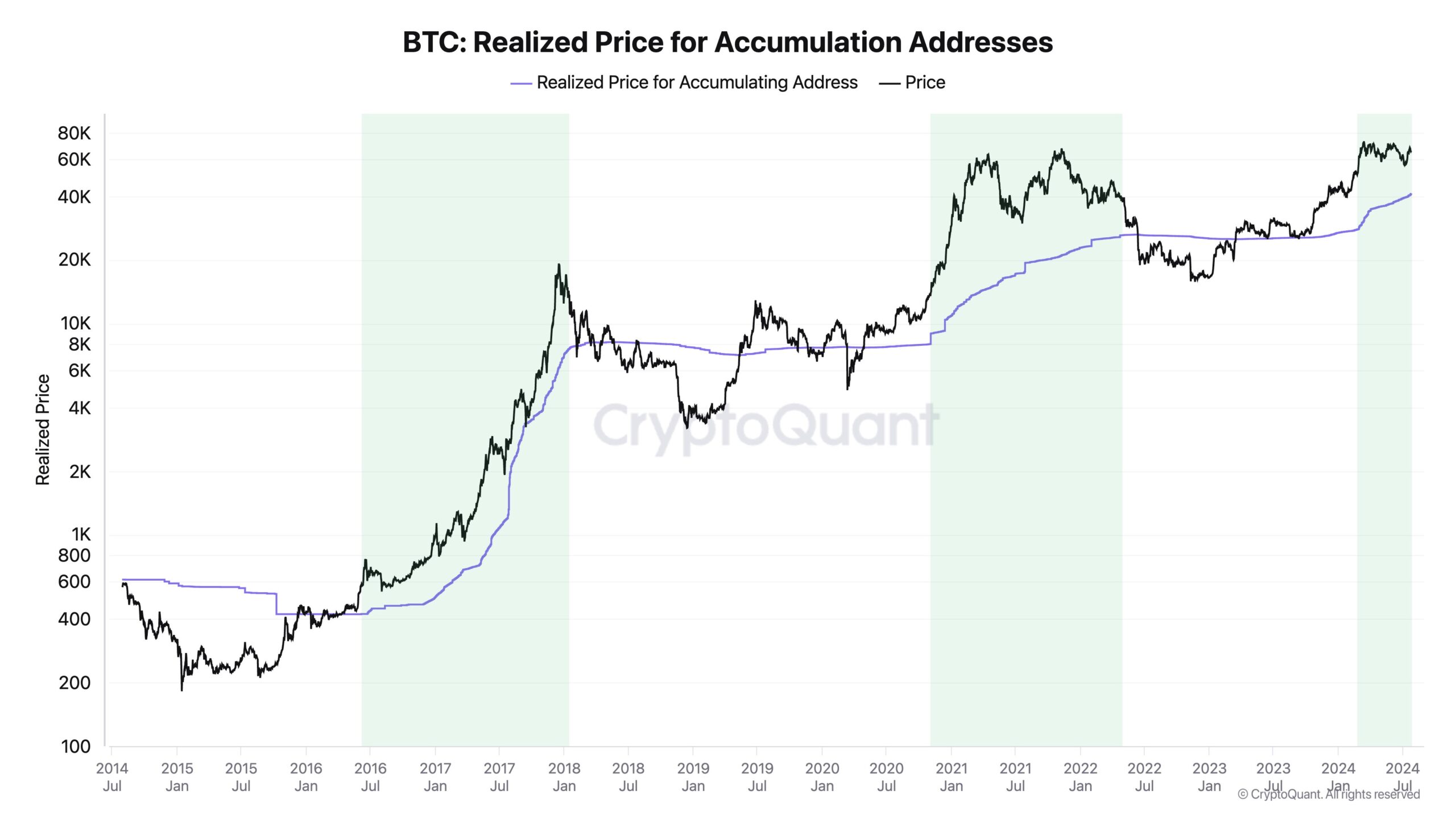

According to Ki Young Ju, the CEO of CryptoQuant’s analytical platform, he believes that the Bitcoin bull market may continue until around mid-2025. This prediction was made by him back in July, suggesting that more capital could potentially flow into BTC, thereby prolonging the positive trend in the crypto market until that time frame.

In November, young Ju shifted his outlook. He stated that if Bitcoin’s price finishes 2024 robustly, it might pave the way for a bear market in 2025.

Young Ju mentioned that he anticipated adjustments as Bitcoin futures market signals became too intense, but we’re now in a phase of price exploration, and the market is getting hotter still. If corrections and consolidation happen, the bull trend might last longer; yet, a powerful end-of-year surge could pave the way for a bear market in 2025.

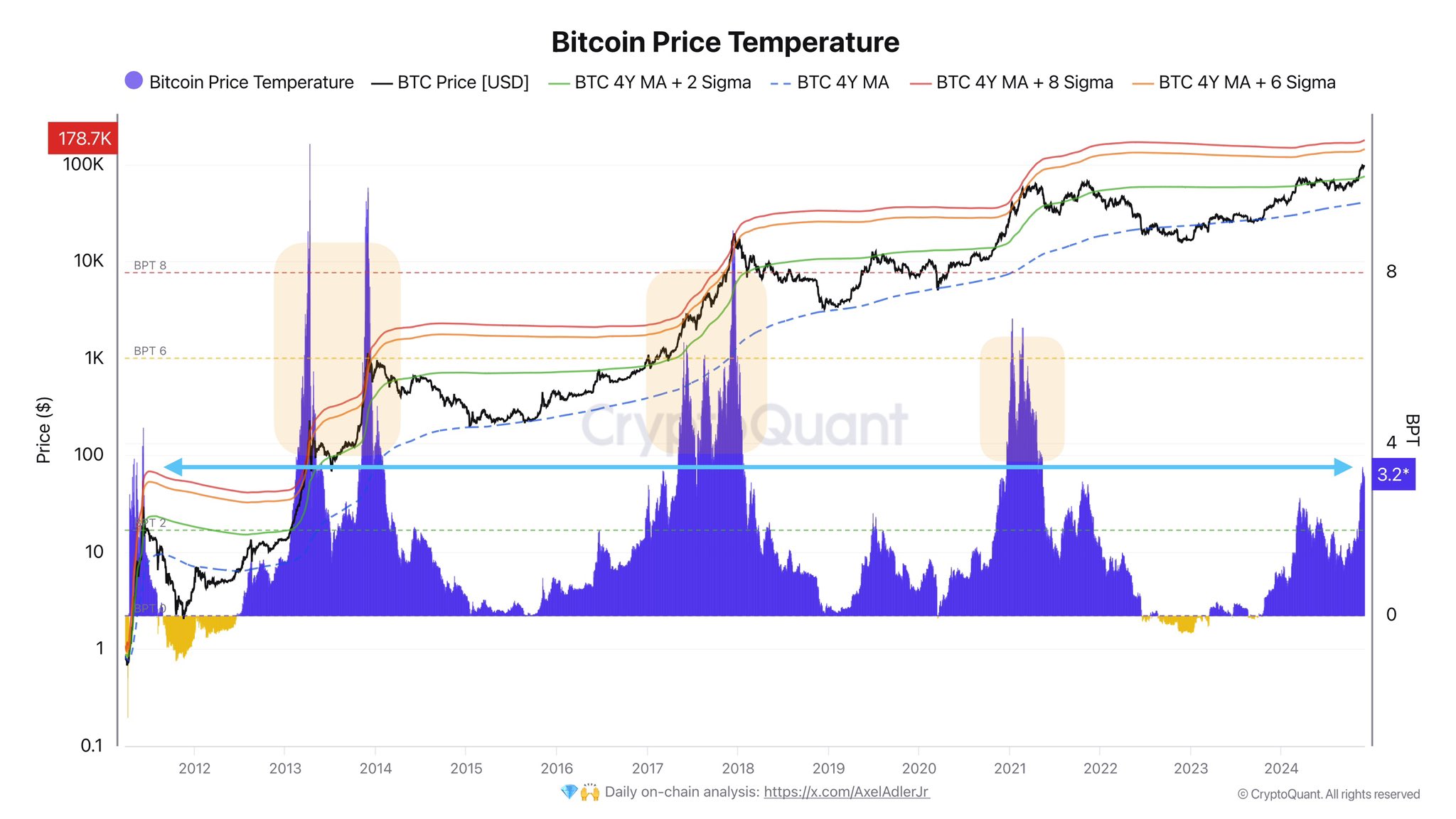

More recently, Axel Adler expounded on the Bitcoin Price Temperature (BPT) concept he developed. This method calculates the gap between the current Bitcoin value and its averaged price over a four-year period.

Generally, Bitcoin tends to hit its cycle peak when the BPT (Bitcoin Price to Realized Value Ratio) ranges from 6 to 8. As of December 7, Adler observed that this indicator stood at 3.2. However, if the BPT increases to 8, it might drive Bitcoin’s price up to approximately $178,000.

As a crypto investor, I’ve been told that when Bitcoin’s Blockchain Price Theory (BPT) level hits 8, we might see the price soaring to an impressive $178K per BTC by the year 2025. This prediction is based on the assumption that the current demand for coins in the spot market remains consistent. In simpler terms, if things keep going as they are, this target could become a reality.

Altcoins Not Left Out: Solana vs Ethereum Rivalry to Continue

Keep in mind that while Bitcoin plays a significant role in the cryptocurrency market, it’s essential not to overlook other digital assets and their potential performance by 2025. It’s also worth noting that only a handful of altcoins from the 2021 bull run have managed to reach new peak prices so far.

Nonetheless, there were some encouraging developments. For instance, Binance Coin (BNB) and Solana (SOL) reached record highs, while Ripple‘s price demonstrated robust growth during the past three months. Furthermore, several emerging altcoins like Sui (SUI), Mantra (OM), and Bitget Token (BGB) also delivered impressive results.

This accolade would, however, be incomplete without mentioning meme coins, which had a strong hold on the market during this cycle. Due to this, experts forecast that meme coins, AI coins, and Real World Assets (RWA) tokens might continue to perform well in 2025.

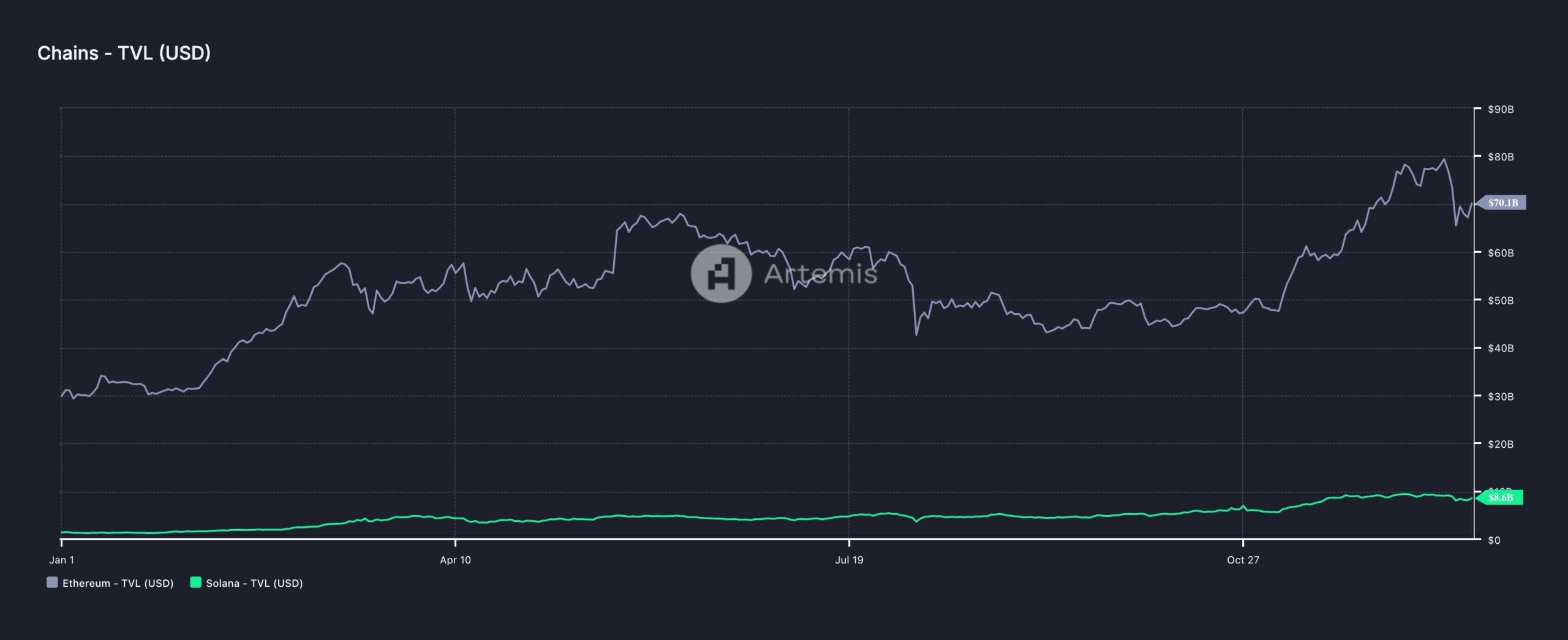

Despite some expectations, Ethereum (ETH) hasn’t quite lived up to its potential as predicted by certain analysts. Consequently, the digital asset management company 21Shares believes that Solana could potentially increase its dominance over Ethereum’s market share in the year 2025.

21Shares’ report suggests that the prediction is based on the low fees offered by the Solana blockchain and the incorporation of the PayPal USD stablecoin (PYUSD). Furthermore, it clarifies that this forecast doesn’t mean Solana will surpass Ethereum’s market capitalization.

The report suggests that although a complete “flippening” (Ethereum overtaking Solana) might not be expected, Solana is well-positioned to surpass Ethereum and grab a larger market share due to its enhanced user experience and robust infrastructure.

Despite that, Ethereum’s Total Value Locked (TVL) remains higher than that of Solana. As of this writing, Solana’s TVL is $8.60 billion, while Ethereum’s is $70.10 billion.

If my prediction holds true, the gap in Total Value Locked (TVL) might narrow down. As for the Solana Exchange Traded Fund (ETF), according to 21Shares, we might see approval within the first three quarters of this year, but it could also be at the end of 2025 or the start of the following year.

It’s anticipated that Solana will take on a larger part in the traditional financial world, potentially leading to the creation of financial instruments like Solana futures on the Chicago Mercantile Exchange or U.S.-based Solana exchange-traded funds (ETFs). Although an ETF approval might not occur in 2025, the possibility is expected to grow as we near the end of this year and move into the first half of 2026, as indicated by 21Shares.

The Trump Effect and What Adoption May Look Like

Looking at things on a larger scale, the asset manager believes that if Bitcoin ETFs are approved, it could trigger increased institutional interest in Bitcoin worldwide. This optimistic outlook might stem from the fact that Donald Trump became the U.S. President, which some people associate with potential regulatory changes favorable to cryptocurrencies.

Throughout his election campaign, Donald Trump frequently pledged that his presidency would bring about clearer guidelines for the cryptocurrency industry. His swearing-in ceremony is set for January 2025, and the potential departure of SEC Chair Gary Gensler might open up more room for the market to operate freely.

Beyond the United States, South Korea is contemplating the removal of restrictions on cryptocurrency Exchange Traded Funds (ETFs). If this happens, it could significantly boost trading activity in the Asian market. Similarly, there’s talk in the UK that retail investors may soon be given access to crypto-based Exchange Traded Notes (ETNs).

Looking at current trends, it seems likely that the cryptocurrency market in 2025 may present more favorable results compared to this year’s performance. Additionally, there’s a chance another nation could emulate El Salvador by adopting Bitcoin as a strategic reserve asset.

Currently, it seems that the United States and Argentina under the leadership of Javier Milei have the capability to attain a significant milestone. Should this occur, it’s anticipated that the value of Bitcoin would reach unprecedented levels, potentially pushing its total market capitalization beyond $5 trillion.

For altcoins, their current state remains uncertain, but if substantial investments flood these assets, they could potentially reach new heights. However, it’s crucial to stay vigilant, as sudden collapses of cryptocurrency platforms similar to those seen in 2025 could invalidate this prediction and plunge the market into a bearish trend.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-12-25 15:42