Nvidia. Ticker: NVDA, to those of us doomed to talk in tickers. The shares dragged their feet for months, like a sullen teenager, until April, when someone yelled “AI” again and they sprinted. Up 30% year to date, as if numbers alone could impress anybody at a poker table. Whether this hot streak will cool or burn on, well, that’s one for the comedy writers. Street consensus says the punchline lands August 27, when the second-quarter earnings drop. Maybe you’ll laugh, maybe you’ll cry.

Last year, Nvidia did the impossible: doubled its sales. If you doubled your money every time you walked into a casino, the casino would burn down. But gravity gets everything in the end, except maybe the S&P 500. Eventually, customers buy enough chips to stack to the moon, and “competitors” show up with something that looks suspiciously like the same silicon—but cheaper. Still, a trader knows: you don’t need to keep breaking your own absurd records to make money. You just need to surpass the dreams of the crowd staring at the ticker tape.

So what’s the detail—the tiny decimal—that matters more than any AI thinkpiece? It’s right here, hiding in plain sight, and it’s the one thing to watch if you want to call yourself more than a tourist in Nvidia stock.

Funny How Demand Works—Until It Doesn’t

People got cold feet about Nvidia earlier this year. Something about China shutting the lights out on American chips. That happens. Markets wake up hungover, too. The US banned certain chip sales to China. Nvidia, thinking itself clever, built the H20 chip just for China. Then they banned that too. The company took a $4.5 billion write-down—some accountants sighed, the Street pretended to care, and the world rolled on.

But the market, bless its jittery heart, is always ready to forget. Now, rumor is, Nvidia is ordering 300,000 H20 GPUs from TSMC. Throw that on the bar tab, since last year they sold a million. It’s not the same as before, but if I had a quarter for every time a “headwind” became a “tailwind” in one financial cycle—well. I’d be writing this from my second yacht, instead of beside a coffee-stained Bloomberg terminal.

This, in parallel with demand for Nvidia’s bleeding-edge Blackwell chips. Everyone wants to build forums for AI to argue with itself in—Saudi Arabia, Indonesia, various folks in Europe, Americans with Stargate dreams. About $500 billion of hallucinated ambition, apparently. It’s all just piles of server racks at the end of the day, but they make the graphs go up. So it goes.

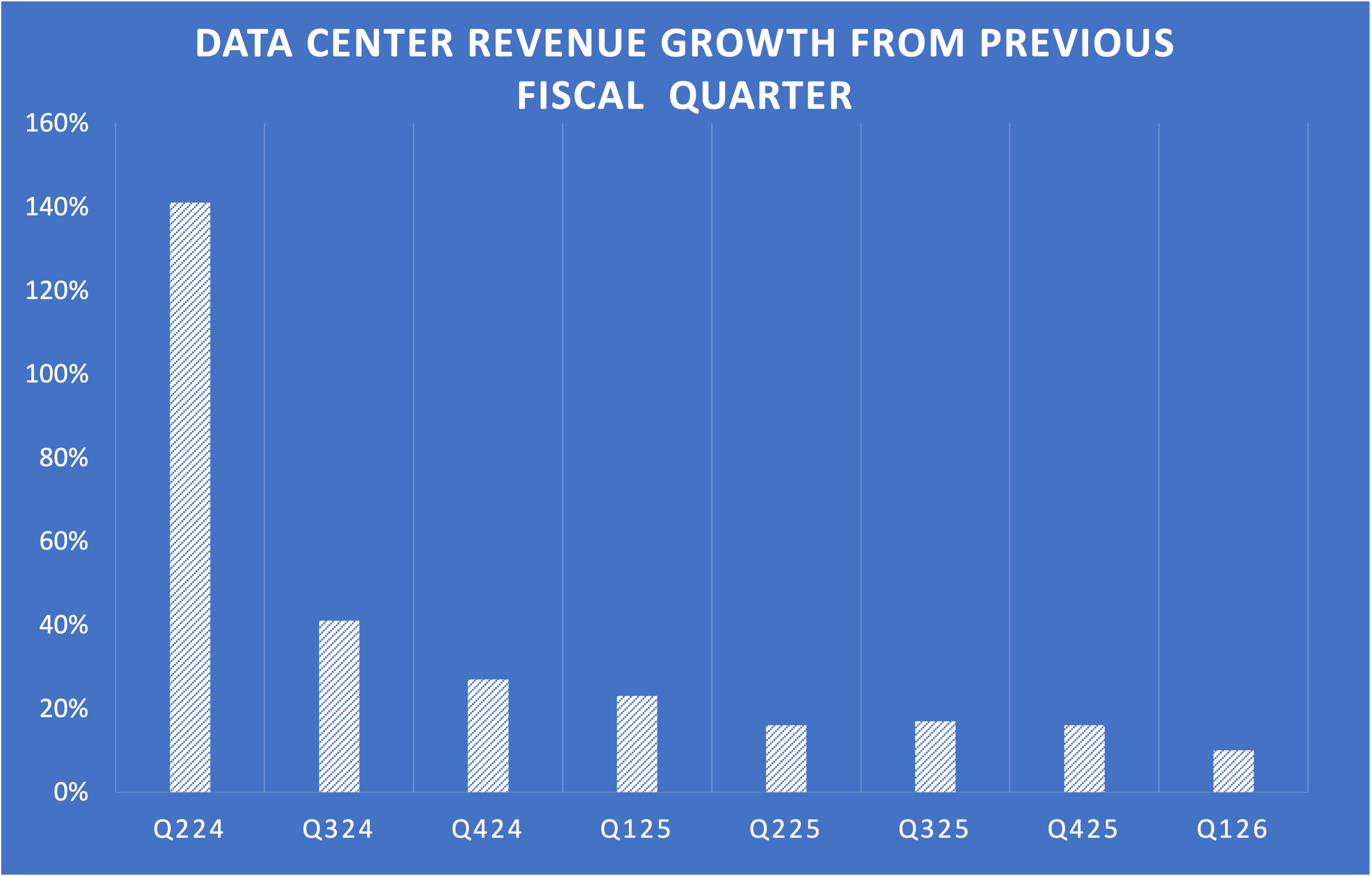

The Line to Watch Isn’t Human—It’s Data Center Revenue

Come August, don’t get distracted by the fireworks display of adjectives. As a trader, you tune out the CEO’s poetry about the “future.” Watch the data center growth number. If you’re going to bet on Nvidia, you have to bet on their chips renting out more and more floor space in the world’s digital basements. Last year was a carnival: 114% revenue growth, big tech and AI companies handing out tickets to everyone they know. Now, the main tent’s quieter. Growth is still there, but quarterly increases drifted downward, settling around 15%. The blip for China? Last quarter slid to 10%. Traders hear “plateau” and start reaching for their parachutes.

Look, four straight quarters of 15% growth? That extrapolates to about a 75% annual pop. Which borders on financial science fiction for a firm the size of Nvidia. Feels like the kind of anomaly that draws statisticians out like cicadas.

Here’s the number I care about, reading through trader’s glasses thick as Coke bottles: Is this quarter’s slowdown—the China business, the shifting trade winds—just a pothole on the road to more data center expansion? Or is it the beginning of long, flat silence? If quarterly growth snaps back above 10%, then even these frothy prices start to look almost reasonable—depending on what planet you’re from.

The chorus of analysts will try to read the entrails of Jensen Huang’s commentary. They’ll listen for any slip, any hint of the future—fortune tellers in Armani suits. But when the dust settles, only one thing remains: the stubborn numbers. The data center revenue, quarter on quarter. It’s always the numbers. Everything else is noise.

And yes, you can bet I’ll be watching. So it goes. 📉

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-05 06:39