As a seasoned researcher with over two decades of experience in financial markets and a strong interest in digital currencies, I have witnessed the incredible growth and volatility of Bitcoin firsthand. The current situation presents an interesting conundrum for investors: on one hand, we have prominent analysts predicting a bullish December for BTC, with prices surging above $100,000; on the other hand, we see BTC ETF outflows and short-term resistance at key levels.

In more recent times, Bitcoin (BTC) has experienced a minor hiccup in its surge towards the projected $100,000 price point. Over the last few days, it’s been hovering below this level, causing investors to ponder about its immediate price fluctuations.

However, a number of prominent crypto analysts remain optimistic about Bitcoin’s prospects in December. This analysis explores some of their forecasts.

Bitcoin May Climb Above $100,000, Analysts Say

As per Juan Pellicer, a Senior Researcher at IntoTheBlock, there’s a strong prediction that December could see a surge in Bitcoin prices. This optimistic outlook is largely attributed to an extraordinary influx of institutional interest in Bitcoin, as demonstrated by the increasing investments in Bitcoin ETFs. This surge in demand is expected to push the price of Bitcoin above $100,000.

As we move towards December, there’s a strong expectation among analysts that Bitcoin could experience a significant rise due to extraordinary institutional interest in Bitcoin ETF investments. This growing institutional involvement, combined with a noticeable decrease in macroeconomic strains, sets Bitcoin up for potentially breaking the $100K mark. The current market pattern indicates substantial accumulation periods, according to the analyst speaking to BeInCrypto.

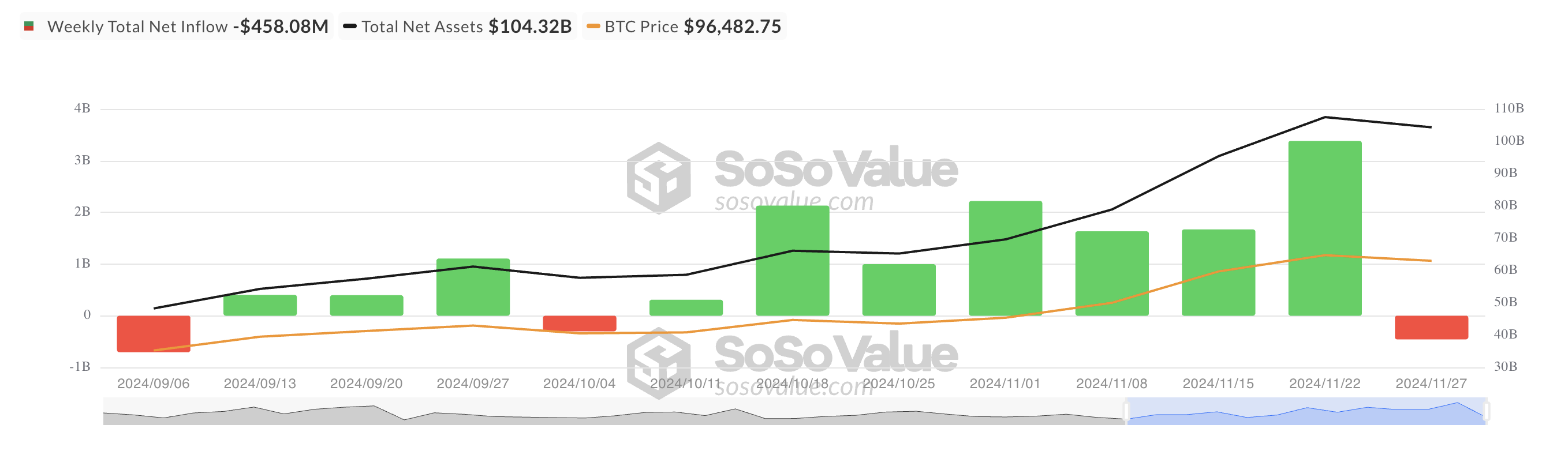

As an analyst, I’ve noticed an intriguing development this week: Bitcoin ETFs have experienced net outflows for the first time in two months. According to SoSoValue, the total withdrawal from these funds amounts to $458 million. This trend follows a substantial drop in BTC’s price, which dipped as low as $92,000 earlier this week. The price downturn might have triggered institutional investors to withdraw their funds from these ETFs, possibly due to the recent market adjustments.

However, a different expert, Brian Quinlivan from Santiment’s Lead Analyst role, anticipates a bullish trend in Bitcoin during December. Quinlivan believes that if Bitcoin whales persist in hoarding the leading cryptocurrency, this growth could be driven by them.

10 or more significant Bitcoin holders added an additional 63,922 BTC in November, equating to approximately $6.06 billion. Despite the peak on Friday, these key players have continued their accumulation at a rapid pace without any signs of slowing down. This trend may indicate that the current dip is just a temporary correction aimed at eliminating less committed traders and those who purchased at around $98,000 to $99,000, according to Quinlivan’s perspective.

BTC Price Prediction: This Support Floor Is Key

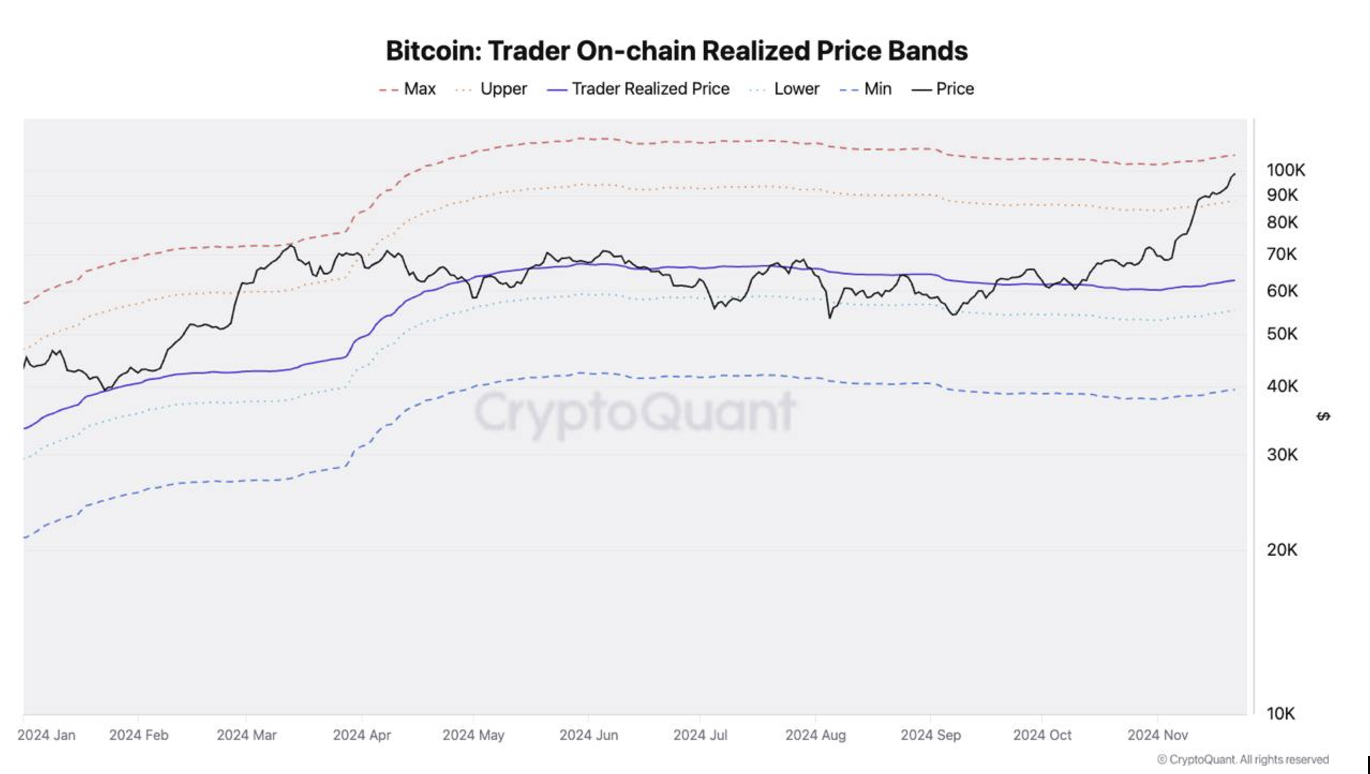

However, while also acquiescing that Bitcoin’s price may rally above $100,000 in December, Julio Moreno, Head of Research at CryptoQuant, noted that the coin may face a short-term resistance at $105,000.

As a crypto investor, I recently learned from Moreno’s analysis that the price range around $105,000 (the highest band) served as a significant barrier for Bitcoin back in March when it momentarily peaked at $74,000. This historical resistance could potentially impact Bitcoin’s future price movements.

This means that once BTC’s price nears this max band around $105,000, it may witness a pullback.

At present, Bitcoin is valued at approximately $96,795. In order for predictions of the price reaching $100,000 to become a reality, Bitcoin must surpass its previous all-time high of $99,588 and transform this level into a support base instead of a resistance barrier. If such a change occurs, we could potentially witness Bitcoin soaring above $100,000 in December.

However, should buying pressure decrease significantly, Bitcoin’s price could drop towards approximately $88,986, contradicting the optimistic forecasts made by analysts.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-29 17:13