On April 11, 2024, Chris Mancini, an associate portfolio manager at Gabelli Gold Fund, talked in depth about the recent gold market trends during a segment on CNBC’s “Power Lunch” program. Normally, when gold-backed ETFs experience significant withdrawals, it results in lower prices. However, contrary to this usual pattern, the price of gold has continued to rise instead. This intriguing situation was the focus of their conversation.

Mancini began by discussing an uncommon occurrence: gold prices climbing even as ETFs, known for their significant influence on the gold market through purchasing and selling, experienced outflows. He suggested this disparity could indicate substantial physical buying from entities not included in standard ETF data.

Mancini emphasized an intriguing aspect: central banks’ growing interest in gold purchases, with China being a significant player over the past year and a half. In his perspective, this trend might stem from the need to diversify their reserves beyond U.S. dollars due to geopolitical strains. The Russia-Ukraine conflict and subsequent sanctions on Russia may have encouraged other central banks to explore gold as a secure alternative reserve asset that can’t be seized or frozen digitally.

Mancini provided insights into the growing preference among investors, especially individual and high-net-worth ones, for investing in physical gold. He attributed this trend to uncertainties surrounding other investment areas, such as China’s struggling real estate market. People are seeking secure, long-term investments, as evidenced by increased sales of gold bars at retailers like Costco. In essence, these purchases signify a broader trend among individuals to safeguard their wealth in tangible assets that are less susceptible to economic or political instability.

Regarding gold stocks, Mancini pointed out that gold mining company shares have been surpassing the value of gold itself recently. This suggests investors are optimistic about the sector’s future. He highlighted Agnico Eagle Mines as an example, a company with thriving operations in secure areas like Northern Quebec, renowned for substantial gold production and excellent free cash flow. Agnico Eagle is a notable investment in the Gabelli Gold Fund.

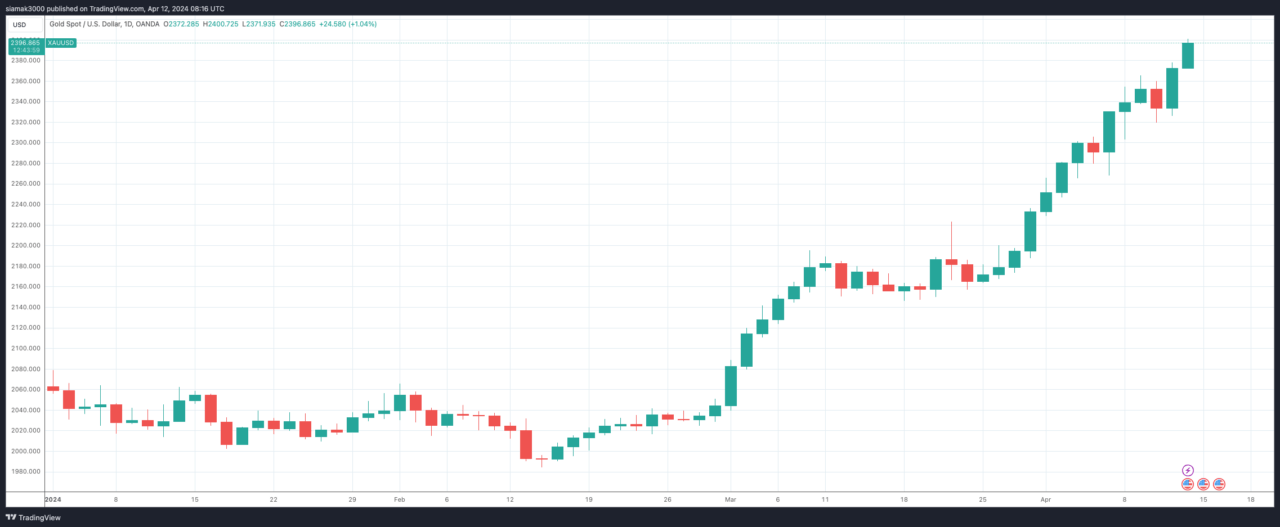

As of 8:15 a.m. UTC on 12 April 2014, gold is trading at $2,396.89, up 1.04% on the day.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-04-12 11:34