Brown-Forman Corporation (BF.B), a leader in the whiskey industry with renowned brands such as Jack Daniel’s, Woodford Reserve, and Old Forester, lags behind in the stock market. In the past three years, its shares have dropped by 63%, diving during 2023 and 2024, despite the broader market experiencing significant growth.

Between 2025, the stock has persistently faced difficulties due to a shift in consumer preferences towards non-whiskey beverages and alcohol products less favorably, coupled with apprehensions about tariffs as American whiskeys have been frequently singled out by foreign countries retaliating against American businesses for imposing tariffs on their exports.

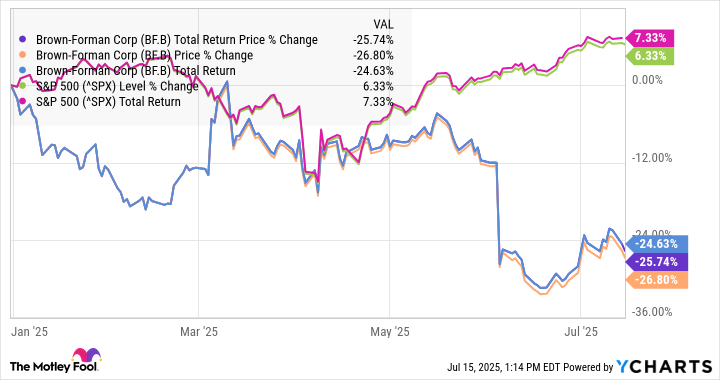

It’s clear from the graph that the stock has significantly decreased in value this year, falling far behind the S&P 500’s performance so far.

What’s ailing Brown-Forman?

Over the past few years, the alcohol industry has faced significant challenges due to growing health concerns about drinking, the surge of non-alcoholic beverages (mocktails), and preferences among Generation Z consumers. Moreover, companies such as Brown-Forman have been affected by trade disputes because they own popular American brands like Jack Daniel’s, which have been targeted in these conflicts.

As an observer, I noticed that throughout the financial year 2025, the company has consistently experienced a decrease in both revenues and profits. Specifically, during the third quarter, which concluded on January 31st, their revenue dipped by 3% to reach approximately $1.04 billion, while net income followed suit with a 6% decrease, landing at around $270 million.

It’s evident that Brown-Forman continues to generate substantial profits, primarily due to the robustness of its brand portfolio. However, external influences are causing some challenges for their operations.

During the fourth quarter, those trends persisted with revenue decreasing by 7% to reach approximately $894 million. After accounting for a $177 million profit from the sale of its Sonoma-Cutrer wine business in the same period last year, operating income actually increased slightly, moving from $198 million to $205 million.

Upon scrutinizing the figures, it appears the company is grappling with widespread obstacles. Management has stated that their operational conditions continue to be tough because of persistent economic and political uncertainties on a global scale.

In my world as a business enthusiast, it’s been a challenging journey this past year. Despite the global success we’ve seen, our revenue dipped in every region, primarily due to the divestitures of Finlandia and Sonoma-Cutrer. However, I must admit that whiskey sales held their ground, managing to stay flat for the entire year. Unfortunately, other beverage categories such as tequila, ready-to-drink, and the rest of our collection didn’t fare so well, all experiencing a decline. On a positive note, we’re learning from these setbacks and are eager to turn things around in the future!

What’s next for Brown-Forman?

This year, Brown-Forman has been affected by a combination of deteriorating consumer confidence and trade disputes, which appears to persist in the near future. Recently, President Donald Trump announced additional tariffs on significant markets for the company, such as the European Union.

Observing here, it appears that the rising June Consumer Price Index indicates a quickening pace of price escalations. This acceleration can be attributed to the tariffs that have already been imposed, suggesting potential worsening hurdles for the company in question. Notably, these increasing prices might prompt some consumers to opt for less expensive alternatives.

According to their own forecast, Brown-Forman expects a modest decrease in both sales and operational earnings for the fiscal year 2026, with the percentage being less than 10.

Investors may find little reason for excitement in this case. Although Jack Daniel’s is a leading brand within the spirits industry and accounts for over half of the company’s sales volume, without any growth, the business primarily functions to generate profits that are later distributed as dividends.

The business, on the other hand, didn’t buy back a large number of shares, which suggests it’s not exploiting the low market price in this manner. Instead, it appears to be utilizing its profits to decrease the total number of shares and boost its earnings per share.

In simpler terms, Brown-Forman’s price-to-earnings ratio of 15 and its dividend yield of 3.4% suggest it offers a fair value and attractive dividends. However, unless there’s a major adjustment in trade policies or a shift in consumer preferences, the stock may face ongoing challenges for some time ahead.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2025-07-20 04:07