In the vast, unforgiving ocean of the market, the great whales and sharks have been feasting on Bitcoin for nearly a month, their appetites insatiable. Yet, the leviathan of price has plunged beneath the $90,000 mark, a grim testament to the fact that the market no longer bows to the whims of these financial behemoths. 🦈💸

This divergence, my dear reader, is not merely a hiccup but a harbinger of structural frailty. Accumulation persists, yet it is swallowed whole by the relentless sell pressure, the thinning liquidity, and the unwinding of leveraged dreams. The market, it seems, has grown indifferent to the once-revered signals of the whales. 🐳🚫

Whales Accumulate, But the Market Yawns

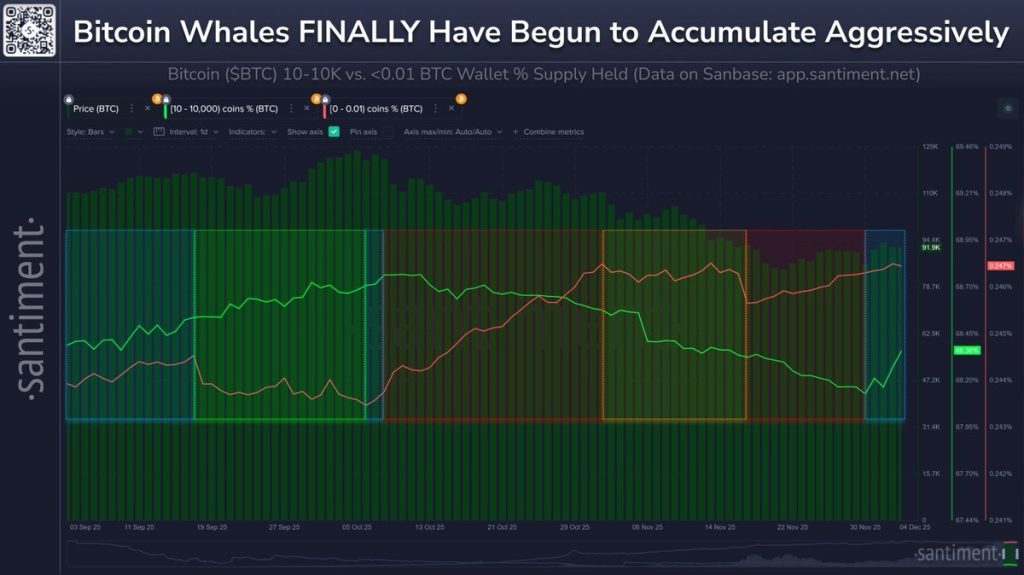

Bitcoin’s latest correction has unveiled a bitter truth for traders: the buying of whales is no longer the oracle of bullishness it once was. For weeks, the wallets of whales and sharks (10-10,000 BTC) have swelled, as the Santiment chart so dutifully records. In saner times, such behavior would herald a reversal or at least staunch the bleeding. But now? BTC has shattered the $90,000 barrier, a stark rebuke to the old order. 📉✨

Why does the market spurn the optimism of these giants? Because the forces dragging it down are mightier than their inflows. Liquidity has evaporated across the exchanges, derivatives markets groan under the weight of leverage, and every downward lurch triggers a cascade of liquidations. In this maelstrom, even the most voracious accumulation is but a drop in the ocean, absorbed without a trace. 🌪️💧

This tells us two things, as clear as the writing on the wall:

- The market is no longer a puppet to the strings of “smart money.” The bottom, if it exists, is not signaled by their whims. 🤹♂️

- Whales may be accumulating out of long-term faith, not short-term greed. Their patience, it seems, is as deep as the ocean itself. 🐋🕰️

In short, whale buying still matters-but it is no longer the bullish beacon it once was. 🌟❌

Where Doth Bitcoin Wander Next?

Bitcoin has slipped below $90,000, adrift in a broader pullback zone. The chart speaks plainly: BTC is in a cooling-off phase, not a confirmed reversal. The next waypoint to watch is the $82,000-$85,000 support zone, where past buying has left its mark. Should Bitcoin descend into this range and hold, the market may yet find its footing. 🗺️⚓

Structurally, BTC moves within a broad descending range, its highs lower and its volatility compressing toward an inflection point. The price has entered a consolidation phase, the Bollinger bands tightening like a noose-a scene reminiscent of early November before the breakdown from the $110,000 range. 🔄⚖️

If this structure holds:

- A sweep of the $82,000-$85,000 liquidity pocket remains likely. 🧹💰

- This zone overlaps with major spot buyer interest and previous consolidation shelves. 📊📦

- A reclaim of $92,000-$95,000 would be the first sign that the downside momentum is waning. 🚀🔄

From a longer-term perspective, nothing in the current price action invalidates Bitcoin’s broader expansion. But the timeline, alas, has shifted. ⏳🌍

End-of-2025 Outlook

- Base Case (Most Probable): $110,000-$135,000 🏠

- Bull Case (Requires strong macro + ETF inflows): $150,000-$170,000 🐂💪

- Bear Case (If liquidity remains tight): $70,000-$85,000 range-bound market 🐻🔒

Conclusion

Bitcoin’s renewed weakness reveals that accumulation without confirmation is but noise, not a catalyst. Whales may position for long-term gains, but until BTC reclaims key levels and leverage resets, their activity alone cannot reverse a structurally heavy market. The path into 2025 depends far more on liquidity, ETF flows, and macro stability than on wallet behavior. 🌊📈

If the BTC price can defend the mid-$80,000 zone and reclaim $92,000-$95,000, the next major expansion phase remains intact. Fail to do so, and volatility may persist. Either way, price-not whale wallets-will determine when the next real breakout begins. 📉✨

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2025-12-06 07:09