In the vast ocean of cryptocurrencies, where the tides of fortune ebb and flow, it is a curious phenomenon that a mere handful of leviathans—those colossal investors, affectionately dubbed “whales”—can sway the currents of this decentralized realm. Their influence, though cloaked in the guise of freedom, often reveals a paradoxical grip on the very essence of autonomy.

In a recent tête-à-tête with BeInCrypto, the astute Lynn Chen, Marketing Manager at SONEX, illuminated the lurking dangers of these aquatic titans and proposed that decentralized autonomous organizations (DAOs) might yet find a way to navigate these treacherous waters.

The Whale’s Ripple: A Double-Edged Sword

Ah, the whales! They can be both the benevolent guardians and the tempestuous tyrants of the market. At times, their grand gestures—those monumental trades—can buoy the spirits of the community, sending prices soaring like a kite in a summer breeze. Yet, in a heartbeat, a single sell-off can plunge the market into chaos, leaving the faithful investors gasping for air, their trust in decentralized systems hanging by a thread.

Indeed, when these behemoths make their moves, they send ripples through the community, often attracting a throng of eager investors and developers, all hoping to ride the wave of prosperity. But beware! For with great power comes great responsibility—or, in this case, great volatility.

And what of governance, you ask? Ah, therein lies the rub!

The Venture Capitalist’s Tight Grip

When a select few large holders command a significant share of the cryptocurrency pie, the delicate balance of power is thrown into disarray, much like a seesaw with an elephant on one end. This concentration of influence can skew governance decisions, favoring the few at the expense of the many.

Take, for instance, the infamous case of Andreessen Horowitz, which, in February 2023, was revealed to hold over 4% of Uniswap’s UNI token supply. With such clout, they could sway the outcome of governance votes, raising eyebrows and questions about the very nature of decentralization.

In a rather theatrical display, they wielded their 15 million UNI token voting block to thwart a proposal favoring the Wormhole bridge, opting instead for LayerZero—a competing platform in which they had a vested interest. Oh, the irony! A venture capitalist playing puppet master in a realm that champions decentralization.

“It’s always a balancing act,” mused Chen. “To preserve decentralization, we might consider vesting schedules for VC tokens, allowing their influence to grow gradually. Non-transferable governance tokens for community members could also help keep the voting power distributed. And let’s not forget transparency—large investors should disclose their voting intentions. After all, who doesn’t love a little accountability?”

As the saga of centralization unfolds, we find ourselves at a crossroads.

The Centralization Conundrum Across Blockchains

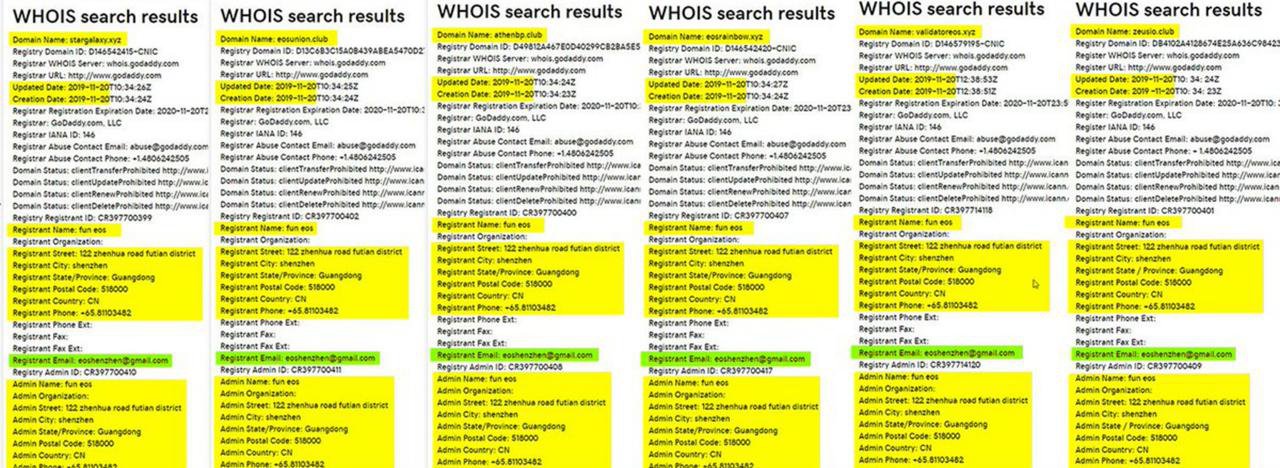

Over the years, the EOS blockchain has faced its fair share of scrutiny, particularly regarding its block producers. In November 2019, it was revealed that a single entity managed six registered producers, raising eyebrows and questions about the integrity of the network.

Similarly, the Solana blockchain has been criticized for its large staking pools, which, by their very nature, concentrate power in the hands of a few. It seems that the more things change, the more they stay the same!

Yet, amidst these challenges, there are glimmers of hope. The concept of quadratic voting has emerged as a potential remedy for the whale-induced woes.

The Quadratic Voting Solution

Quadratic voting, dear reader, is a delightful innovation that seeks to level the playing field. It allows the passionate minority to have their voices heard, even when the indifferent majority might overlook them. “It’s a splendid idea!” Chen exclaimed. “It makes it harder for whales to dominate, as their voting power increases at a diminishing rate. We could also set caps on voting power to prevent any single entity from monopolizing decisions.”

“Delegated voting is another strong tool,” she continued. “It allows smaller token holders to pool their influence by assigning

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Thunderbolts: Marvel’s Next Box Office Disaster?

- Does Oblivion Remastered have mod support?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DODO PREDICTION. DODO cryptocurrency

- Oblivion Remastered: How to get and cure Vampirism

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-02-12 14:54