In a turn of events that would make even the most seasoned stockbroker raise an eyebrow, Cardano has witnessed a veritable stampede of whale activity over the past 24 hours. This delightful frenzy coincides with a broader market recovery that has added a staggering $50 billion to the total crypto market capitalization. It seems the bulls are back in town, and they’re ready to party!

As the bullish pressure mounts like a well-stacked pancake, ADA appears to be gearing up for a delightful upward jaunt. Hold onto your hats, folks!

Cardano Sees Heavy Whale Accumulation

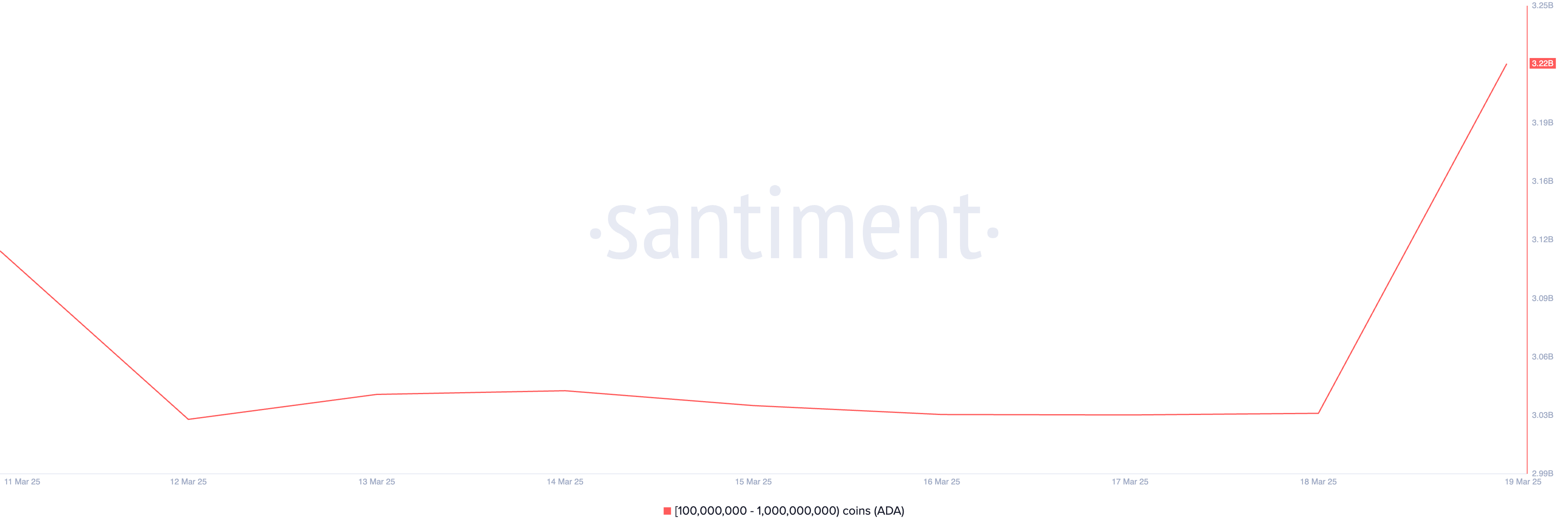

According to the latest on-chain gossip, Cardano whales—those hefty investors with a penchant for hoarding between 100 million and 1 billion coins—have snatched up a jaw-dropping 190 million ADA in just 24 hours. This merry band of large ADA aficionados now holds a staggering 3.22 billion coins. Talk about a whale of a tale!

When these aquatic giants increase their coin holdings, it’s a clear signal of their unwavering confidence in the asset’s future price potential. It’s like watching a group of aristocrats at a garden party, all convinced that the next round of tea will be the best yet!

This large-scale accumulation is akin to a game of musical chairs, reducing ADA’s available supply in the market. If demand remains steady, we could see prices soaring higher than a kite on a windy day. The trend is decidedly bullish, as whales typically buy in anticipation of higher prices—after all, who doesn’t want to be the life of the party?

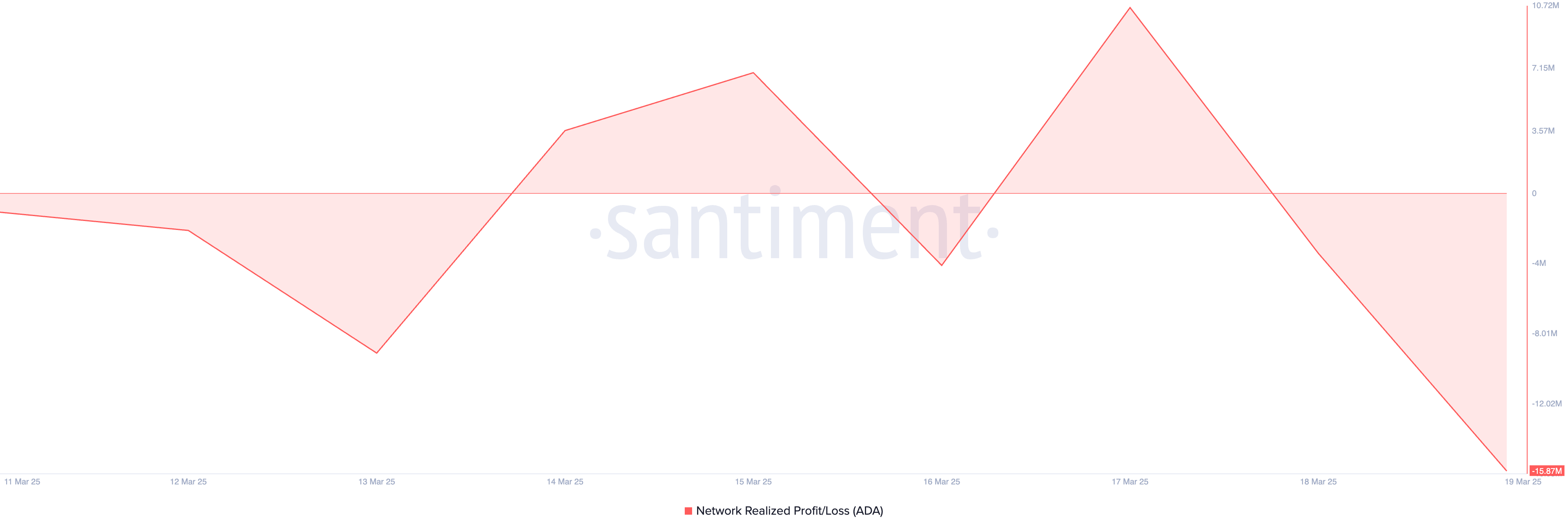

ADA’s Network Realized Profit/Loss (NPL) further supports this optimistic outlook. At the time of writing, it stands at a rather unfortunate -15.87 million. Oh dear!

This metric measures the net profit or loss of all coins moved on the blockchain, depending on their acquisition cost. When an asset’s NPL is negative, it’s like a gloomy cloud hanging over many investors who are holding at a loss. But fear not, dear reader!

This situation tends to reduce selling pressure in the market, as traders may opt to hold onto their assets rather than realize losses. It’s a classic case of “I’d rather not sell my prized possession at a discount!” This could support a potential price rebound, much like a phoenix rising from the ashes.

The steady dip in ADA’s NPL indicates that many holders are sitting on unrealized losses. To avoid selling at a loss, they may choose to hold onto their investments, reducing selling pressure. The longer they hold, the tighter the supply becomes, and who knows? ADA’s price might just take off like a rocket!

ADA’s Buying Pressure Increases—Will It Fuel a Price Breakout?

As of the latest update, ADA is trading at a modest $0.72. On the daily chart, the coin’s Chaikin Money Flow (CMF) is in an uptrend and is poised to cross above the zero line, highlighting a delightful rise in buying pressure. It’s like watching a well-rehearsed dance number unfold!

This indicator measures fund flows into and out of an asset. When it attempts to break above the zero line, it signals a potential shift from selling pressure to buying pressure. If this breakout is sustained, it would confirm strengthening bullish momentum in the ADA market and hint at a potential price uptrend. In this case, the coin’s price could rally toward $0.82. How splendid!

However, if selloffs intensify, this bullish projection will be dashed like a soufflé in a thunderstorm. In that unfortunate scenario, ADA’s price could plummet to $0.60. Oh, the humanity!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

2025-03-19 23:09