Ah, Cardano (ADA), the once-mighty titan of the crypto seas, now finds itself adrift, down nearly 34% in the last 30 days and a staggering 15% in just a week. With a market cap now languishing at $22 billion, it has been trading below the illustrious $1 mark for over a month, a reflection of the persistent gloom that hangs over its prospects like a dark cloud on a rainy day. ☔️

Technical indicators, those fickle friends, reveal a strong downtrend, with the ADX soaring to 46.8, signaling that the selling pressure is not just intense; it’s practically a stampede! Yet, should the key support levels hold firm, there remains a glimmer of hope that ADA might just break free and rise above $1 in March. But let’s not hold our breath, shall we?

Cardano ADX: A Strong Downtrend, or Just a Strong Coffee?

Currently, ADA’s ADX sits at a rather alarming 46.8, a sharp rise from a mere 10.3 on February 23. The Average Directional Index (ADX) measures the strength of a trend, but alas, it does not reveal its direction.

It ranges from 0 to 100, with values above 25 indicating a strong trend and those below 20 suggesting a market that’s about as lively as a sloth on a Sunday. An ADX above 40? Well, that’s a very strong trend, indeed, showing that market participants are strutting about with confidence in the current price movement. 🕺

With ADA’s ADX at 46.8 and the price in a downward spiral, it seems the bearish momentum is gaining strength faster than a cat chasing a laser pointer. This suggests that selling pressure is intensifying, making a continuation of the downtrend more likely.

Unless, of course, buying interest suddenly skyrockets, which seems about as likely as finding a unicorn in your backyard. The high ADX value confirms that the current bearish trend is strong and persistent, reducing the likelihood of a quick reversal.

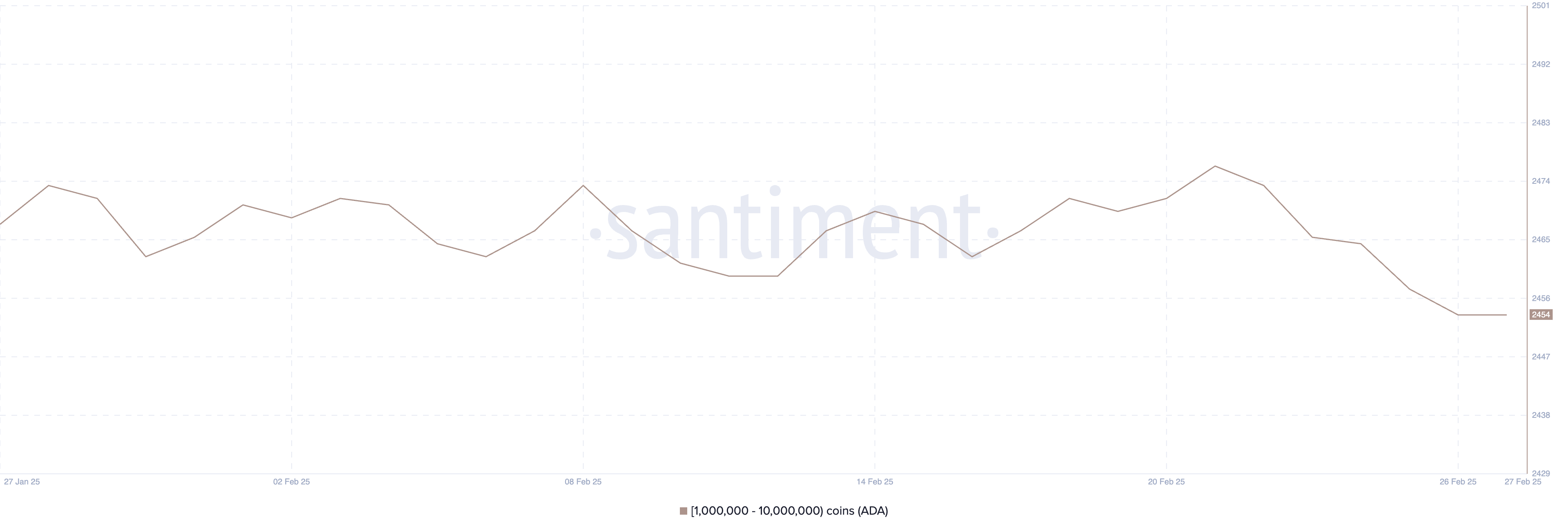

ADA Whales: A Vanishing Act Since January

In a rather disheartening turn of events, the number of Cardano whales—those addresses holding between 1 million and 10 million ADA—has been steadily decreasing. From 2,477 on February 21, it has now plummeted to 2,454, the lowest level since January 9. 🐳

Tracking these whales is crucial, as they represent large investors whose buying or selling actions can send ripples through the market, much like a pebble tossed into a still pond. When whale addresses decrease, it suggests that major holders are either reducing their positions or distributing their holdings, which can indicate a bearish sentiment.

This sharp decline in the number of Cardano whales could signal increasing selling pressure, potentially leading to further downside for ADA’s price. As large holders reduce their exposure, it creates more supply in the market, driving prices lower. A decreasing number of whales also suggests that confidence among big investors is waning, which could trigger further selling from smaller holders.

If this trend continues, ADA could face increased downward momentum in the coming days, much like a balloon losing air. 🎈

Will Cardano Ever Return to $1 in March? The Million-Dollar Question!

ADA’s EMA lines currently show a bearish setup, with short-term lines positioned below long-term ones, indicating ongoing downward momentum.

Should this downtrend persist, ADA could test the crucial support level at $0.5. If this support is lost, the price could tumble further to $0.32, marking its lowest level since early November 2024.

This bearish configuration suggests continued selling pressure, increasing the likelihood of further downside unless buying interest picks up, which, let’s be honest, seems about as likely as a snowstorm in July. ❄️

Read More

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- Are Lady Gaga’s Ever-Changing Wedding Plans Suiting Fiancé Dizzy? Here’s What’s Happening

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2025-03-01 04:03