As a seasoned crypto investor who has navigated through the crypto wilderness since the early days of Bitcoin, I must say that the recent surge in private transactions and institutional interest is nothing short of fascinating. Having witnessed the rise and fall of countless altcoins, I can confidently assert that Bitcoin’s resilience and adaptability are truly remarkable.

As reported by the CEO of CryptoQuant, Ki Young Ju, this recent increase is associated with a surge in institutional involvement, such as Bitcoin ETFs, prominent investors like MicroStrategy, and large-scale Bitcoin owners who are not publicly identified, often referred to as “whales.

The Surge in Private Transactions: A Strategic Shift

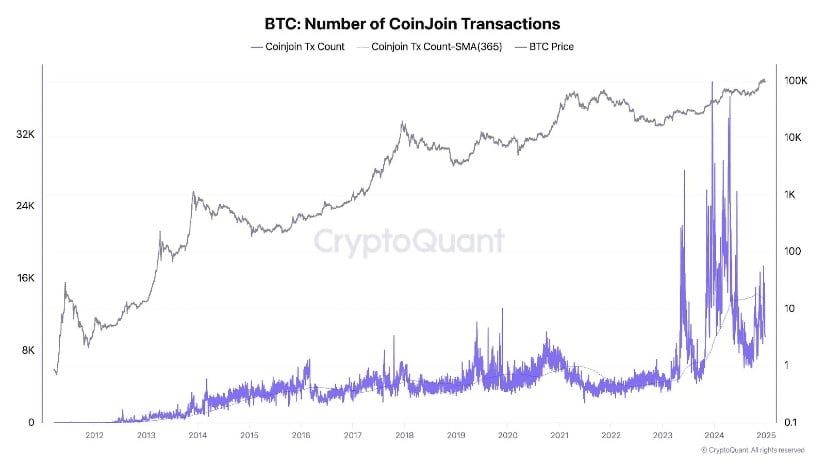

Starting from 2022, the number of private Bitcoin transactions has more than tripled. This significant surge is attributed to a growing trend among large institutional investors increasing their holdings. As explained by CryptoQuant’s Ki Young Ju, these major players often employ privacy tools like CoinJoin to transfer Bitcoin to new institutional buyers. These privacy methods serve to mask the source and destination of Bitcoin, a practice commonly linked with evading attention and safeguarding the anonymity of involved investors.

Although worries exist about CoinJoin being misused by illicit actors, Ju refuted allegations that it’s primarily employed for laundering stolen funds. In actuality, Chainalysis found that Bitcoin theft losses in 2024 totaled $2.2 billion, which is a minimal percentage of Bitcoin’s market value, suggesting that the majority of Bitcoin transactions are untainted by illegal activities.

As the conversation about privacy and Bitcoin develops, it’s primarily the influence of large-scale institutions that draws widespread attention.

Institutional Giants and the Rise of Bitcoin ETFs

Over the past year, significant institutions have been actively purchasing Bitcoin. This trend has been led by Bitcoin ETFs, companies like MicroStrategy, and entities backed by governments. As per CryptoQuant’s data, institutional investors now control around 31% of all existing Bitcoin holdings – a figure that was only 14% in the year 2023. The majority of this acquisition can be attributed to spot Bitcoin ETFs, which have attracted billions from traditional financial markets. In December alone, inflows into mainstream products like BlackRock’s iShares Bitcoin Trusts exceeded $1.4 billion; these financial tools are already playing a crucial role in the development of Bitcoin.

One notable large Bitcoin investor is MicroStrategy, a business intelligence firm based in Virginia. With an impressive 440,000 BTC in its reserves, the company now controls approximately 2% of the total circulating supply of Bitcoin, which has a market value exceeding $46 billion. Michael Saylor, the founder of MicroStrategy, initiated a strategy to invest in Bitcoin, and this approach has served as a model for many other institutional investors. Firms like Metaplanet have also followed suit, increasing their BTC holdings in line with the growing trend.

Mysterious Whales and Unidentified Large-Scale Purchases

A particularly intriguing aspect of the current Bitcoin landscape is the growing influence of unidentified whales. CryptoQuant’s CEO revealed that between 240,000 and 420,000 BTC have been purchased by unknown entities this year alone. This raises questions about the identity of these massive holders, especially as the market’s focus shifts to large institutional purchases and ETF-backed investments.

Although much discussion revolves around whether countries or authorized groups might be involved, the mystery surrounding these large Bitcoin holders (often referred to as “whales”) continues to cause unease within the broader cryptocurrency community. Some experts propose that these unidentified whales could potentially be foreign governments or state-supported entities secretly amassing Bitcoin for reasons such as hedging against economic turmoil or circumventing sanctions.

The Role of Governments in Bitcoin Accumulation

Various governments have become major actors in the Bitcoin market, with the U.S., China, and El Salvador taking the lead. The U.S., for instance, holds more than 198,000 Bitcoins, most of which were obtained from seizures on the Silk Road online marketplace. On the other hand, China is believed to possess around 190,000 Bitcoins, a significant amount despite its ban on all crypto-related activities. This suggests that government involvement in Bitcoin extends beyond financial policies to include surveillance and asset accumulation.

If Sen. Cynthia Lummis’s proposed Bitcoin Act of 2024 becomes law, a strategic reserve could potentially accumulate as much as 1 million Bitcoins by 2030, which would represent about 5% of the total supply and make the U.S. one of the largest Bitcoin holders in this vast sea of digital assets. In other words, the reserve’s Bitcoin holdings could significantly increase over time.

Privacy and the Regulatory Backdrop

Global regulators and law enforcement agencies are increasingly scrutinizing the increase in private Bitcoin transactions, specifically those facilitated by CoinJoin. The U.S. Department of Justice’s recent actions against privacy-focused tools like Samourai Wallet and Tornado Cash serve as a clear indication of mounting regulatory interest in the issue of Bitcoin anonymity.

These tools help users conceal the origin and destination of their Bitcoin transactions, which are often associated with illicit activities such as money laundering and funding on the dark web. Authorities are becoming more vigilant in suppressing features that facilitate such unlawful practices. The detention of Tornado Cash creator Alexey Pertsev and the confiscation of Samourai Wallet’s website demonstrate a growing focus on privacy-focused Bitcoin platforms.

Nonetheless, crucial to researchers’ endeavor of maintaining Bitcoin’s decentralization are features like CoinJoin. This means that as governments and big businesses exert pressure on Bitcoin, intensifying the argument about privacy versus surveillance is inevitable.

MicroStrategy and the Corporate Adoption of Bitcoin

As an analyst, I’ve observed that MicroStrategy’s Bitcoin holdings signify more than just a financial venture; they symbolize a broader corporate trend towards adoption. By amassing Bitcoin as a treasury asset, MicroStrategy has served as a catalyst for other companies like Tesla and Metaplanet to follow suit. This trend is increasingly becoming mainstream among public corporations, creating a ripple effect that’s attracting various investment vehicles. One such example is the Bitwise Bitcoin Standard Company ETF, which invests in companies with substantial Bitcoin holdings.

Michael Saylor, the CEO of MicroStrategy, is a strong proponent of Bitcoin and predicts it could reach up to $13 million by 2045. While this prediction might seem excessively optimistic to some, others believe that Saylor’s bold approach to investing in Bitcoin has already yielded significant returns for his company.

The Future of Bitcoin: A Polarizing Asset

As Bitcoin develops further, the influence of large investors, governments, and privacy concerns will remain key topics in the discourse. The growing power of ‘whales’ and intensifying regulatory focus imply that Bitcoin may encounter fresh difficulties soon. Yet, with a growing number of institutional and governmental stakeholders, Bitcoin’s status as a valuable asset appears increasingly solidified, even amidst the obstacles it encounters.

As our world keeps evolving at a rapid pace, it’s unmistakable that Bitcoin’s story is far from being concluded. The way it’s owned and utilized will significantly impact where it stands within the international monetary landscape.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-28 14:36