- Oh look, whales are at it again, throwing tens of millions into Bitcoin like it’s nothing. What are they planning?

- Market sentiment says these whales aren’t just dabbling; they might be in it for the long haul. Guess they know something we don’t!

Bitcoin, our beloved cryptocurrency, has been taking it easy lately—no dramatic gains, just a little nudge up (1% over the past month, yawn). But wait! Market whispers hint that things could change soon, especially as whales keep munching up Bitcoin like it’s going out of style.

But before you panic, remember: Bitcoin has been hanging around, steady as a rock, moving within a cozy little range. The question on everyone’s mind: Could these big fish know something we don’t? 🐟

Whales Can’t Stop, Won’t Stop Buying Bitcoin

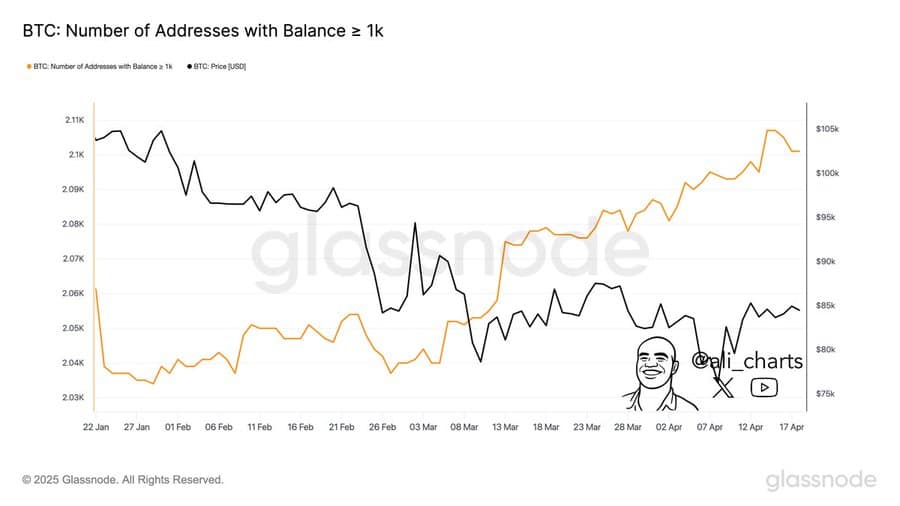

These creatures of the deep have been munching up Bitcoin like there’s no tomorrow. Seriously, since March, a whopping 60 new whales have decided to join the Bitcoin party, each snapping up no less than 1,000 BTC. That’s around $85 million in total—just a small fortune. 🤑

The real kicker? This all happened while Bitcoin was trading way below its all-time high. Hmmm… could it be that these whales think Bitcoin is seriously undervalued? Someone’s got some juicy intel, eh?

Meanwhile, the market liquidity is drying up faster than a puddle in the desert, with capital inflows plunging from $8.2 billion to a mere $2.38 billion in two weeks. That’s a huge drop! When liquidity shrinks, the assets that do get attention are often the ones that shoot to the moon. Could Bitcoin be one of those?

Institutions and Key Whales Making Big Moves

It’s not just the whales having a good time. No, no. Institutions are also getting in on the action. According to some fine analysis from AMBCrypto, one whale, under the name “Abraxas Capital Mgmt,” has been on a shopping spree, gobbling up Bitcoin like it’s Black Friday.

Since April, this whale grew its Bitcoin stash from a humble $2.8 million to a jaw-dropping $253 million. That’s one big shopping cart! And as if that wasn’t enough, it’s got another $43 million in LBTC, bringing the total to nearly $300 million. That’s not pocket change, folks!

Institutions, too, are getting cold feet about selling. In fact, by the end of the week, institutional investors poured $106.9 million into Bitcoin ETFs. Well, well, well… looks like they’re not so sure about the whole “sell high” thing after all. 🤔

If the whales and institutional investors keep it up, Bitcoin might just be gearing up for a little rally. Time to buckle up! 🚀

Long-Term Traders Know What’s Up

But hey, it’s not all about the whales and big money bags. Let’s talk about the long-term holders—those brave souls who aren’t just in it for a quick buck.

AMBCrypto took a little peek at the “Coin Days Destroyed” (CDD) metric, which tells us if long-term holders are holding or selling. Guess what? They’re holding on tight, like a toddler to their favorite stuffed animal. CDD has been trending near zero, meaning these savvy holders aren’t jumping ship, no matter how choppy the waters get.

With whales snatching up Bitcoin, institutions jumping on the bandwagon, and long-term holders sitting pretty, Bitcoin is quickly becoming the go-to magnet for liquidity in this drying-up market. Could a big rally be on the horizon? The signs are there… 🍿

If these trends keep up, don’t be surprised if Bitcoin not only holds steady but starts its next big climb. Who’s ready for the ride?

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- DEXE PREDICTION. DEXE cryptocurrency

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- General Hospital Spoilers: Will Willow Lose Custody of Her Children?

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- SDCC 2024: Robert Downey Jr. Confirms MCU Return As Dr Doom In Avengers: Doomsday

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-04-20 20:11