So, here we are, folks. Bitcoin (BTC) has decided to rise from the ashes like a phoenix that just remembered it left the oven on. After closing at a dismal $78,620 on March 10, it’s now on a slow but steady upward trend, much like my attempts to get out of bed on a Monday morning.

In the past week, our beloved cryptocurrency has managed a 1.2% price increase. Yes, you heard that right! It’s like finding a dollar in your winter coat pocket after months of searching. And guess what? The whales are back, and they’re buying up BTC like it’s going out of style.

Bitcoin Whale Demand Surges as Investors Buy the Dip

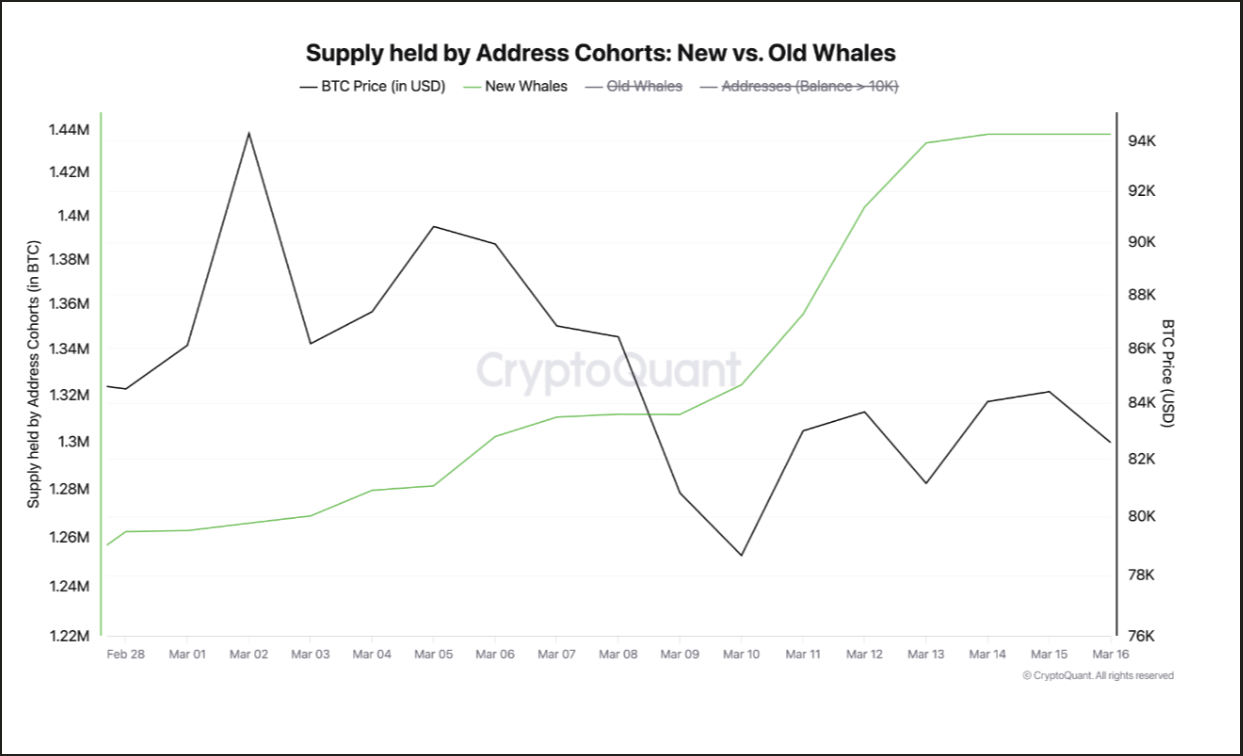

According to the ever-mysterious CryptoQuant analyst Onchained (who I assume is a wizard), a new wave of Bitcoin whales has emerged. These aren’t your average investors; they’re the kind of people who have at least 1,000 BTC wallets and an average acquisition age that’s younger than my last relationship.

“On-chain data confirms that since November 2024, these wallets have collectively acquired over 1 million BTC, positioning themselves as one of the most influential market participants. Their accumulation pace has accelerated notably in recent weeks, accumulating more than 200,000 BTC just this month,” Onchained wrote.

When these new whales start showing interest in BTC, it’s like a sign that the party is just getting started. BTC’s recent plunge to multi-year lows has turned into a buffet for these whales, who are eager to “buy the dip” and sell at a higher price—because who doesn’t love a good bargain?

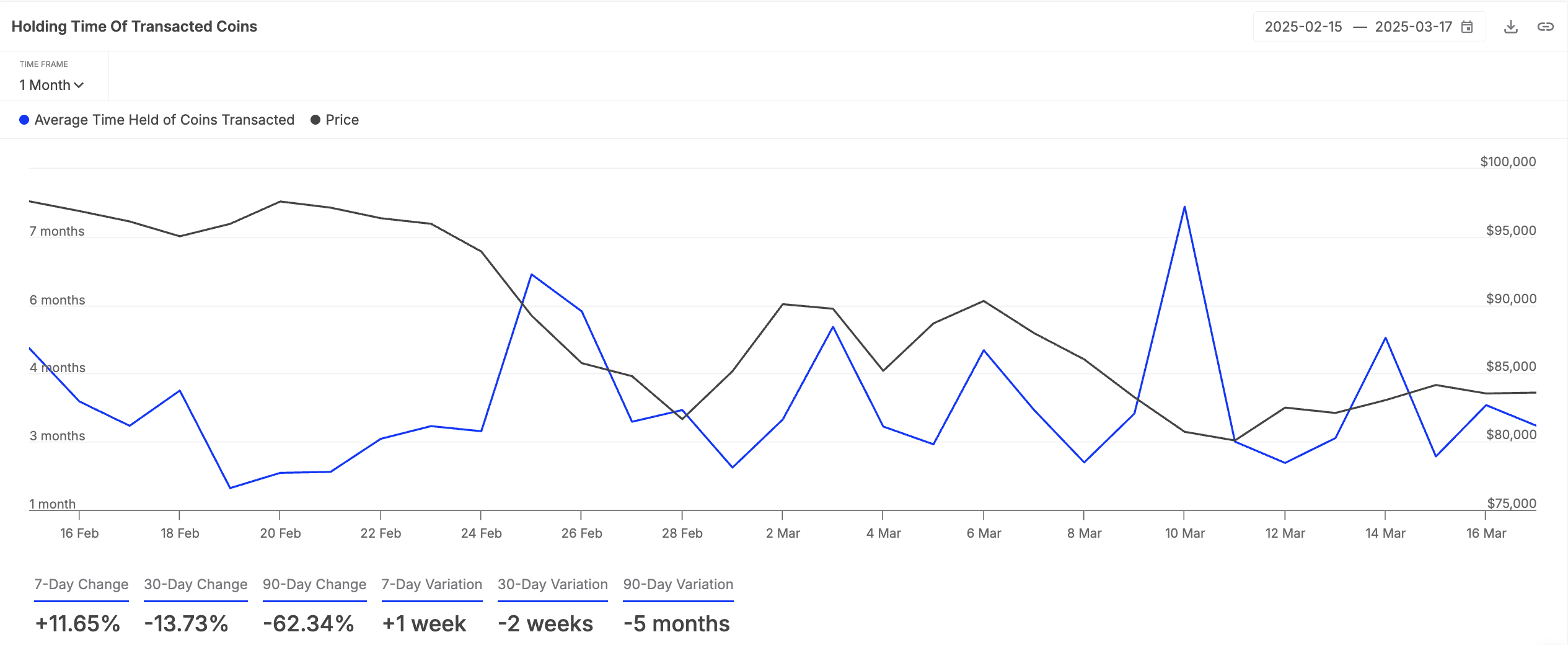

Moreover, BTC holders have decided to hold onto their coins longer than I hold onto my New Year’s resolutions. In fact, according to IntoTheBlock, this has increased by 12% over the past week. It’s like they’re saying, “I believe in you, Bitcoin!”

The holding time of an asset’s transacted coins measures how long these tokens are kept before being sold or transferred. When this time extends, it shows stronger investor conviction—like that one friend who insists on keeping their ex’s hoodie because “it smells like them.”

This can help reduce selling pressure as supply dries up, driving up the coin’s value in the near term. It’s like a game of musical chairs, but with more money and fewer chairs.

Bitcoin at a Crossroads: Rebound to $89,000 or Drop to $77,000 Next?

Now, let’s talk about the Elder-Ray Index, which continues to post red histogram bars. But don’t worry, their sizes have been shrinking, much like my patience during a long meeting.

This indicator compares buying pressure with sell-offs to determine price trends. When the bars decrease in height, it means bearish pressure is weakening. It’s like watching a toddler lose interest in their toy—eventually, they just give up.

This suggests that BTC sellers are losing momentum, and buyers might be stepping in. If this trend continues, we could see BTC’s price rebound and climb toward $89,434. Fingers crossed, right?

But hold your horses! If selling pressure strengthens, the king coin risks plummeting to $77,114. It’s like a rollercoaster ride, and I’m just here for the snacks.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-03-18 14:53