On a rain-soaked Thursday, the analytics house Santiment delivered pronouncements akin to those of a seasoned village gossip—Bitcoin’s notable stakeholders, the so-called “whales” and “sharks,” have lately indulged in a feeding frenzy that could portend favor for the asset. We are but humble onlookers as these behemoths swim in circles, clutching purses the size of provincial railway stations.

Meanwhile, in the Grand Aquarium: Fish With Expensive Tastes

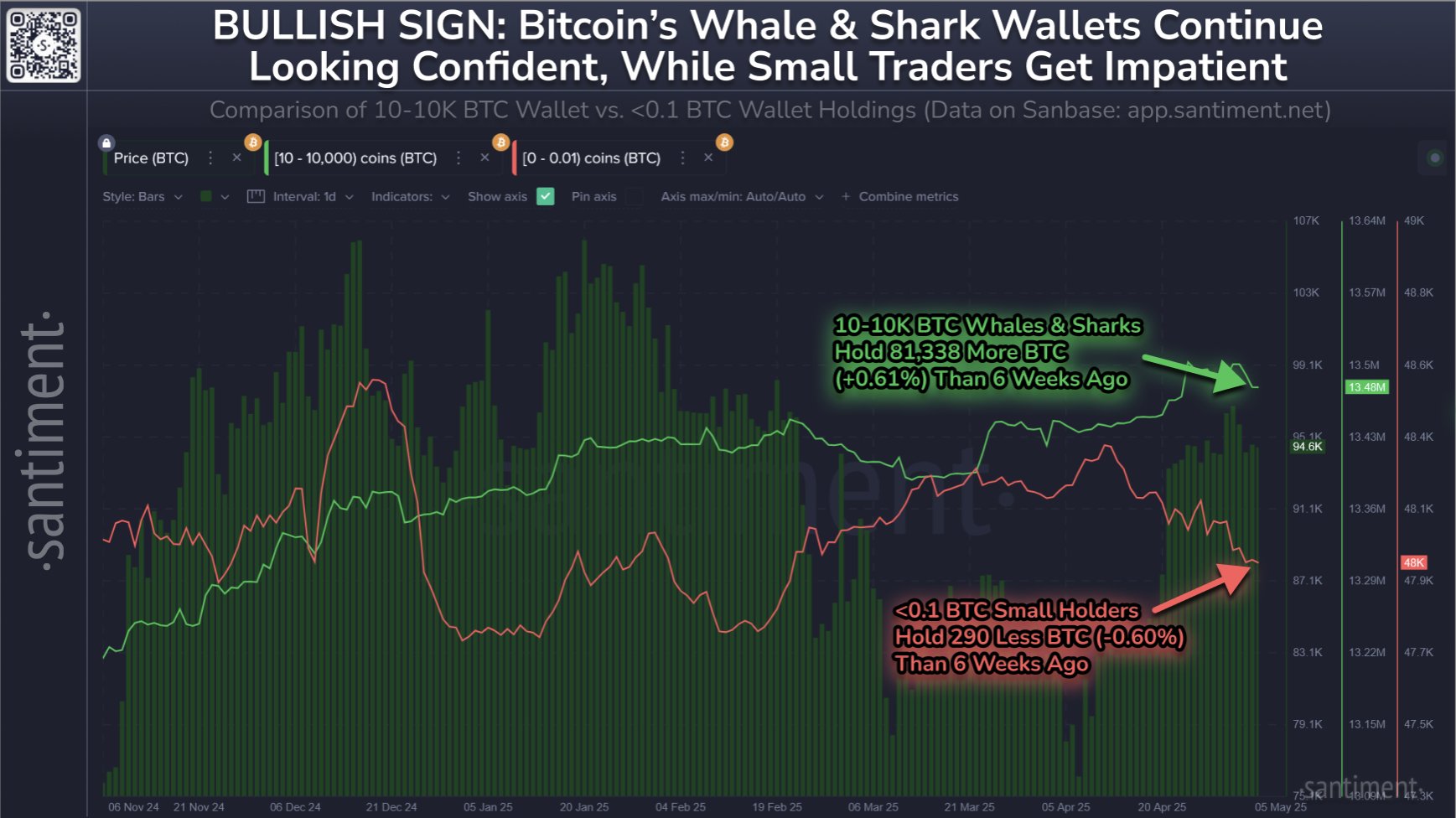

A dispatch surfaced upon the digital post-office known as X. There, Santiment chronicled the affairs of Bitcoin’s influential hodlers in a chart that, to the untrained eye, might resemble seismic tremors or the fever dreams of a bookkeeper. The matter at hand is the mysterious “Supply Distribution” – a gauge most explicit in its proposal to inform us of how much Bitcoin each wallet grouping, each minor duke and grand baron, has amassed.

Wallets are sorted with bureaucratic delight: 1-10 coins for those with aspirations; 10 to 10,000 coins for the true socialites. At present prices, the lower crust of this group could only vie for a modest mansion, while the upper bound might seek an entire city block in Moscow.

So we find, within this social club, sharks and whales—less a financial term than an apt description of those who can capsize the entire pond with a flick of their tails.

Here, supplied for your solemn contemplation, is the latest chart on their hoarding habits:

As the lines meander upward, we see that these creatures of deep water have managed to snag 81,338 more BTC during the last six weeks. One imagines the retail fry gnawing at crumbs while the sharks congratulate one another on their incisors.

There’s another twist. Santiment, with a sly wink one could almost discern through the screen, points at the tiny investors whose pockets emptied even as the deep-pocketed were busy fattening themselves. As the common folk shed their coins—perhaps from fear, ennui or the irresistible urge to buy a new teapot—the great beasts amassed more, waiting for the price to make its next dramatic exit stage left.

“Observe,” Santiment remarks, “when behemoths fill their chests as the rabble scampers, it bodes well for future drama.” One might add: this is not unlike the village elders buying up winter potatoes when everyone else sells at the first sign of frost.

Yet the play twists still further. Of late, the balance among these whales slipped a tad—a few undoubtedly cashing out, dreaming of yachts or perhaps, an early retirement to Crimea. Still, their accumulation suggests that, like a family argument after dinner, there is more volatility to come.

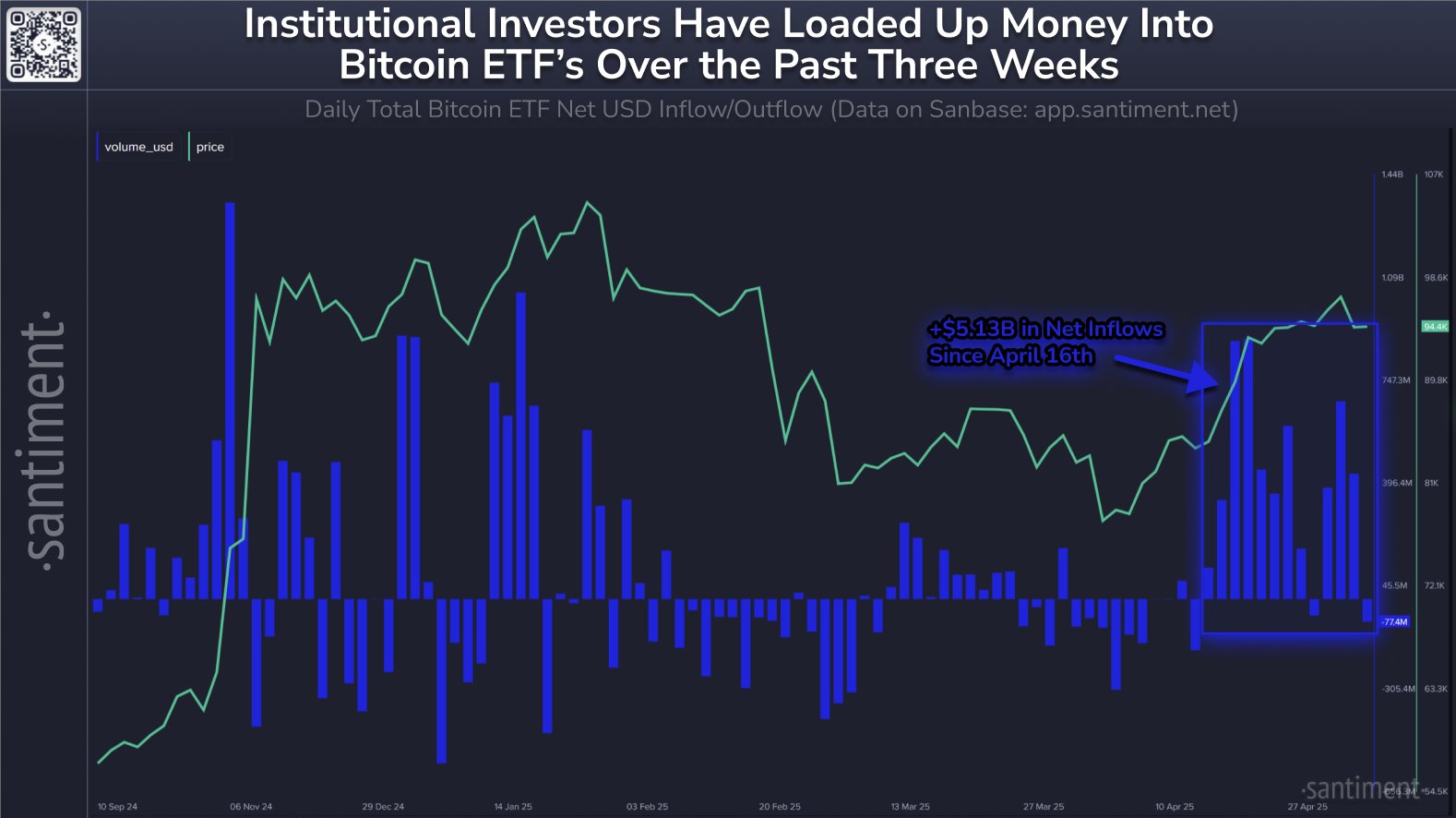

Not to be outdone, Bitcoin spot ETFs have drawn in vast sums, much to the quiet glee of a previously unremarkable accountant somewhere—$5.13 billion since April 16th swept in, a number so large it almost seems imaginary.

Santiment’s commentary here suggests a whimsical inevitability—these funds scooping up coins while the rest of us wonder what’s left for next week.

And How Is Our Illustrious Hero—BTC?

In the last twenty-four hours, Bitcoin once again surged above the $97,000 mark, a comeback only slightly less astonishing than Aunt Polina’s resurrection from her sickbed upon hearing the price of flour had dropped.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-05-08 12:41