As an experienced financial analyst, I closely follow market trends and economic indicators. Based on my analysis of Scott Wren’s insights during his CNBC interview, I believe that the U.S. stock market is experiencing a potential shift towards broader participation beyond the technology and communication services sectors.

Scott Wren appeared as a guest on CNBC’s “Closing Bell Overtime” show on the 11th of July to share insights and analysis on the recent developments in the US stock market.

Scott Wren serves as a senior strategist in the Global Market Strategies team at Wells Fargo Investment Institute (WFII), which is a registered investment adviser that’s entirely owned by Wells Fargo Bank, N.A. The primary mission of WFII is to deliver superior investment knowledge and counsel to clients, empowering them to handle risks effectively and ultimately achieve their financial goals. In this role, Wren plays a pivotal part as a committee member in the Global Investment Strategy Group. Here, he collaborates on creating and endorsing asset allocation plans and investment suggestions for various sectors, encompassing global financial markets, real assets, and alternative investments.

Wren commented on the unexpectedly gentle U.S. Consumer Price Index (CPI) figure for June 2024 and encouraging jobless claims data. According to Wren, these signs pointed to a favorable economic climate that spurred a rebound in underperforming stocks, particularly within the Russell 2000 index. He underscored that while the Russell 2000 experienced a substantial one-day increase, it’s premature to interpret this as a persistent trend. Wren anticipates the economy will continue in its sluggish growth phase for the next two to four quarters.

Based on Wren’s perspective, the technology and communication services sectors have been spearheading the US stock market’s growth over the past 18 months. He believes these sectors have experienced significant advances, pushing their valuations higher. According to him, recent favorable inflation data has fueled optimism for a wider range of market involvement beyond just these leading industries.

Wren shared that WFII has been shifting investment funds from technology and communication services towards industries such as industrials, materials, and energy. According to him, these sectors, which had impressive gains on the interview day, present better value and are less inflated than major tech stocks. He particularly emphasized the attractiveness of industrials and materials due to their cyclical nature and the surge in data center development driven by AI progress. Additionally, healthcare and energy were pointed out as promising sectors with excellent investment potential.

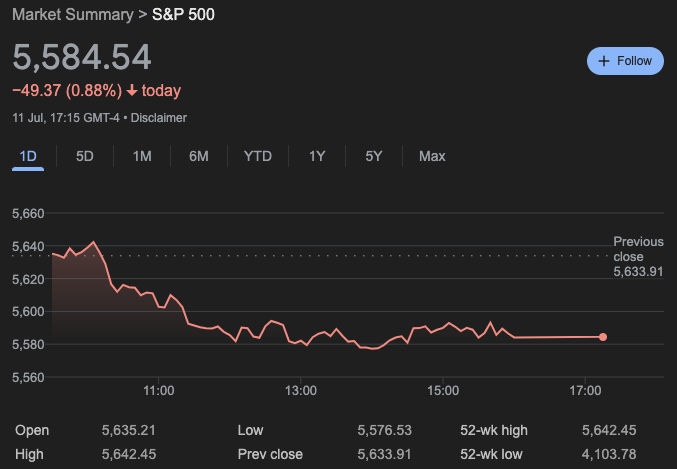

Wren drew attention to the overvalued prices of the “Mag 7” tech companies: Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, Broadcom, and Tesla. On the day of the interview, these prominent tech stocks experienced substantial drops, all losing more than 2%. This downturn significantly affected the S&P 500, illustrating the significant sway these large-cap companies hold over the index.

Although tech giants saw a drop in value, other market sectors reported growth, indicating a possible trend toward more diverse investment opportunities. The heavy reliance on a handful of major tech stocks has been both beneficial, leading to substantial profits during bull markets, and detrimental, resulting in steep losses when these companies falter.

The June Consumer Price Index (CPI) revealed a modest decrease in the cost of urban consumer goods and services. Specifically, the CPI-U dropped 0.1% on a seasonally adjusted basis after remaining constant in May. Over the last twelve months, the overall index for all items grew by 3.0% before adjusting for seasonal fluctuations.

In June, the gasoline prices saw a substantial drop of 3.8 percent following a 3.6 percent decrease in May. This marked decline in gasoline prices led to a 2.0 percent reduction in the total energy index for the month. The sustained downward trend in energy costs played a pivotal role in mitigating price hikes in other sectors like housing, as seen in the previous month.

Food prices showed a modest 0.2% rise last month. The cost for eating out increased by 0.4%, while the price for groceries at home went up by a smaller margin of 0.1%. These incremental hikes suggest a gradual, yet moderate, escalation in food costs for consumers.

Core inflation, which represents the change in prices for all goods and services excluding food and energy, climbed by 0.1% in June. This uptick came after a 0.2% rise in May. Several key categories witnessed price hikes last month: shelter, motor vehicle insurance, household items and services, medical care, and personal care. In contrast, airline fares, used cars and trucks, and communication experienced price decreases during this period.

As an analyst, I’ve reviewed the inflation data for the past year. Specifically, I’ve noticed that the all items index grew by 3.0 percent during the 12-month span ending in June. This is a slight decrease from the 3.3 percent increase reported for the 12 months up to May. It’s important to note that the core inflation index, which excludes food and energy prices, experienced a 3.3 percent rise over the past year – this is the smallest 12-month increase since April 2021. The energy index saw a more modest 1.0 percent increase during the same period, while the food index registered a 2.2 percent uptick.

I’ve analyzed the Consumer Price Index (CPI) data for June 2024, and the decrease in the index indicates a mild relaxation of inflationary pressures. The main cause of this trend stems from the persistent fall in gasoline and energy prices. This reduction could bring some comfort to consumers who have struggled with increasing costs across multiple sectors over the past year. Nevertheless, it’s essential to acknowledge that ongoing price hikes in shelter and other necessities underscore ongoing inflationary challenges within specific market segments.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2024-07-12 10:10