Ah, WazirX, that illustrious bastion of digital finance, now finds itself in a most peculiar predicament! With the audacity of a jester, it proposes to return a staggering 85.25% of the ill-gotten gains lost in the grand heist of July 2024, where a mere $230 million vanished into the ether—quite literally! The exchange, having completed its asset rebalancing on a Tuesday (for what is life without a touch of irony?), assures its beleaguered users that their refunds shall grace their accounts come April. 🎭

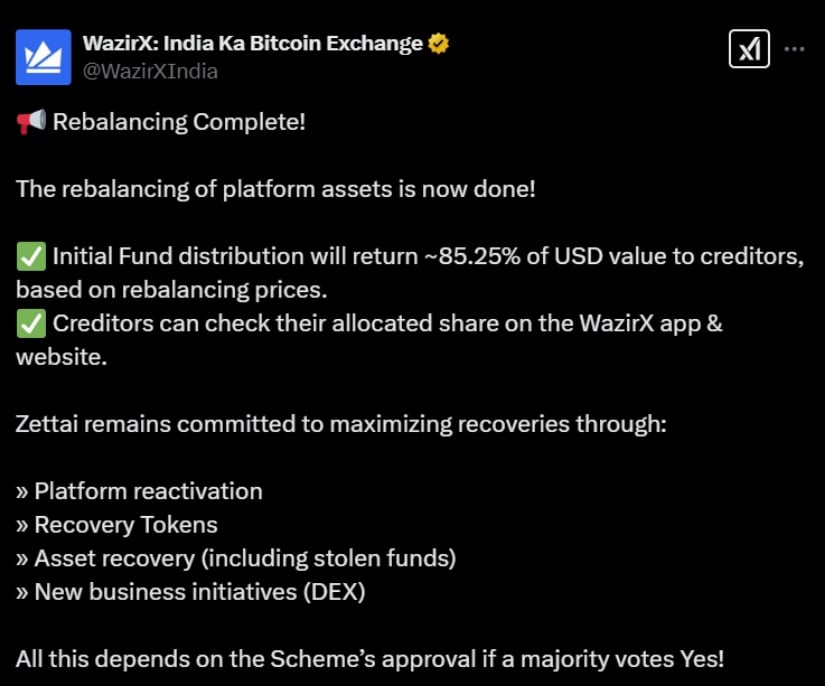

As of this fateful Tuesday, users are now privy to their balances in both U.S. dollars and Indian rupees, a reflection of the stolen treasures from that fateful July day. The redistribution plan, a veritable feast of upside gains from the tokens that remained unscathed, promises a recovery that exceeds the wildest dreams of those affected. But lo! The clock ticks ominously—February 19 is the deadline for creditors to embrace this rebalancing scheme, requiring a majority vote of 75%. A mere formality, one might say, if only the stakes were not so high! ⏳

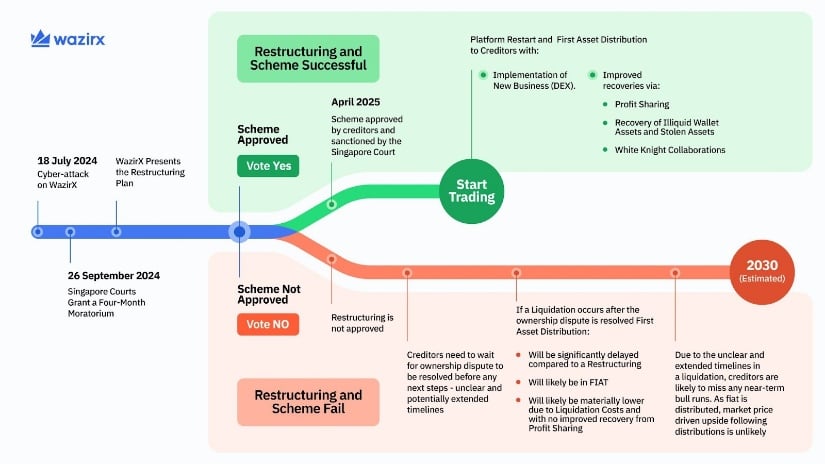

Yet, should the creditors turn their backs on this scheme, the restructuring effort shall crumble like a house of cards, leading the company to the dark abyss of liquidation under Section 301 of the Singapore Companies Act. A fire sale of remaining assets could ensue, leaving creditors with naught but a pittance. In the most tragic of scenarios, the arduous journey of recovering and redistributing funds could stretch into the distant future of 2030. How delightfully grim! 😱

WazirX’s $230M Hack — Now Eyes DEX to Avoid Liquidations

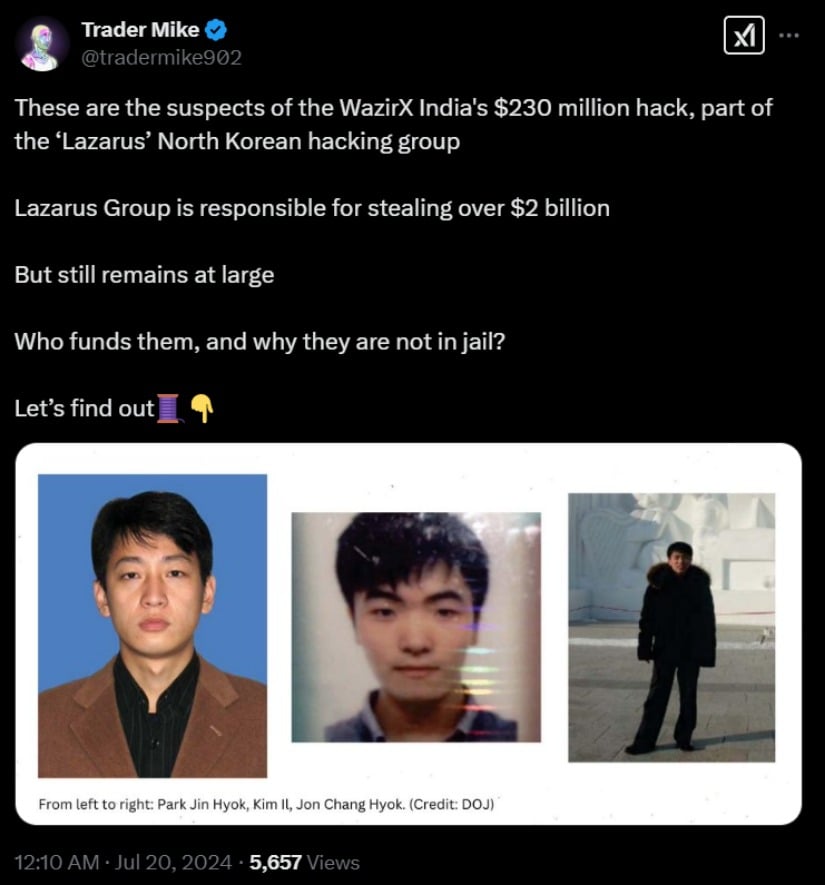

On that fateful day of July 18, 2024, a breach of $230 million occurred, as if scripted by a playwright of misfortune. A multi-signature wallet, under the watchful eye of Liminal Custody, was compromised, leading to the siphoning of over $100 million in Shiba Inu (SHIB) and $52 million in Ether. Both WazirX and Liminal, in a display of theatrical denial, claimed their networks were untouched, only to later seek debtor protection in Singapore. How very dramatic! 🎭

The funds lost represented nearly half of WazirX’s total reserves, a staggering revelation that would make even the most stoic of investors weep. The infamous North Korean hacking group Lazarus, known for its high-profile cyber escapades, was the villain in this tragic tale.

In a bid to avoid the grim reaper of liquidation, WazirX has donned its bravest armor. The exchange plans to launch a decentralized exchange (DEX) and introduce recovery tokens, which shall dance upon the open market. These tokens will be periodically bought back using the profits of the platform, a delightful scheme that promises to unfold over the next three years. If the plan garners approval, WazirX will relaunch its platform with enhanced security and capabilities, a phoenix rising from the ashes! 🔥

Transparency Push After Hack

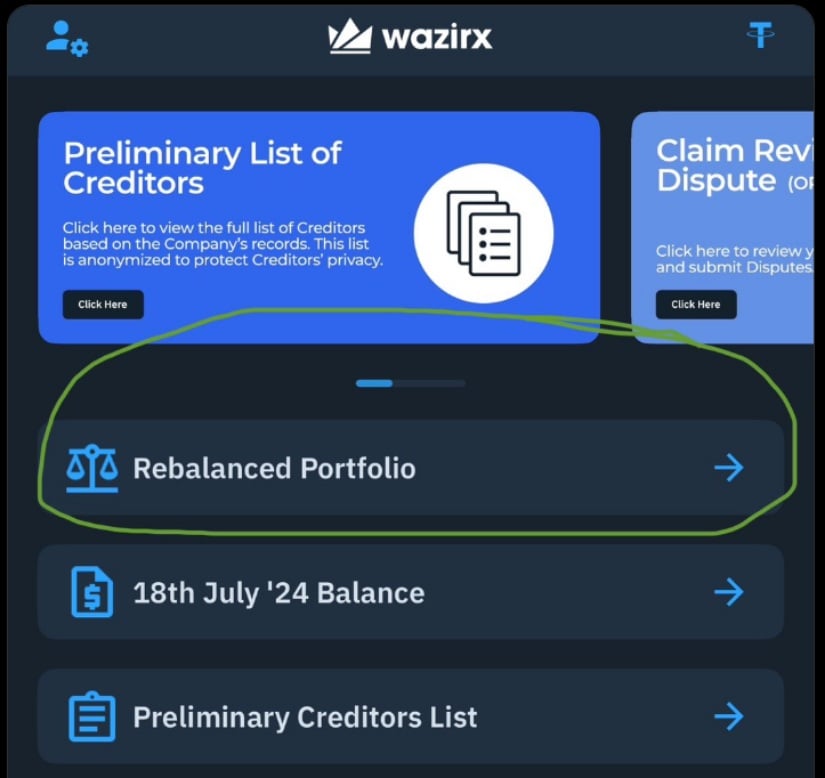

In the wake of the hack, WazirX has taken steps to improve transparency, introducing three new tabs on its mobile app and website. Users can now view their rebalanced portfolio, check their balance as of July 18, 2024, and access a preliminary creditor list. Co-founder Nischal Shetty, ever the showman, shared a screenshot of these updates on X, as if to say, “Look, we are still here!” 📱

As the February 19 deadline looms like a dark cloud, creditors must decide whether to accept the compensation scheme. Should they approve it, WazirX will gallantly move ahead with its restructuring plan, including the launch of its DEX and recovery token program. However, should they reject it, liquidation shall be the only path forward, leaving creditors with far less than they had hoped.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-12 16:07