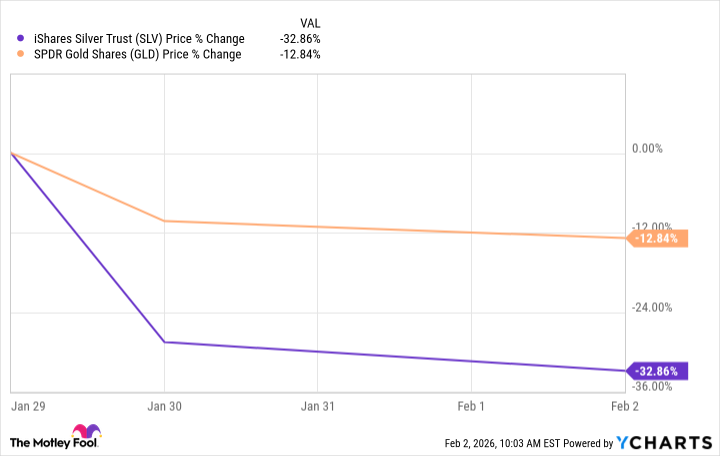

Right. So, Trump’s finally named Kevin Warsh as his Fed chair pick. Honestly? It’s less a surprise, more a… calculated move. Everyone was bracing for someone a little too eager to please, someone who’d treat monetary policy like a personal favor. Warsh? He’s…safe. Boringly so. Which, after the last few years, feels almost radical. Like choosing beige over neon. And the market, predictably, breathed a sigh of relief. Or maybe it just saw a slightly less chaotic path to profits. Either way, silver and gold took a hit. A proper one.

Warsh, for those keeping score, was the baby-faced wonder on the Fed board back in ’06. He’s also done time with Stanley Druckenmiller – which, let’s be honest, is like getting a financial pedigree from royalty. The market likes that. It likes things with a history of…not collapsing. It’s a low bar, really.

But here’s the thing. The market reacted. It wasn’t just a dip; it was a proper wobble for precious metals. And it got me thinking. We’ve all been clinging to gold and silver as some kind of geopolitical life raft, haven’t we? A shiny insurance policy against…everything. Trump’s tantrums, inflation, the general sense that the world is slowly but surely losing its mind. It was a nice little rally while it lasted, but I suspect it ran way too far, too fast. It’s always the way, isn’t it? We get carried away with our own narratives.

The Independence Game

Look, let’s not pretend Trump was suddenly concerned with fiscal responsibility. He’s been openly frustrated with the Fed for not slashing interest rates fast enough. Affordability is a mess, housing is a joke for anyone under 40, and wages haven’t kept up. It’s a perfect storm of economic anxiety. And Trump, being Trump, decided to have a little…fun. Attempted removals of governors, subpoenas for Powell. Honestly, it was like watching a toddler throw a tantrum with the U.S. economy as his building blocks.

There was even talk of Kevin Hassett, Trump’s former economic advisor, getting the nod. A man who’d publicly called for quicker rate cuts. You could practically see the inflation ticking upwards. Lower rates can help, sure, but without a solid economic foundation, it’s just kicking the can down the road. And probably into a ravine.

The Powell subpoena, though. That was a choice. It sent a clear message: the Fed’s independence was under threat. And what do people do when they feel threatened? They flock to hard assets. Precious metals. It’s a primal thing. Except, it turns out, Powell wasn’t going to take it lying down. He publicly accused the administration of wanting a Fed that would simply follow orders. Which, let’s be honest, is terrifying. It’s like asking your accountant to cook the books. And then being surprised when things fall apart.

So, maybe the Warsh nomination is a bit of a backtrack. A calculated move to restore some semblance of normalcy. The market seems to think so. But honestly? I’m not convinced. It feels…temporary. Like a ceasefire in a war that’s far from over.

Where does this leave silver and gold? Well, I still think a small allocation to precious metals can be sensible within a diversified portfolio. But let’s be realistic. It shouldn’t be a panic buy. It shouldn’t be based on some doomsday scenario. And it definitely shouldn’t be based on the assumption that we can predict what Trump will do next. Because, frankly, that’s just asking for trouble.

Think long-term. Think basket of metals. And maybe, just maybe, think about investing in something a little less…shiny. Like, I don’t know, a good therapist. You’ll need one.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-02 18:54