As Warren Buffett prepares to relinquish the day-to-day reins of Berkshire Hathaway’s CEO office by year’s end-though not the chair-his departure serves as a quiet prelude to a series of signals, both subtle and overt, that merit careful consideration. For investors navigating the precarious waters of market valuation, these cues are less fireworks than they are dimming lighthouse beacons, flickering warnings woven into the fabric of his recent moves.

Deciphering the Subtle Warnings: What Isn’t Being Done?

Among the most telling aspects of Buffett’s current stance is what he chooses not to do. Historically, Buffett’s affinity for stock buybacks-deployed at opportune moments when shares traded below intrinsic value-has been emblematic of his capital allocation acumen. Yet, Berkshire Hathaway has abstained from repurchasing its shares since Q2 2024. This conspicuous pause in monetization hints at a cautious outlook, perhaps driven by an awareness that equities may be overextended.

Additionally, Buffett’s net selling streak, extending over twelve consecutive quarters, underscores a strategic de-risking-not panic, but prudence. It signals a belief that the valuation multiples of many holdings are elevated beyond justifiable levels, increasing the likelihood of a mean reversion. These “inactions”-the silence in buybacks and the consistent withdrawal from stock accumulation-paint a portrait of a seasoned investor wary of complacency amidst mounting overvaluation.

The Year of Abundant Cash: A Not-So-Subtle Signal

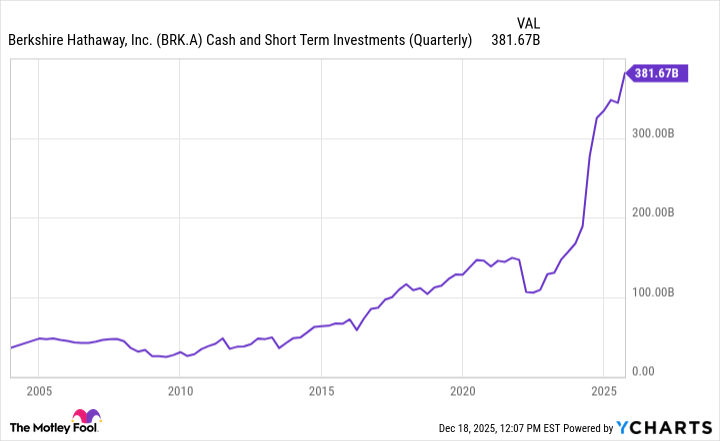

More unequivocal are Buffett’s recent cash-building initiatives. Berkshire’s cash position, topping out at approximately $381.7 billion-surpassing any prior peak-serves as a stark testament to the “waiting for the right moment” approach. This magnitude of dry powder dwarfs typical corporate buffers, suggesting a preference for patience over participation at current valuation levels.

The implication is clear: Buffett perceives the broad market as overvalued, presenting limited opportunities for judicious deployment of capital-an assertion reinforced by the historical context of his famed Buffett indicator. Currently operating at approximately 224%, the ratio-representing the ratio of total market capitalization to gross domestic product-raises questions about the sustainability of the current valuation landscape.

The Buffett Indicator: A Cautionary Measure

Since Buffett first articulated his concerns over the “playing with fire” level of market capitalization relative to GNP-now GDP-the metric has continually climbed, approaching levels that historically precede corrections. While no single indicator guarantees timing, the persistent elevation signals a potential vulnerability in the valuation fabric of equities.

Strategic Implications for Investors

Given this backdrop, what can vigilant investors reasonably deduce? It remains prudent to consider several strategic pathways:

- Maintain liquidity reserves-Buffett’s approach suggests patience rather than panic, ready to capitalize on market dislocations.

- Avoid wholesale liquidation of positions absent clear signals; market timing remains an enterprise fraught with risk.

- Identify quality stocks trading at attractive valuations-while overall market multiples may seem lofty, individual opportunities persist.

Fundamentally, mimicking Buffett’s comportment-focused on patient capital deployment and risk awareness-has historically served disciplined investors well over the decades. The message is not one of impending catastrophe but of measured vigilance, underscored by the value of waiting for clarity amidst the fog of elevated valuations.

In the grand calculus of market cycles, the prudent often find that their most valuable asset is patience-something Buffett’s latest moves underscore with quiet conviction. As we edge closer to 2026, it’s worth appreciating that the true art lies not in guessing the next turn but in recognizing the subtle signs before the storm arrives. 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-12-21 11:58