Within the relentless theater of Wall Street, where profits often dance like shadows, Warren Buffett’s Berkshire Hathaway has adopted a notably contrarian stance. The infamous sale of his holding in Apple, once the behemoth comprising more than 40% of his meticulously curated portfolio, has dwindled to a mere 22%. Such decisions evoke a mélange of speculation and intrigue in the hearts of observers, but even more so, they underscore a principle not always appreciated: the act of selling does not preclude the act of pursuing new opportunities.

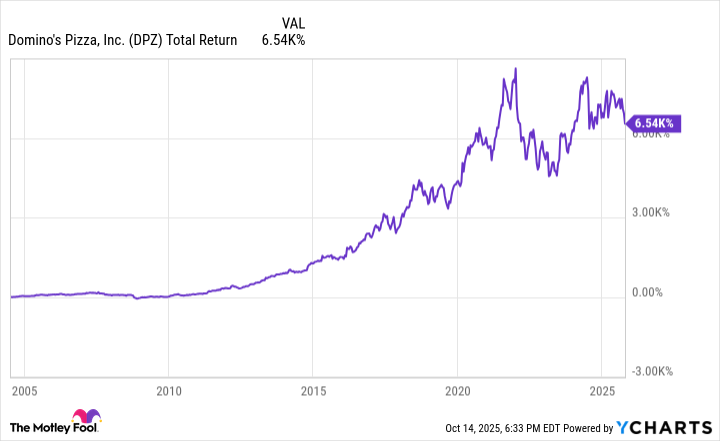

Amid this precarious transformation, one notable acquisition has emerged from the sidelines-Domino’s Pizza (DPZ). The monumental ascendance of this stock, bolstered by an awe-inspiring rise exceeding 6,500% since its inception in 2004, springs forth questions worthy of contemplation. Why does an investor of Buffett’s caliber, a man who navigates the treacherous waters of capital with unmatched prudence, now set his sights on a dining establishment etched in grease and delivery boxes? To ponder this is to invite deeper scrutiny into the essence of the business, its worth, and its allure to the everyday investor.

Berkshire Hathaway and Domino’s

Domino’s has been the phoenix rising from the ashes of missed early investments, yet Buffett’s recent dalliance suggests he perceives the sparks of future growth still flickering within this enterprise. Having commenced stock purchases in the third quarter of 2024, the gradual amplification of holdings-currently echoing in the realm of 2.6 million shares or 7.75% of outstanding capital-echoes a belief that the journey is far from over.

But here lies an irony worthy of note: as the world’s largest pizza chain, with sprawling tentacles reaching across 21,750 locations as of the close of fiscal Q3, Domino’s thrives where others falter. The marketplace may rise up against the threat of low entry barriers in the culinary domain, yet no rival has managed to cultivate a legacy comparable to this bustling chain. Herein lie the competitive advantages that capture the interest of the sagacious investor-an investor who sees potential flickering in the shadows of earnings, even amidst the noise of cheap imitation.

At the heart of Domino’s operation lies its franchise model-a mechanism that possesses the uncanny ability to minimize capital requisites while maximizing brand recognition and consumer loyalty. The secret ingredients in this recipe for success are augmented by its savvy digital-first strategy, which streamlines ordering through intuitive interfaces, enhancing the quotidian experience.

This operational efficiency extends to logistics, with a supply chain that not only standardizes product quality but also curtails costs, imbuing the customer experience with a tantalizing consistency. Moreover, credibility flows through a menu that adapts to diverse culinary preferences, whilst innovative offerings-such as the extravagant parmesan-stuffed crust-serve to entice and reclaim clientele with each passing season.

The financial case for Domino’s

Fueling Buffett’s interest is undoubtedly the financial foundation that anchors this business. The first nine months of fiscal 2025 revealed revenue of $3.4 billion-an intangible testament to a 4% growth that belies deeper undercurrents. Free cash flow surged-a remarkable 32% increase to $496 million-painted through the lens of robust asset management and prudent capital expenditure.

This burgeoning free cash flow effortlessly enveloped the dividend obligations, amounting to $119 million, during the same timeframe. Offerings of $6.96 per share yield a 1.6% dividend that reinvigorates the whiff of value amidst the normally arid landscapes of investment returns, eclipsing even the S&P 500’s pedestrian yield. There exists an inherent merit in the streak of thirteen years of dividend hikes-a history rich with promise and expectation.

Therefore, when one casts an eye upon Domino’s valuation, the P/E ratio standing at 25 does not elicit foreboding; rather, it evokes considerations of potential. Over the preceding five years, this ratio hovered near 30, indicating that despite moments of exuberance, it has not significantly dipped below the level of 25 since the early 2010s, thus suggesting the security of a reasonable acquisition.

Should you follow Berkshire Hathaway into Domino’s stock?

As investors stand at the crossroads, the opportunity to follow in the venerable footsteps of Berkshire Hathaway into Domino’s stock unfurls before them like a vast and open road. Yes, the allure of a staggering 6,500% return may paradoxically deter prudence in potential buyers, yet the strategic insights warrant consideration.

Yet, amid the chaos of the pizza industry-where competition reigns and market whims sway with fickle fervor-Domino’s brand endures, fortified by operational prowess and a well-oiled supply chain. The time-honored wisdom to acquire such a stock at a reasonable price while enjoying a respectable dividend yield should not be discarded lightly.

Indeed, even if Domino’s does not whip up a tempest of excitement-like some of its more glamorous contemporaries-it possesses the understated potential to generate rising dividends and returns that outstrip the broader market over time. Value, it appears, springs forth most subtly in the unassuming corners of the marketplace. 🍕

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2025-10-19 14:42