Warren Buffet has an enormous amount of funds available for investment, as Berkshire Hathaway holds close to $348 billion in cash, with Buffet having the authority to decide how these funds are utilized.

It seems that Buffett is having trouble locating stocks that match his strict investment standards. Yet, I believe there’s a well-established, undervalued company that aligns flawlessly with his investment strategy.

A business Buffett understands

Buffett often emphasizes that he invests in businesses he fully comprehends. In his 1996 letter to Berkshire Hathaway shareholders, he stated: “You don’t need to know the ins and outs of every company, or even many. You just need to be able to assess companies within your area of expertise.

It’s highly likely that no industry falls within Buffett’s expertise more than insurance, as Berkshire Hathaway derives a substantial portion of its income from property and casualty insurance. Regardless of the specific type of insurance, the fundamental strategies for managing an insurance business remain consistent. The secret to success lies in accurately assessing risk and setting premiums that cover this risk while still earning a profit.

The UnitedHealth Group (UNH) is America’s biggest health insurance provider, and it’s clear that Buffett has a deep understanding of their operations. It’s not surprising, given he invested in UnitedHealth for Berkshire Hathaway’s portfolio back in 2006 and held the shares for three years.

Financials Buffett would find appealing

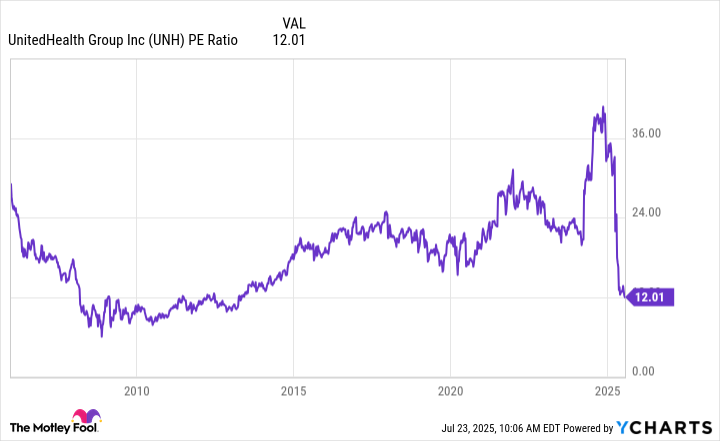

From my perspective, it appears that UnitedHealth Group’s share price has dipped significantly this year, dropping over 50%. This decline followed a first-quarter performance that fell short of expectations. At first, the company adjusted its full-year forecast, but later decided to withdraw it entirely. Despite these setbacks, I have reason to believe that Warren Buffett might find UnitedHealth’s financial standing still attractive.

In previous discussions, Buffett emphasized the significance of Return on Equity (ROE). He often mentions a target of 20% as an ideal benchmark. Notably, UnitedHealth Group has managed to surpass this threshold, with their ROE over the last year reaching 22.7%.

Although UnitedHealth Group fell short in Q1 earnings, the company managed to increase its revenue by an impressive $9.8 billion compared to the previous year, reaching a total of $109.6 billion. The company also reported a profit of approximately $6.3 billion. With over $34.3 billion in cash reserves and a manageable debt level, it’s clear that UnitedHealth Group has strong financial footing. I believe Warren Buffett would be more interested in these solid numbers than Wall Street’s predictions about the company’s performance.

A price Buffett almost certainly likes

What’s keeping Warren Buffet from investing Berkshire Hathaway’s large cash reserves? He seems to be having difficulty finding companies whose stock prices are reasonably priced. However, UnitedHealth Group, with its current price, is likely to catch Buffett’s interest.

The shares for the healthcare company are being sold around 12 times their past year’s net profit. Back in early 2006, when Buffett made his initial investment in UnitedHealth Group, its earnings multiple was noticeably greater.

Indeed, Buffett prioritizes a company’s potential for future earnings growth. It might seem as though he could have concerns about whether UnitedHealth Group’s profits will persist at their current level. However, I personally believe it’s unlikely.

The major challenge facing the company is that expenses for certain Medicare Advantage plans have turned out to be more than anticipated. Buffett understands that health insurers can typically tackle such issues within a year by raising premiums. Given UnitedHealth Group’s forecast, he might think the company will resume growth in 2026.

Is Buffett buying UnitedHealth Group stock?

It’s uncertain whether Buffett is purchasing UnitedHealth Group shares. There’s a possibility he might choose to hold onto Berkshire’s cash, allowing Greg Abel to take charge of major decisions once Buffett steps down as CEO in the coming year.

UnitedHealth Group aligns with Buffett’s investment strategy, which has proven to be highly effective over time. Investors aiming to mimic Buffett might find it worthwhile to think about purchasing this discounted blue-chip stock, even if Buffett himself doesn’t make a purchase.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-07-25 10:12