Let’s all clap for the departing maestro of money management, Warren Buffett, who’s reportedly retiring from Berkshire Hathaway’s daily grind. At 95, the guy’s basically been investing since the Stone Age, somehow turning $1 into roughly $57,500 in Class A shares. But let’s not get misty-eyed over the “Oracle of Omaha” just yet. His real farewell gift to Wall Street? A fire sale so loud it could wake the dead—or at least the comatose hedge fund managers clinging to his coattails.

Buffett’s been quietly dumping stocks like a teenager untagging themselves from a cringe family vacation photo. Eleven straight quarters of net selling? That’s not a streak—it’s a resignation letter to the entire concept of capitalism. And yet, here we are, acting shocked that the man who built his empire on “buy low, sell high” is suddenly all about the selling.

Buffett’s $177 Billion Mic Drop

Let’s crunch the numbers like a CFO fudging quarterly reports. Since late 2022, Buffett’s been offloading stocks like a Black Friday shopper fleeing a burning mall. $177 billion in net sales! That’s enough to buy every publicly traded company in the S&P 500… and still have change left for a solid gold Rolodex. The upcoming 13F filing? Just a formality. The man’s portfolio is now 60% cash, which is basically the financial equivalent of hiding under a mattress with a panic room underneath.

- Q4 2022: $14.64B in sales (The “I Just Realized My IRA’s in Crypto” Quarter)

- Q2 2024: $75.536B (The “Y’all Ain’t Ready for This Jelly” Quarter)

- Q3 2024: $34.592B (The “I’ll Take My Chances With the Rapture” Quarter)

Why the Fire Sale, Omaha? The Market’s Basically a Yard Sale

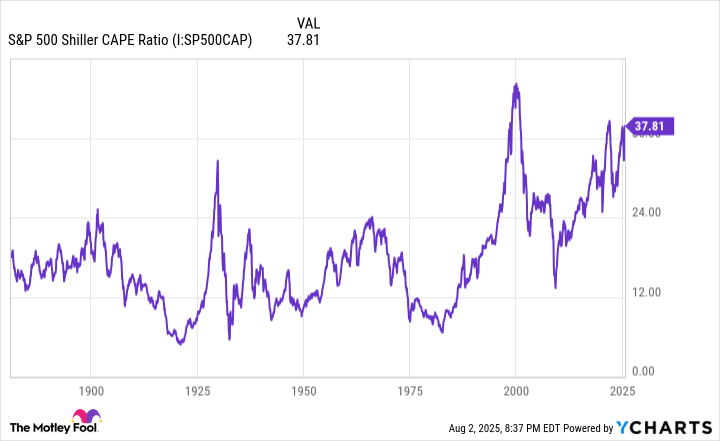

Buffett’s got two golden rules: Never bet against America (unless you’ve seen the latest jobs report), and never overpay. Spoiler: The stock market’s currently priced like a Beyoncé concert—obscene. The Buffett Indicator (market cap/GDP) just hit 210%, which in normal-person math means “everyone’s selling their IPO dreams on Venmo.” The S&P 500’s Shiller P/E ratio? A nosebleed 38.97. Historically, that’s been the financial version of hearing “Hold my beer” right before a Darwin Award entry.

So why not just deploy that $344 billion cash hoard? Because even Buffett’s not dumb enough to buy a lottery ticket when the jackpot’s fake. As he famously didn’t say: “Be greedy when others are fearful, but pack a parachute when the plane’s on fire.”

Patience: The Real MVP (Most Valuable Paralysis)

Remember when Buffett bought Bank of America preferred stock in 2011? That “bailout” that turned into a $12 billion profit? Classic move. It’s the investing version of finding a $20 bill in a thrift store jacket—except the jacket’s a collapsing bank, and the $20 bill’s a suitcase full of gold bars. But those deals don’t exist in 2025 unless you’re shopping at the Dollar Store of Distressed Assets™.

Will Greg Abel, Buffett’s successor, ever push the “buy” button again? Sure—right after he finishes reading the instruction manual for Berkshire’s literal money-printing press. Until then, the lesson here is clear: When the Oracle starts acting like a day trader on Ambien, maybe it’s time to short the confetti cannons at the IPO party. 🧁

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-04 10:13