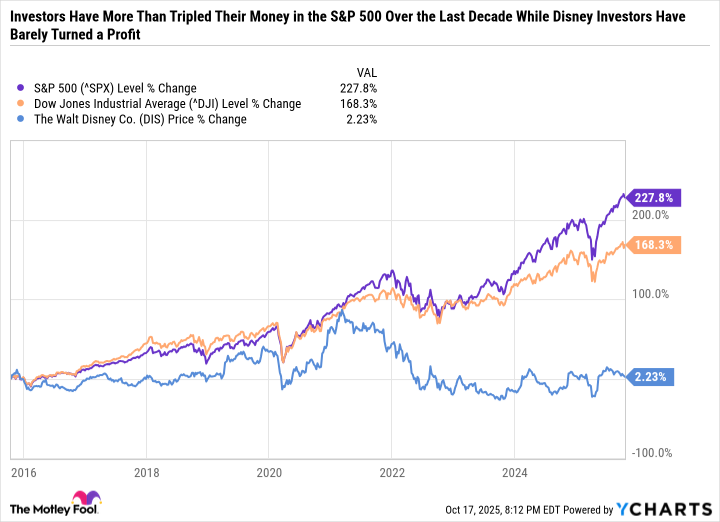

The S&P 500 (^GSPC), a veritable giant of the stock market arena, has trampled the humble Dow Jones Industrial Average (^DJI) over the past decade, buoyed by a tide of dazzling tech stocks as if they were the great ships of state sailing across a placid sea. Alas, our dear investors who clung to the doughty Dow found themselves marooned, save for those who pinned their hopes on the famed Walt Disney (DIS)-a forlorn castaway, its fortune stagnant, languishing in a state most akin to a withering flower at the season’s end.

And yet, dear reader, within this disheveled mulch of stock performance lies an ember of promise, one that could, perchance, light the way towards a resurgence where Disney not only recovers but triumphs over its S&P siblings in this coming decade of enigmatic fortunes.

The Road to Redemption

What travails Disney has endured! In the fruitful years of the mid to late 2010s, the Walt Disney Company, like a prodigious bard at a feast of indulgence, serenaded the masses with a parade of box office triumphs, its Marvel and Star Wars franchises effusing profits akin to golden rain.

A fateful proclamation arose when Disney+ emerged in November 2019, heralded as a sovereign to carve a proud niche among the streaming elite. At first, like a hopeful child, it flourished in subscriber growth. But lo! The specter of the COVID-19 pandemic, that harbinger of discontent, descended, bringing down its parks, experiences, and film offerings with a merciless fist. Disney+, though rich in patrons, became a gaping maw of expenditure, its costly appetite insatiable. Recovery was slow to come, and only after a torturous march did profitability diminish in the legacy cable enterprise of its so-called linear networks-a slow decline reminiscent of a winter’s icy grip.

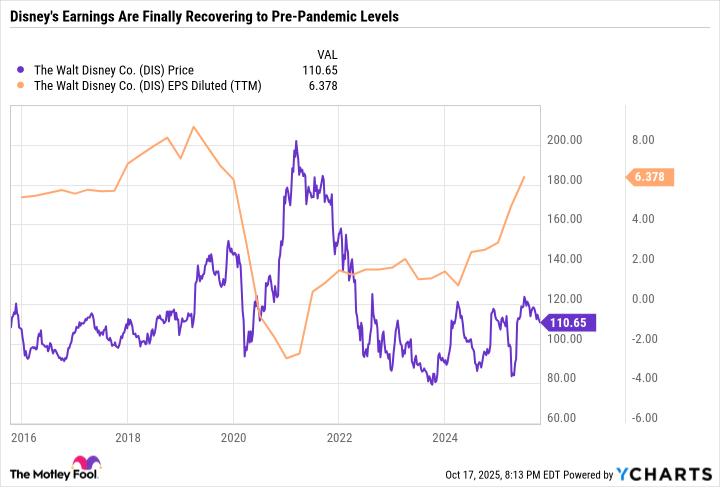

And now, as one peers through the murky fog of time, it becomes evident that Disney’s linear networks and box office endeavors languish in a weakened state, their collective vigor waning compared to their robust forms of yesteryear. Yet, in a triumphant flourish, Disney+ has found profitability, while its parks and cruise lines bloom with promise. But beneath this veneer of revival, the growth in earnings has been a whisper-a mere afterthought over the past decade.

During a 1993 tête-à-tête with the persuasive Charlie Rose, the illustrious Fidelity mutual fund manager Peter Lynch distilled the essence of stock valuation into a humble nugget. He remarked, with a tone of soothing assurance, that a company’s earnings over the years would directly correlate with its stock price. Behold the enduring truth of McDonald’s, a titan of burger and fries; while the world frets over the grand tapestry of macroeconomic concerns-money supply, petroleum prices, political players-none affect the golden arches. As long as their profits burgeon, their stock shall follow suit.

This sage observation, while seemingly simple in its apparent wisdom, dances around a complex truth: investors ought to anchor their aspirations in a corporation’s potential for earnings growth rather than forecasting fickle stock movements.

The story of Disney, a mirror reflecting Lynch’s logic, reveals that recent years have not been kind. Yet, solace emerges for the keen-minded investor: the horizon gleams anew, for a company’s future beckons with untold potential. Disney may rise like a phoenix from its ashes, its earnings drawing ever so persuasive and robust, lifting its price with a buoyant leap onto the shores of capital appreciation.

Through Rosy Glasses: A Fortunate Perspective

Fiscal 2025, in all its economic hues, has proven a most exceptional theatre for Disney, especially when juxtaposed against the retail landscape, rife with the carcasses of consumer-driven enterprises. Countless retailers, restaurants, and those making merry in the auto industry find themselves grappling under the weight of inflation, as consumers clutch their purses tighter than the crown jewels.

Suffice it to say, Disney’s crystal ball predicts an 8% growth in operating income from its experiences segment and double-digit percentages from entertainment-a veritable cornucopia! Meanwhile, the direct-to-consumer entertainment arm, led by that raucous newcomer Disney+, anticipates a bumper crop of $1.3 billion in added operating income and an adjusted earnings per share of $5.85 for fiscal 2025, marking an 18% escalation from the previous year.

This year stands as a testament to the resilience of a titan reborn in the post-pandemic epoch, proving that Disney+ may evolve into a steady stream of cash-a deluge of prosperity where weary travelers are compelled to drop their worldly worries at the gates of Disney’s cherished lands and cruises.

The primary catalysts for Disney’s resurgence nestle within its direct-to-consumer side, bolstered by the illustrious ESPN venturing forth into the stand-alone cosmos; coupled with the fruitful investment in its parks and sea-bound escapades, these elements could ignite explosive growth.

In September 2023, the oracle unfurled plans to double capital expenditures in Disney’s Parks, Experiences, and Products to an eye-watering $60 billion over the next decade. Much of it is earmarked for the adorned galleons of the cruise line, which is set to swell from five to thirteen ships by 2031, launching forth adventurous new vessels-one even named Disney Treasure, promising riches aplenty under the waves.

To sweeten this grand expansion, Disney also commits to invigorate its existing parks with glittering attractions and enchanting realms. A new theme park and resort looms on the horizon in Abu Dhabi, poised to grace the sands once the decade unfurls fully.

To grasp Disney stock now is to place faith in the potential transformation of cost into earnings, a quiet bet on the fulfillment of grandiose dreams.

Should the waters of growth rise in concert with earnings expansion, the valuation of Disney could ascend to newfound heights, brushing past its historical norms adorned with a price-to-earnings (P/E) ratio of 17.4-rather paltry compared to its 10-year median P/E of 21.5.

Disney: The Beacon for Long-term Value Seekers

As the currents of the market swirl, Disney emerges as a beacon for astute investors, who can discern the brilliance glinting within the shadows cast by box office disappointments and fading linear networks. In shifting focus to its sacrosanct high-margin endeavors, Disney embodies a calculated pivot in alignment with its revered franchise flywheel model.

Disney understands the art of prolonging the lifecycle of its beloved content through the alchemy of monetizing across film and theme park experiences. Witness how Toy Story has flourished, yielding both adoration and profit through multiple cinematic offerings, toys, and vibrant rides-far outlasting the ephemeral glow of a single box office triumph.

If the discerning Wall Street begins to appraise Disney’s steady earnings akin to its streaming peer, Netflix, while its ventures bear fruit, it is conceivable that Disney might even find itself seated at the banquet table, outshining the S&P 500 with its robust, sustained earnings growth. The strategy presents itself as a moderate risk with potentially scintillating rewards for the discerning long-term investor, a veritable banquet within the ever-turning wheel of capitalism. 🤑

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

- 9 Video Games That Reshaped Our Moral Lens

2025-10-20 21:26