Walmart, that temple of calculated convenience, has ascended to the trillion-dollar mark. A milestone, certainly, though one wonders if sheer size is now mistaken for genuine prosperity. It is, after all, far easier to accumulate wealth than to cultivate taste. The market, in its relentless pursuit of the quantifiable, has once again confused the shadow of value with the substance itself.

The company’s recent performance, a 28% ascent over the past year, has captivated the herd. It is a curious spectacle, watching investors flock to the mundane as if it held the key to some profound truth. One might venture that the truly discerning eye seeks elegance, not merely abundance.

The Price of Practicality

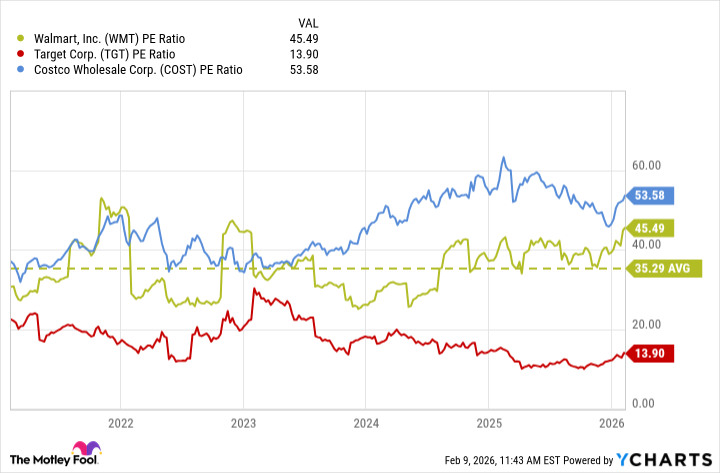

A trillion-dollar valuation demands scrutiny, not celebration. The price-to-earnings ratio, that most pedestrian of metrics, reveals a multiple of 45. A figure that suggests investors are paying a considerable premium for the privilege of owning a share of… well, a very large discount retailer. It’s a curious equation, valuing practicality as if it were poetry.

The disparity is rather amusing. Investors seem willing to pay handsomely for competence, while overlooking the virtues of brilliance. Target, a company that has momentarily misplaced its way, trades at a far more reasonable valuation. Costco, a purveyor of curated abundance, commands a similar respect. But Walmart? It seems the market believes mere scale is sufficient justification for extravagance.

The current fervor reminds one of a particularly enthusiastic auction. Everyone is bidding, not because they understand the true worth of the object, but because they fear being left behind. A most unrefined spectacle, really.

The Illusion of Growth

Walmart’s business is undeniably robust. The foray into online retail is commendable, and the acquisition of Vizio, while a curious alliance, hints at ambitions beyond the purely transactional. However, a single-digit growth rate, around 6% as of the last earnings report, hardly justifies a premium valuation. It is, to put it mildly, a rather pedestrian performance dressed in the finery of a trillion-dollar market cap.

One must ask: are investors purchasing a share in a growing empire, or simply paying for the illusion of stability? The market, alas, often mistakes predictability for progress. As great a business as Walmart may be, it is not immune to the laws of financial gravity. To pay a king’s ransom for a modest return is not shrewd investing; it is merely a demonstration of excessive enthusiasm.

The pursuit of value, one often finds, is far more rewarding than the accumulation of mere possessions. And in the case of Walmart, one suspects the true value has been rather… overbid. There are, after all, far more elegant investments to be made.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-09 21:06