Walmart (WMT) has long stood as a monument to American enterprise, its red-and-blue banners fluttering like flags over a landscape of brick-and-mortar fortresses. Since 1962, it has plied its trade with the stoicism of a Russian nobleman tending his estate-unmoved by fads, unshaken by storms. Its creed? To clothe the world in affordability, one humble grocery item at a time.

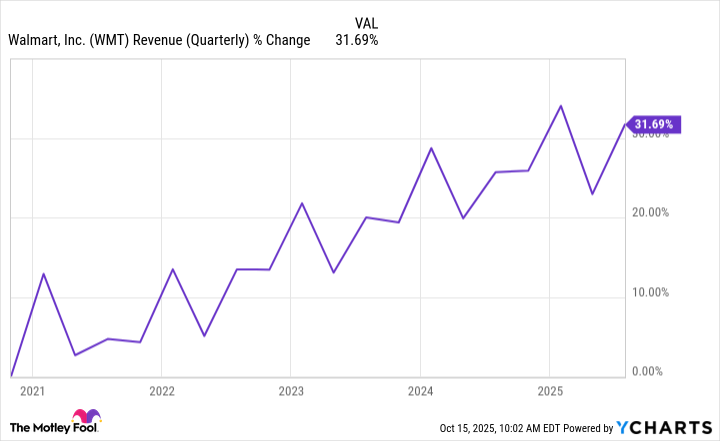

The company’s stock, like its warehouses, has accumulated value with the patience of a miser. Over the past decade, it has yielded annual returns of 20.5%, a figure that humbles the S&P 500’s 14.8%. This year alone, it has climbed 19% through October 15, a performance that whispers of resilience rather than boastful fanfare. Yet for all this success, the road ahead remains uncharted, and the seasoned investor senses opportunity in the mist.

1. The Digital Frontier: A Battle of Wits

When Amazon’s shadow fell upon the retail world, many feared Walmart would become a relic-a superfluous character in a story written for the future. Yet the retailer, like a veteran general, has adapted its tactics. It has not merely defended its domain but extended its reach into the digital ether, where pixels now dictate commerce.

In its most recent fiscal quarter, Walmart’s e-commerce sales surged 26% in the U.S., 22% internationally. These figures are not mere numbers but the echoes of a strategy that turns its 5,000+ stores into a network of fulfillment centers. Here lies its genius: to transform the very thing that once threatened it-its physical presence-into a weapon. Same-day delivery to 93% of U.S. households? A feat worthy of Tolstoy’s war narratives.

2. The Subscription Symphony

Walmart+ is the latest movement in this grand symphony of survival. A membership program, yes-but one that sings a melody of convenience, loyalty, and margin expansion. For 12.95 dollars a month, customers gain free delivery, fuel discounts, and a smattering of streaming perks. It is not Amazon Prime, but it is its equal in ambition: a subscription model that transforms casual shoppers into habitual patrons.

In the second quarter, Walmart+ revenue grew by double digits. These subscriptions, like the quiet ticking of a clock, add rhythm to the company’s cash flow. They are the dividends of the digital age, where margins are stretched thin but profits endure. And what is a membership but a pact between merchant and customer-a bond that outlives the fleeting allure of a sale?

3. The Dividend’s Eternal March

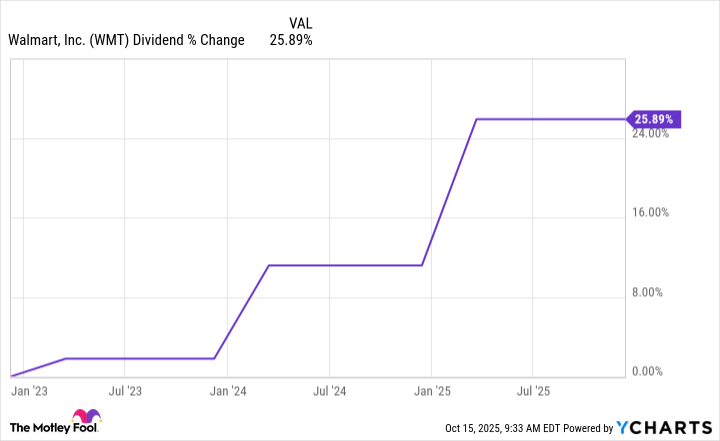

Walmart’s dividend is a relic of another era, a tradition upheld with the solemnity of a cathedral service. At 0.85%, its current yield may seem modest, but its history is a tapestry of consistency. For 52 consecutive years, it has raised its payout-52 years of unbroken resolve, a testament to the durability of its cash flow.

In February, the company increased its dividend by 13%, a gesture as inevitable as the turning of seasons. Such confidence in one’s finances is rare in these uncertain times; it is the mark of a company that knows its roots run deep. The dividend is not a bribe, but a promise-a promise that even as the world changes, Walmart will remain a steadfast companion to those who dare to invest in its quiet triumph.

In the end, Walmart is not a stock to chase, but a story to follow. Its chapters are written in the ink of resilience, its plot a dance between tradition and transformation. For the seasoned investor, it is a reminder that greatness need not shout to be heard. 🌾

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-17 17:36