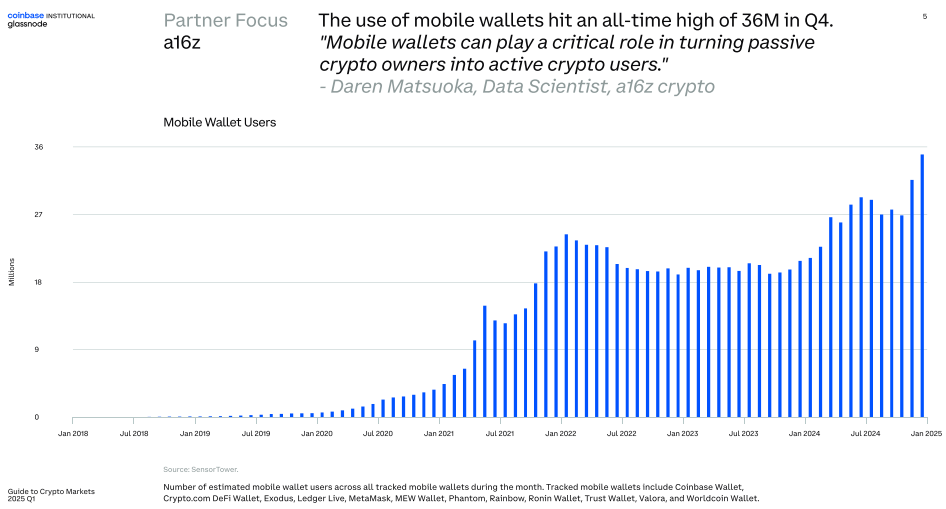

It has come to my attention that the adoption of those curious “cryptocurrency mobile wallets” has reached a positively dizzying height, with a reported 36 million souls actively employing them in the fourth quarter of 2024. One must wonder, are these digital purses truly so very convenient? 🤔

Furthermore, these “stablecoins” have, it seems, experienced a rather immoderate surge in their availability, the two trends combined suggesting a most dramatic shift in how individuals are choosing to interact with these fantastical, if somewhat perplexing, digital currencies.

Coinbase Report: The Role of Mobile Wallets in Crypto Engagement (One Hopes, for Good)

According to a report from the aforementioned Coinbase (a name, I must admit, which elicits neither admiration nor fear), released on January 29th, these mobile wallets are instrumental in driving a more keen participation in digital assets. It would appear, then, that the previous, more passive state of merely possessing these “cryptos” is giving way to a more active involvement in blockchain applications, and these “decentralized finance” protocols—a concept as nebulous as the mist on a winter’s morning.

“Mobile wallets, it is suggested, may indeed transform the somewhat lethargic crypto owner into a far more spirited crypto user,” intoned one Daren Matsuoka, a data scientist, apparently, at a16z Crypto. I suppose we shall see if such activity truly proves beneficial. 🤔

Previously, many an owner of these digital coins were content to merely store them. However, these latest reports seem to suggest that more and more individuals are engaging in, as it were, the “DeFi” sphere, as well as that of “non-fungible tokens,” and other blockchain-based services – a curious state of affairs, indeed!

With such activity increasing, one might well anticipate a surge in innovation and a more general acceptance of all these digital currencies, though one cannot help but wonder if some might be better left to the realm of the speculative. With all the institutions now casting a watchful eye on these matters, and the common man throwing himself into these “dApps”, I suppose the future of these “mobile wallets” will continue in this most curious expansion.

Meanwhile, a most curious parallel report from Triple-A reports that some 560 million souls across the globe have now embraced these crypto-holdings. Taken altogether, these occurrences reflect a quite significant acceptance, and indeed confidence, in this odd “crypto economy”.

“As of 2024, we have estimated global cryptocurrency ownership to be at an average of 6.8%, with over 560 million crypto owners worldwide,” the report declares. One hopes their confidence is not misplaced. 😮

While this increased adoption is heartening, one must always be mindful of the persistent threat of those dreadful swindlers. A recent deception involving fake “XRP wallets” tied to the US Treasury has, one hears, been spreading on social media. How dreadful!

As the BeInCrypto journal tells us, this particular trickery induced the unwary to transfer funds to these villainous fake accounts, a most deplorable occurrence. This scam is, of course, a reminder that enhanced security and a constant vigilance are most essential in the ever-changing crypto marketplace. ⚠️

Even with such risks, the increased activity involving mobile wallets and this blockchain technology presents a hopeful step toward a more integrated financial future for those who partake of cryptocurrencies around the globe.

Stablecoin Supply Rises by Over 18% in Q4 – How Very Extravagant!

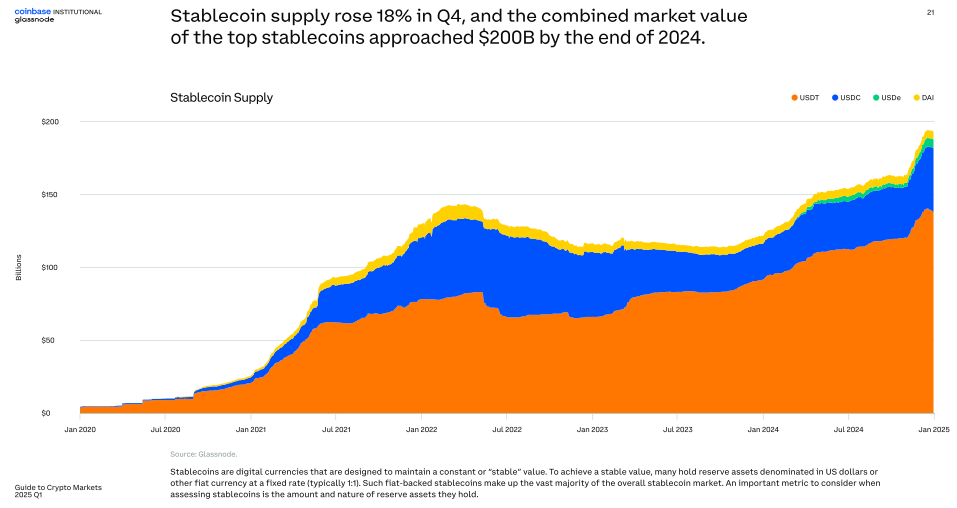

In a similar vein, the aforementioned Coinbase report draws attention to the growth of these “stablecoins” in 2024, with their availability increasing by a surprising 18%. It is reported that they nearly surpassed the $200 billion mark before the year’s conclusion. A growing supply of these coins, it is suggested, may signal some impending buying spree of crypto and also an increased appetite from investors, since such coins are primarily how one makes the transition from common fiat to the more exotic world of digital currencies.

Furthermore, the trading of these stablecoins has been said to have increased more than threefold to $30 trillion during the year! In the month of December alone, trading volume surpassed $5 trillion, coinciding, as it happens, with the quite sensational “Bitcoin” rally to $100,000.

Additionally, the movement of these stablecoins to these “crypto exchanges” hit a record monthly high of $9.7 billion on the 21st of November – a mere two weeks before “Bitcoin” reached that $100,000 mark for the first time! Such rapid and unpredictable movements – it quite boggles the mind. 🤔

However, while these stablecoins are said to be poised for greater adoption, some more clear and concise regulations are crucial in encouraging broader financial inclusion. It is emphasized that the pathway for using these stablecoins in payments, digital capital markets, and financial services for the unbanked (or underbanked) is now in place. One cannot help but wonder what this means for our very own economy.🧐

“The stage, it would appear, is now set for the broader employment of these stablecoins in remittances, digital capital markets, and the provision of financial services for the unbanked,” states the report.

This aligns, it seems, with some recent comments from a Mr. Kash Razzaghi, Chief Business Officer at one “Circle”. In a statement shared with BeInCrypto, he seems to imply that these stablecoins are remaking those high inflation economies, by providing an alternative to volatile local currencies. One can only imagine the dramatic impact these changes will have.

“This may prove particularly beneficial for businesses that struggle with high cross-border payment costs, not to mention fluctuating local currencies, as well as enabling employees to be paid promptly in US dollars,” claims Mr. Razzaghi.

Meanwhile, CEOs Richard Teng and Simon Kim of “Binance” and “Hashed,” respectively, have predicted that these stablecoins will be a key trend in the coming year. We shall, of course, have to wait and see if their predictions come to pass! 🤷♀️

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-30 14:56