Over the past three years, AI-related news has been a common sight in financial headlines on Wall Street. However, it’s essential to note that this isn’t the sole factor contributing to the record-breaking levels of the main stock market indices. Other significant trends have also played a crucial role.

Alongside the growing interest in Artificial Intelligence, the buzz around stock splits in several prominent companies has significantly contributed to the overall upward trend in the market.

Stock-split euphoria has gained momentum on Wall Street

A stock split refers to a company’s action of dividing its existing shares into a greater number of shares while maintaining the same total value. This results in a lower share price but doesn’t affect the market capitalization or the company’s overall business operations.

While stock splits can cause a company’s share price to rise or fall, investors generally perceive the two types of splits quite distinctly. Reverse splits, which boost a company’s share price while decreasing the number of shares outstanding, are often seen unfavorably by investors. Companies opting for reverse splits are typically grappling with operational issues and aim to prevent delisting from significant stock exchanges.

Instead, investors tend to prefer companies that perform forward stock splits. These splits are structured to make a company’s shares more accessible financially for regular investors, as they cannot usually buy fractional shares through their brokers.

Companies that perform forward stock splits tend to excel in innovation and execution compared to their competitors, which is often why their share prices reach a level necessitating such a split. Furthermore, these companies have shown a pattern of outperforming significant stock indexes on Wall Street in the year following their initial announcement of the split.

It’s likely not surprising that the stock predicted to be the most eagerly awaited on Wall Street in 2025 is the top pick among four highly influential and prosperous billionaire investors who dominate the stock market.

Billionaires have loaded up on this trillion-dollar stock — and it’s not hard to understand why

So far in 2025, just three well-known stocks not belonging to the tech industry have undergone a forward stock split. The anticipation on Wall Street is high for the lone company from the “Magnificent Seven” and one of the 11 firms ever to reach a $1 trillion market cap to announce its inaugural stock split. That’s right, I’m referring to Meta Platforms (META -0.22%), the social media powerhouse.

Within 45 days after a quarter ends, institutional investors managing over $100 million in assets must submit Form 13F to the Securities and Exchange Commission. This report offers a brief overview, enabling investors to observe which stocks prominent Wall Street fund managers are acquiring, disposing of, or holding onto.

Among the vast majority of billionaire investors, each tends to favor distinct investment strategies. However, Meta stands out as a commonality in their top investments by market value.

As of the end of March, Meta Platforms stock was the top holding of four billionaire investors:

- Chase Coleman of Tiger Global Management: 16.18% of invested assets

- Terry Smith of Fundsmith: 10.19% of invested assets

- Philippe Laffont of Coatue Management: 9.55% of invested assets

- Stephen Mandel of Lone Pine Capital: 8.75% of invested assets

Although Meta’s AI aspirations undoubtedly generate excitement, it’s crucial to remember that its financial backbone lies in its ownership of popular social media sites. Meta is the guardian of daily haunts such as Facebook, Instagram, WhatsApp, Threads, and Facebook Messenger. These apps collectively drew an average of 3.43 billion people daily in March, a figure yet to be matched by any other social platforms. Consequently, businesses are eager to invest more to showcase their messages on these highly-trafficked platforms.

Delving deeper into this topic, it’s fascinating to note that nearly 98% of Meta Platforms’ revenue comes from advertising. While recessions are a common and temporary part of the economic cycle, they typically don’t last long. Since World War II ended almost eight decades ago, the average recession has only lasted about 10 months, while economic expansions have usually continued for around five years. This imbalance in the economy is actually advantageous for ad-driven businesses like Meta. As an enthusiast, I find this pattern intriguing and hopeful for the future of such companies!

It’s worth mentioning that Meta’s future relies heavily on integrating AI technologies. Currently, they are offering generative AI solutions to their advertising clients, enabling ads to be customized for individual users and boost click rates. Additionally, it is anticipated that AI will significantly impact the creation of the metaverse – a 3D virtual world where users can engage with one another and their surroundings. Mark Zuckerberg aims to position his company as a primary access point to the metaverse in the near future.

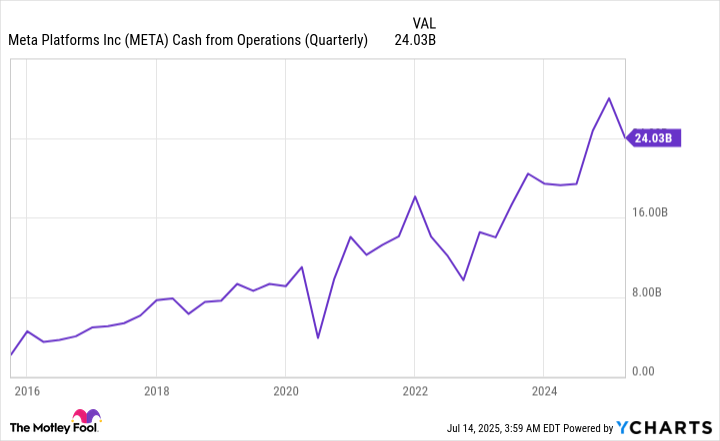

This company’s financial situation, marked by a spotless balance sheet, demonstrates its robustness and capacity for investment. By the end of March 2025, Meta boasted over $70.2 billion in liquid assets, and it produced more than $24 billion in net cash flow from operations within the first quarter alone. This places it among a select group of companies that can afford to pursue daring ventures and invest heavily in an AI-centric future.

A delightful bonus for Meta is that it has ample room to grow, despite its impressive 340% increase in value over the past three years (as of July 12). Remarkably, the company’s shares are valued at a reasonable 25 times the estimated earnings for the upcoming year.

With Meta Platforms shares now exceeding $700 once more and approximately a quarter of these shares owned by everyday investors, there’s strong evidence that Meta could soon join the ranks of stocks undergoing a split due to Wall Street. Although it seems unlikely that this is the main reason for billionaire investors like Chase Coleman, Terry Smith, Philippe Laffont, and Stephen Mandel to make Meta their top pick, it would still be one more factor driving the company’s growth.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-17 20:57