Now, it comes to my attention – and a body can’t help but notice these things when folks are throwin’ money about like confetti – that the Stock Market, bless its fickle heart, has been performin’ a right lively jig these past few years. The S&P 500 and the Nasdaq Composite, they’ve been climbin’ higher than a politician’s promises, notching up gains for three years run. Seems every Tom, Dick, and Harriet thinks they’re a Wall Street wizard.

Technology, industrials, energy, even the utilities – they’re all takin’ the lead, mostly thanks to this newfangled “artificial intelligence.” Folks are speakin’ of it like it’s the Second Comin’. But a man who’s seen a few seasons come and go – and I have, believe you me – knows that what goes up, generally has a mighty hard fall. It’s a law of nature, and Wall Street, for all its fancy charts and calculations, ain’t exempt.

So, the question lingers, doesn’t it? Could this here bull market run outta steam in 2026? A body’d be a fool not to wonder.

A Warning Whisper from the Past

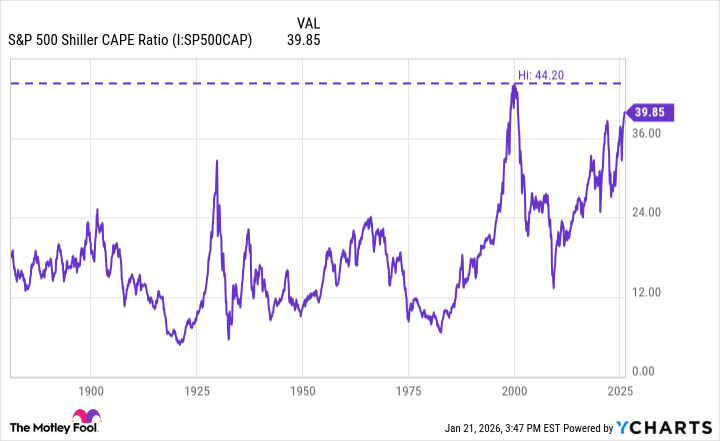

There’s a heap of ways to try and figure out if the market’s overvalued or undervalued. Most of ’em are about as useful as a screen door on a submarine, if you ask me. But there’s one method, a bit of a curiosity, called the “cyclically adjusted price-to-earnings” ratio, or CAPE. It’s a fancy way of sayin’ they look at ten years of earnings, see how prices have danced around, and try to get a feel for things. It’s like lookin’ at a family’s history to predict what the youngsters might do – not always accurate, mind you, but better than guessin’ with your eyes closed.

Now, this CAPE ratio is sittin’ around 40, which, as near as I can reckon, ain’t happened much in history. There’s been only two other times when it got this high. Back in the late 1920s, it climbed into the mid-30s, and in 2000, it hit a peak of 44. And what happened then? Why, the market crashed, of course. In the ’20s, it led to the Great Depression, and in 2000, the dot-com bubble burst with a sound like a thousand fortunes goin’ up in smoke.

The Future, or a Repeat of the Past?

Now, some folks might say this means a crash is comin’ in 2026, and they wouldn’t be entirely wrong to think so. But the world is a complicated place, and things ain’t always as simple as they seem. The truth is, the S&P 500 is currently bein’ propped up by a handful of companies – ten or so, give or take. These are the giants, the ones that have already made a pretty penny off this artificial intelligence craze.

That’s a key difference, you see. Back in the internet days, a lot of those companies never turned a profit. They were all sizzle and no steak. But these AI companies? They’re makin’ money hand over fist. So, the gains we’ve seen in the S&P 500 might actually be sustainable. Might. Don’t go bettin’ the farm on it, though.

And let’s be honest, just because the CAPE ratio has only been this high twice before don’t mean it’s a sure thing. Statistics can be twisted to say just about anything. It’s like tryin’ to predict the weather – you might get it right, but you’re just as likely to be wrong.

A Prudent Course for 2026

So, what should an investor do? Well, history suggests a sell-off might be comin’ in 2026, but whether it’s a full-blown crash or just a little correction is anyone’s guess. Either way, the same playbook applies.

I reckon it’s a good idea to reduce your exposure to those speculative investments, those fly-by-night companies that promise the moon but deliver nothin’ but heartache. Instead, build a diversified portfolio with solid, blue-chip businesses, the kind that have stood the test of time, and keep a healthy cushion of cash on hand. That way, you’ll be protected if the market takes a tumble, and you’ll be ready to take advantage of any opportunities that come along. It’s a slow and steady approach, but it’s usually the best one in the long run. A man’s got to be sensible, you see.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-26 16:42