The third year of the bull market on Wall Street unfolded with a sense of inevitability, as if the market itself were a machine whose gears had been greased by some unseen hand. The Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite, those three titans of capital, ascended in measured increments, their gains a ritual performed with mechanical precision, their record highs a testament to a system that seemed to hum with self-satisfaction. Yet beneath this veneer of triumph lay an unspoken question: was this a celebration of prosperity, or a prelude to an inescapable reckoning?

For the investor, the stock market’s performance has long been a rite of passage, a cycle of ascent and descent that has persisted with the reliability of a clockwork mechanism. Over the past century, equities have outpaced all other asset classes, their returns a steady stream of gold poured into the coffers of those who dared to participate. But even the most steadfast observer might now feel the weight of an unspoken dread, as if the market’s current euphoria were a mirage, a fleeting illusion before the curtain of reality descends.

And so, the year 2026 looms, not as a promise of continuation, but as a question mark. The headwinds that gather on the horizon are not mere obstacles, but portents of a deeper, more inscrutable malaise. Valuation metrics, once reliable guides, now seem to defy logic, their numbers ascending into realms that suggest not confidence, but a collective surrender to an unknowable force. The Federal Reserve, that once-revered arbiter of economic stability, now appears as a labyrinth of conflicting directives, its members speaking in tongues that only the initiated can decipher.

Stock market headwinds are mounting on Wall Street

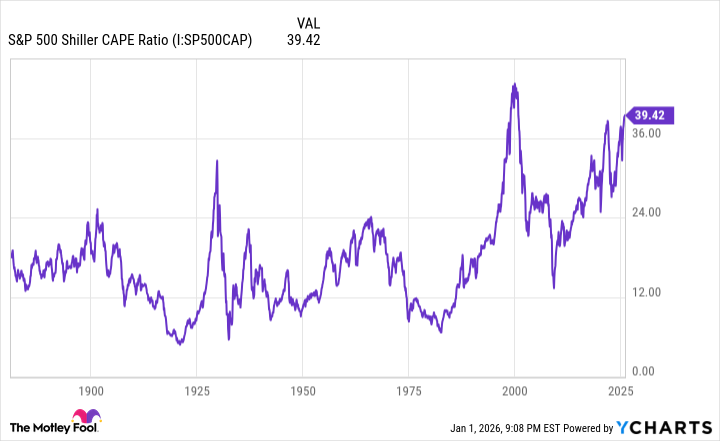

The catalysts for a market correction are as inevitable as the tides, yet their outcomes are as unpredictable as the whims of a capricious deity. The naysayers, ever-present, whisper of impending collapse, their warnings dismissed by the faithful who see only the path of ascent. But history, that silent judge, has a habit of revealing truths buried beneath layers of optimism. The Shiller P/E ratio, that elusive barometer of market sanity, had ascended to levels that defied historical precedent, as though the market had entered a realm where reason no longer held sway. Its value, a grotesque 40, stood in stark contrast to the 17.3 average of the past 155 years, a number that suggested not prosperity, but a feverish delirium.

The CAPE Ratio, that siren’s song of market valuation, has a chilling track record: when it exceeds 30, it is not a warning, but a prophecy. It does not dictate the timing of a crash, but its inevitability. The market, in its current state, is a ship adrift on a sea of uncertainty, its course dictated by forces that even its most ardent believers cannot name.

Yet the tariffs, that specter of economic disruption, are but a minor inconvenience in the grander scheme of things. The president’s tariffs, those bureaucratic edicts, are a curious spectacle, their implementation a dance of negotiations and recalibrations. They are not mere economic tools, but symbols of a system that thrives on complexity, where the line between protection and destruction is as thin as a razor’s edge.

The economists of the New York Federal Reserve, those guardians of economic truth, have warned of the unintended consequences of these tariffs. Input duties, those invisible shackles, threaten to constrict the very lifeblood of American industry, their effects a slow, insidious poison. The data from 2018 and 2019, those grim records of decline, suggest a pattern that cannot be ignored: employment, productivity, sales, profits-all diminished, as if the market itself were a machine that could not withstand the weight of its own contradictions.

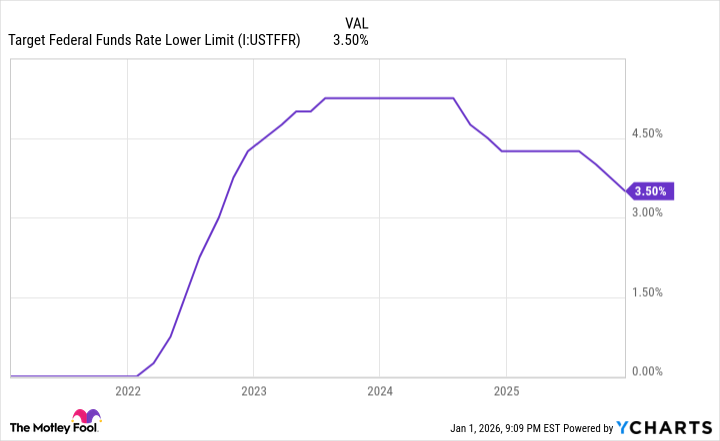

But it is the Federal Reserve, that enigmatic institution, that casts the longest shadow. Its actions, once a source of comfort, now seem to echo with the dissonance of a fractured entity. The FOMC, that assembly of economists and policymakers, has become a stage for a performance of chaos, where dissenting voices rise like whispers in a cathedral, their messages lost in the cacophony of competing agendas.

The Federal Reserve made dubious history in 2025 and it’s a bad sign for the stock market

The Federal Reserve, that guardian of monetary stability, operates under a veil of mystique, its decisions a labyrinth of jargon and opaque logic. Its mandate is clear: to maximize employment and stabilize prices. Yet its methods, those open market operations and federal funds rate adjustments, are as enigmatic as the riddles of the ancients. The FOMC, that 12-member council, is a microcosm of the larger system, its members locked in a perpetual struggle to reconcile the demands of economic theory with the chaos of reality.

And yet, in recent months, the Fed has revealed a troubling dissonance. The past six months have been marked by a series of FOMC meetings where dissenting opinions have not only been expressed, but have taken on a life of their own. The October and December meetings, in particular, have become infamous for their contradictory directives, as if the committee had fractured into factions, each pursuing a different path through the same maze.

The number of meetings with opposing dissents is a statistic that speaks volumes. Since 1990, only three such instances have occurred, and two of them have taken place in the last three months. This is not a mere anomaly, but a harbinger of a deeper instability, a sign that the Fed, once a beacon of certainty, is now a ship adrift in a storm of uncertainty.

The implications of this discord are profound. Investors, those wary gamblers in the market’s grand game, have long been willing to tolerate the Fed’s missteps, viewing them as the price of admission. But now, with valuations at historically inflated levels and the specter of tariffs looming, the lack of a unified message from the Fed is a wound that cannot be ignored. It is as if the market has been left to wander a desert, its compass spinning in circles, its destination obscured by the haze of doubt.

And then there is the matter of Jerome Powell’s impending departure. His term, that brief interlude of leadership, is set to end in May 2026, leaving a void that could be filled by a nominee whose allegiance is uncertain. The prospect of a Fed chair who does not command the confidence of Wall Street is not merely a political concern, but a seismic event that could shake the very foundations of the financial world.

Yet even in this bleak landscape, there is a flicker of hope. The AI infrastructure spending, that relentless tide of investment, has quelled fears of a bubble, its momentum a reminder that even the most dire predictions can be proven wrong. But the Fed’s divisions, its inability to present a unified front, are a different matter. They are not a temporary setback, but a fundamental flaw in the system’s design, a crack in the foundation that could widen into a chasm.

Thus, the question lingers: will 2026 be a year of triumph or a year of reckoning? The market, that ever-shifting entity, has always been a stage upon which the actors of finance perform their roles with a dissonance that suggests an impending reckoning. And as the clock ticks toward the new year, the Fed’s role in this drama remains as enigmatic as ever, a force that could either avert disaster or accelerate it.

🕒

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Anime Series Hiding Clues in Background Graffiti

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2026-01-04 12:24