As an analyst with a background in financial markets and experience observing trading trends, I find the degen phenomenon fascinating yet concerning. The report by Hannah Miao and Gunjan Banerji for The Wall Street Journal sheds light on this unique group of traders who have significantly impacted both the stock and crypto markets with their unconventional approaches to trading.

A report by Hannah Miao and Gunjan Banerji for The Wall Street Journal (WSJ) reveals that an unconventional group of traders, referred to as “degens,” have made a notable difference in the stock and crypto markets recently. This eclectic band of individuals, who are frequently amateur enthusiasts, favor daring trading tactics that diverge from conventional investment practices. The moniker “degen” is a lighthearted nod to “degenerate gamblers,” encapsulating their fearless and unconventional trading style.

An article in The Wall Street Journal describes a subculture of individuals, primarily young men, who are known as “degens.” These people are recognized for their bold investment decisions and skepticism towards traditional financial advice. The degen community flourishes on digital platforms where traders exchange stories about purchasing unconventional assets such as obscure digital tokens, meme stocks, and speculative options. This trend is driven by the quest for swift gains and a sense of connection to a group bonded by humor and memes.

According to the Wall Street Journal report, one prominent illustration of degenerate trading behavior has emerged in the form of the meme-stock phenomenon, particularly surrounding GameStop stocks. This group of internet traders collaborating intensively can cause substantial fluctuations in asset values, and social media serves as a crucial platform for their activities. In May, there was a marked rise in social media discussions about “degen,” reaching approximately 370,000 mentions – a noteworthy escalation compared to the preceding month, underscoring the expanding sway of this trading approach.

Many find the allure of degenerate trading irresistible, with the potential for swift gains being more enticing than conventional lottery tickets. Previously a professional poker player, Daniel Moravec now engages in degenerate trading, appreciating the thrill of high-risk transactions. The pandemic has fueled the surge in day trading, with services like Robinhood streamlining the process and eliminating hurdles such as commissions and substantial investment requirements.

Miao and Banerji add that degenerate traders, unfazed by risks, diversify their investments extensively. They trade various assets ranging from worthless digital tokens to volatile options. Robinhood’s implementation of around-the-clock trading has reportedly given degens the freedom to follow market trends continuously.

As a crypto investor following the exciting world of financial markets, I’d put it this way: I’ve been closely watching the captivating journey of Keith Gill, also known as “Roaring Kitty” and “DeepFuckingValue,” who has garnered attention for his influence on the GameStop stock surge in early 2021. By openly discussing my investment strategies and insights on Reddit and YouTube, I’ve joined the “meme stock” movement – a powerful force where individual investors, like myself, have significantly impacted the prices of companies such as GameStop and AMC. My activities have led to high-profile outcomes, including congressional testimony and a portrayal in the 2023 film “Dumb Money.” With his recent return to social media, I’ve found myself drawn back into the thrilling world of meme stocks, causing notable market fluctuations once again.

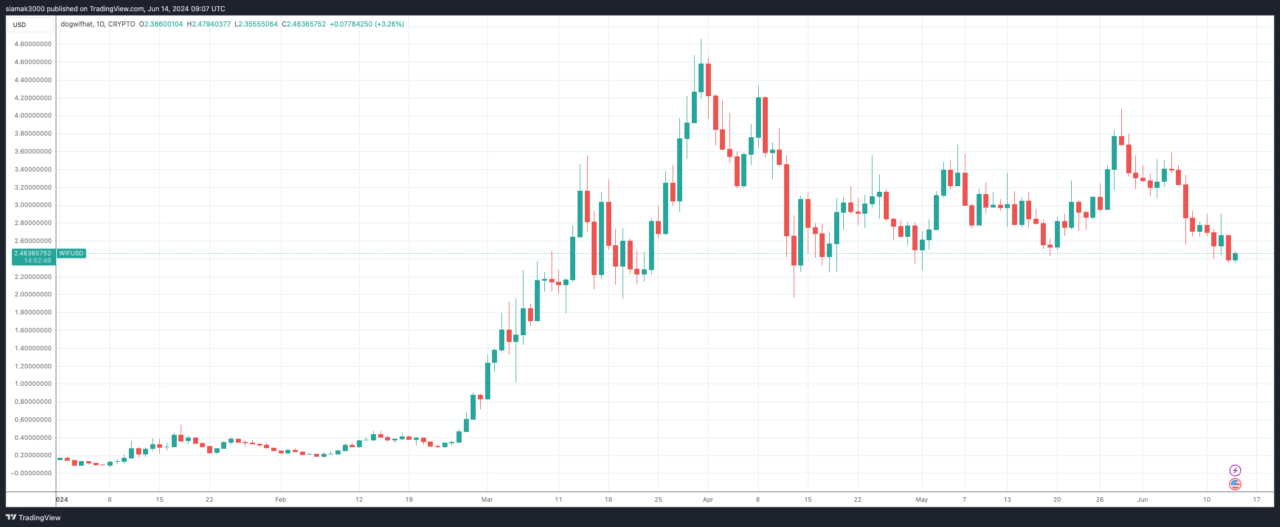

The Wall Street Journal article points out that the degenerate trading behavior, which was initially observed in the stock market, is now spreading to other areas. The trading volumes for cryptocurrencies have hit new records, with degens participating in meme coin investments created primarily for entertainment online. For instance, Dogwifhat ($WIF), a memecoin built on the Solana blockchain, has experienced a significant surge in value, symbolizing the highly speculative nature of degenerate trading within this space.

As a researcher studying the world of investing, I’ve come across an intriguing trend: the ongoing growth of the degener community, despite the risks and criticisms levied against it. For numerous young investors, conventional financial strategies appear insufficient in the context of escalating living costs and economic instability. The degener mindset, which carries significant risk, provides a beacon of hope for those yearning to escape financial limitations.

As a crypto investor, I’ve been keeping an eye on meme coins lately, which are an intriguing type of digital currency that originated from internet jokes. In a recent Forbes report, Sandy Carter discussed these coins, highlighting their impressive market performance in 2024. Top meme coins like Dogecoin and Shiba Inu delivered returns exceeding 1,300%!

According to Forbes, celebrity endorsements from figures like Elon Musk have contributed to the popularity and success of certain meme coins, such as Dogecoin. Nevertheless, Forbes emphasizes that the genuine worth of these digital currencies hinges on their practical applications in the real world. It’s important to note that not all meme coins carry equal potential, and some may warrant a more cautious perspective.

As a crypto investor, I’ve noticed that for a meme coin to thrive, it needs to cultivate a large and passionate community behind it. A prime example is Floki, which has transformed into a social phenomenon by backing utility projects and NFTs, leading its market capitalization to surpass $2.5 billion. Moreover, some resilient meme coins are developed on robust blockchains such as Bonk on the Solana network. This strategic placement provides them with extensive ecosystem integrations, adding significant value to their coins.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 9 Kings Early Access review: Blood for the Blood King

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-06-14 12:27