The Vanguard International High Dividend Yield ETF – a mouthful, isn’t it? – had a year in 2025 that would make a provincial accountant blush. A 38% gain. It’s enough to make one suspect insider trading, though we shall remain politely skeptical. It was, by all accounts, the best calendar year since this fund first ventured into the treacherous waters of global finance, nearly a decade ago.

For years, international stocks have been treated like distant relatives – acknowledged, perhaps, but rarely invited to the feast. All the excitement, all the capital, has flowed toward American technology stocks and the seemingly inexhaustible S&P 500. Dividend stocks? Considered relics of a bygone era, fit only for pensioners and those lacking the stomach for real speculation. A sad fate, really, for a perfectly respectable investment strategy.

But the winds, as they often do, are shifting. Global trade relations are becoming…shall we say, complicated. And whispers of economic slowdowns are echoing through the boardrooms of the world. Investors, those fickle creatures, are beginning to reconsider their infatuation with growth stocks. Non-tech sectors, those long-forgotten corners of the market, are finally receiving a glance. And international stocks, bless their resilient souls, are near the top of the list. A curious development, wouldn’t you agree?

Let us examine, then, whether this particular ETF, tracking two rather obscure British indexes (exclusive of American exuberance, naturally), can repeat its performance in 2026. A bold prediction, perhaps, but we at least have the advantage of hindsight…and a healthy dose of cynicism.

Why the Vanguard International High Dividend Yield ETF Performed So Well

The simple explanation, as is often the case, is that the artificial intelligence craze was a rising tide, lifting all boats – even the leaky ones. Tech and communication stocks, predictably, were the primary beneficiaries, leading the charge with the fervor of a newly-minted revolutionary. The “Magnificent Seven,” a rather grandiose moniker if you ask me, were responsible for more than a few lifted spirits and overflowing coffers.

But this ETF, remarkably, doesn’t own a single tech stock in its top thirty holdings. The tech rally, therefore, was not its engine of growth. The real catalyst, my friends, was geopolitical turmoil. President Trump’s “Liberation Day” tariffs, a rather dramatic name for a trade dispute, triggered a brief but significant risk-off event. Tech stocks, predictably, took a tumble.

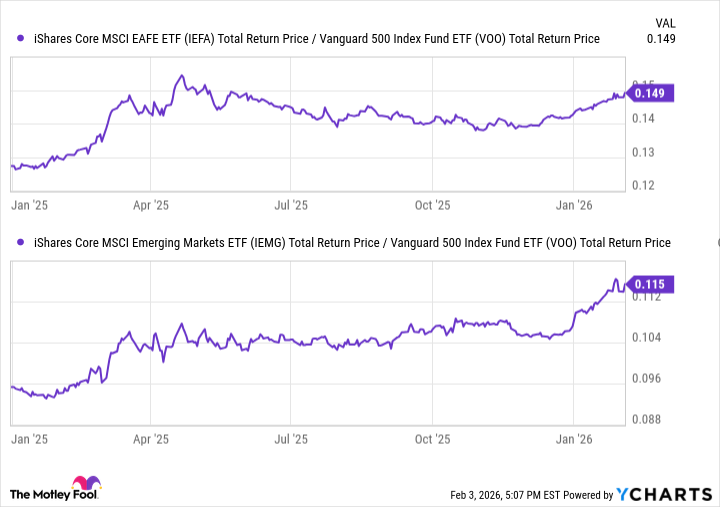

The resulting rotation, a rather elegant term for a mass exodus, triggered substantial outperformance for international stocks. Investors, those pragmatic souls, saw better value overseas. And the financial fallout from the tariffs was viewed as potentially more damaging to American companies than to their foreign counterparts. Some of that concern has subsided, but international stocks managed to hold onto their gains for the remainder of the year. A remarkable feat of resilience, wouldn’t you say?

And let us not forget the falling dollar. A weaker dollar, you see, enhances the returns of non-U.S. assets. It’s a rather simple principle, really, though often overlooked in the frenzy of speculation. The dollar index fell from around 109 to less than 100. A substantial drop, and a welcome boost for international investors.

Why it Can Outperform Again in 2026

The market rotation out of American tech suggests that investors may have reached their limits with overpriced growth stocks. If the economic outlook is indeed changing, that could be a recipe for other areas of the market to take the lead. This year, we’ve seen energy, value, dividend, and international stocks do quite well. This fund trades at just 15 times earnings, compared to around 30 for the S&P 500. An undeniable value tilt, wouldn’t you say? A bargain, even.

Tech stocks account for only 3% of the ETF. It won’t take a beating if there’s a big retreat in the AI boom. There could be some risk in the fund’s 40% allocation to financials, but the 7%-8% allocations to energy, industrials, materials, consumer staples, healthcare, and consumer discretionary stocks provides solid diversification elsewhere. A sensible strategy, though perhaps lacking in the flamboyant ambition of a true speculator.

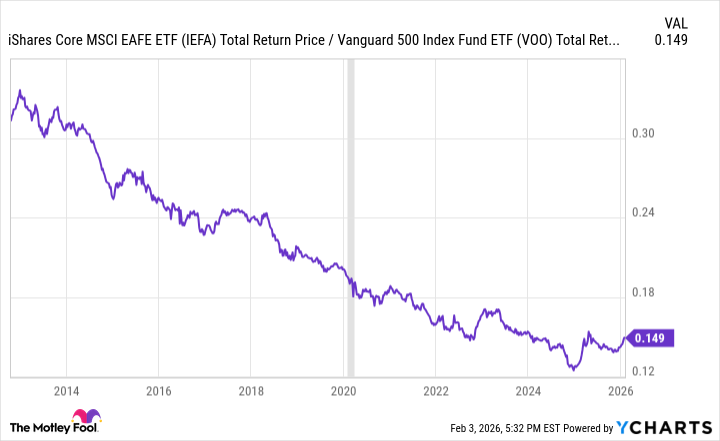

And let’s not discount the fact that international stocks have steadily underperformed the S&P 500 for more than a decade. Global equity market leadership tends to rotate in multiyear cycles. The time for international stocks to have their moment is certainly long overdue. It’s a bit like waiting for a train that’s perpetually delayed, isn’t it?

This ETF doesn’t necessarily need an above-average growth environment to outperform again. It just needs the shakeout from American tech stocks to continue. Any bad news – corporate earnings, geopolitics, or a simple slowdown in growth rates – could keep undervalued stocks in the lead for an extended stretch. A rather cynical observation, perhaps, but one grounded in the realities of the market.

The Vanguard International High Dividend Yield ETF would be unquestionably well-positioned to take advantage of that trend and continue to outperform. A modest prediction, perhaps, but one based on a careful examination of the facts…and a healthy dose of skepticism. After all, in the world of finance, the only certainty is uncertainty.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Opendoor’s Stock Takes a Nose Dive (Again)

2026-02-06 14:12