The American market, that restless beast, has shown a semblance of recovery, a fleeting eighteen months of growth since its recent turmoil. The S&P 500, a barometer of collective optimism and despair, has climbed. But is this ascent a genuine striving towards something…higher? Or merely a temporary reprieve before the inevitable descent? One cannot help but ponder the fragility of such gains, built as they are upon the shifting sands of human expectation.

Yet, beyond the familiar shores of American finance, a different tale unfolds. A quiet performer, the Vanguard International High Dividend Yield ETF – VYMI – has begun to cast a long shadow, eclipsing the S&P’s gains with a disturbing ease. A forty-one percent rise since the beginning of 2025…it feels almost…unnatural. A silent rebuke to the anxieties that plague our domestic markets.

A Reach Across the Void

VYMI, as its name suggests, casts its net wide, seeking out companies beyond our borders that offer a generous share of their profits. But it is not merely about yield; it is about survival. Each company included must demonstrate a capacity to sustain its dividend, a testament to its underlying strength. Currently, the fund encompasses over fifteen hundred stocks, distributed thus:

- Europe: 44%

- Pacific: 25.9%

- Emerging markets: 20.9%

- North America: 8.2%

- Middle East: 0.8%

- Other: 0.2%

This is not diversification for diversification’s sake, but a recognition of the inherent instability of any single economic sphere. To place all one’s faith in a single nation, a single system…it is a form of madness. VYMI offers a glimpse of stability through breadth, a spreading of risk that acknowledges the capricious nature of fortune. The inclusion of both developed and emerging markets is a gamble, certainly, but a calculated one. The former offers a degree of predictability, while the latter…ah, the latter holds the promise of explosive growth, and the ever-present threat of ruin.

Consider its holdings: Roche, HSBC, Novartis, Nestle, Royal Bank of Canada. These are not ephemeral startups, but established pillars of their respective economies. Companies that have weathered storms and endured. Yet, even these titans are not immune to the currents of fate. Their shareholder-friendly policies are not born of altruism, but of a cold, hard necessity: to maintain investor confidence, to stave off the inevitable tide of disillusionment.

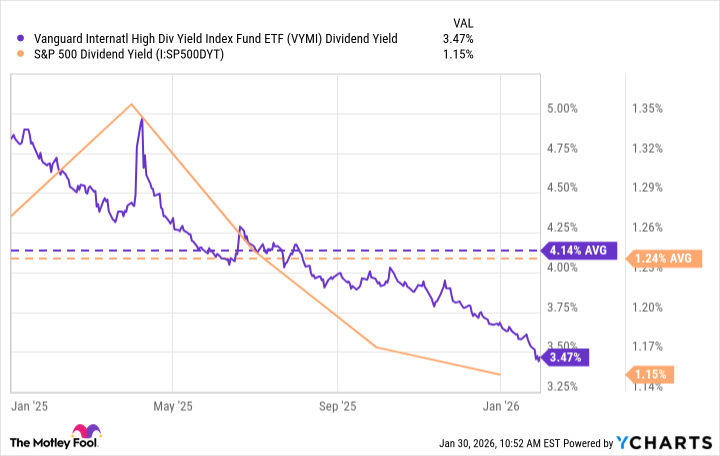

The Allure of the Dividend

VYMI’s current dividend yield hovers around 3.4%, averaging 4.1% since the start of 2025. More than triple that of the S&P 500. A seemingly attractive proposition, but one must ask: is this merely a temporary anomaly? A fleeting moment of generosity before the inevitable tightening of belts? Or is it a sustainable income stream, a testament to the underlying strength of the companies within? To assume a 4% yield, as some do, is to indulge in a comforting delusion. The market is a cruel mistress, and she rarely rewards such naiveté.

A Shield Against the Abyss

To diversify internationally is not merely a prudent investment strategy; it is an acknowledgement of our own limitations. To believe that America is immune to the vagaries of global economics is to succumb to a dangerous hubris. I would maintain the bulk of my investments within the American market – approximately 90% – for its long-term track record is undeniable. But to ignore the potential benefits of international exposure is to court disaster. VYMI, in this context, serves as a buffer, a shield against the abyss. A source of income even when – and it will happen – the American market stumbles.

Even if VYMI loses momentum, even if its gains begin to wane, it can still provide a steady stream of income. A small consolation, perhaps, in a world consumed by chaos. But sometimes, it is the small consolations that sustain us. The quiet dignity of a consistent yield, a reminder that even in the face of overwhelming uncertainty, there is still something to be salvaged.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2026-02-03 20:24