When the common investor murmurs the sacred name of “the market,” they invoke the S&P 500 (^GSPC), that paragon of American capital. To be fair, it holds dominion over 80% of the U.S. stock market’s wealth-a figure as comforting as a well-tailored waistcoat. Yet to confine oneself to its realm is to mistake a single sonnet for the entire Shakespearean canon. Stocks, after all, are the lifeblood of growth, but not all veins bleed gold.

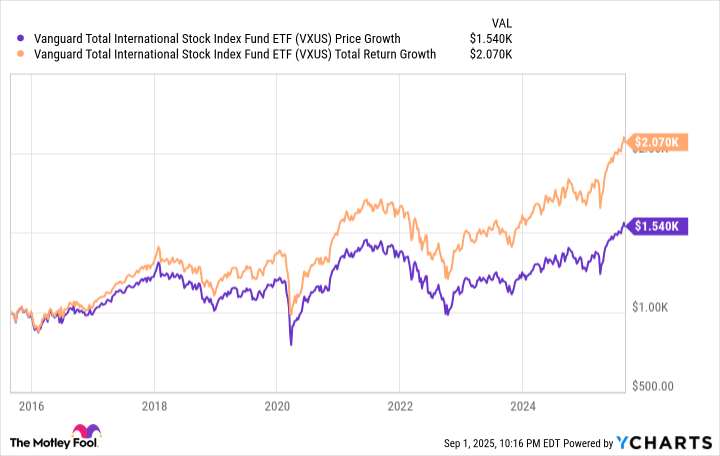

Consider, then, the curious case of the Vanguard Total International Stock Index Fund ETF (VXUS), a globe-trotting contraption that excludes America’s glittering jewels. A decade ago, a $1,000 wager on this cosmopolitan venture would now yield $1,540-a result as unremarkable as a monochrome portrait. But reinvest the dividends, and the sum swells to $2,070, a 7.6% annualized return. One might call it the difference between a polite nod and a grand flourish.

Contrast this with the SPDR S&P 500 ETF Trust (SPY), that paragon of domestic triumph. The same $1,000 would now gleam at $3,263-or $3,875 with reinvested dividends. Annualized gains of 12.5% and 14.5%, respectively. One might conclude that American stocks, like a well-bred peacock, have displayed their feathers more ostentatiously. Yet to judge a bird solely by its plumage is to ignore the song it might sing.

Not All Stocks Are the Same

Does this arithmetic prove U.S. large-cap stocks superior? Hardly. The past decade has been a tempest of pandemics and silicon-age miracles, both disproportionately American in origin. Yet to dismiss foreign equities as mere curios is to conflate geography with genius. The Vanguard Total International Stock Index Fund ETF, though a noble endeavor in diversification, holds 47 countries’ worth of companies-many of which one might politely decline to meet at a dinner party. Indexing, while a respectable strategy, is no substitute for discernment. A portfolio is not a museum; it is a curated salon.

Let us not forget: to chase returns without strategy is to play chess with a pawn and expect to win. The market, like fashion, rewards those who know where to look and when to fold. 🌍

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-03 00:32