So, the Russell 2000 is up, huh? Five-point-something percent in January. Wonderful. Everyone’s getting all excited about small caps. It’s like they’ve never seen a market cycle before. And naturally, the Vanguard Russell 2000 ETF (VTWO) is supposed to benefit. It’s the rule, isn’t it? Index goes up, ETF goes up. Except… is it really that simple? It just feels… incomplete. Like someone left out a crucial clause in the agreement.

They say small caps will do well because of economic growth and lower interest rates. Fine. Okay. But let’s be real: lower interest rates just mean more money chasing the same questionable business models. It’s not growth; it’s… inflation of mediocrity. And these companies, these “small caps,” are supposedly more “domestically focused.” Which, translated, means they’re less likely to have a coherent international strategy. Just… focused. On… stuff. It’s unsettling.

This ETF? It’s… Fine. Which is the Problem.

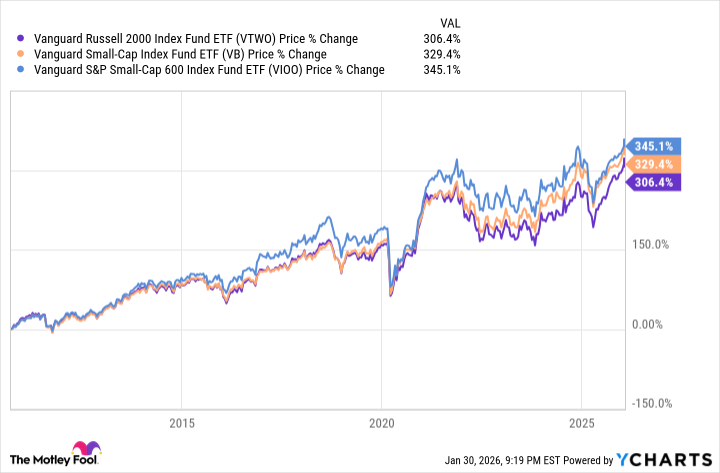

Look, the Vanguard Russell 2000 ETF isn’t bad. That’s the infuriating part. It’s just… aggressively average. And Vanguard has another small-cap ETF, the S&P SmallCap 600 (VIOO). And apparently, over fifteen years, it’s done better. Fifteen years! It’s like ordering a pastrami on rye and being told, “Oh, we have a slightly better pastrami on rye.” What was the point of the first sandwich?!

They’re both index funds, naturally. But the S&P one requires companies to have… earnings. Positive earnings. Can you believe it? A financial metric! The Russell 2000? Doesn’t bother. Apparently, it’s perfectly acceptable to include companies that are actively losing money. It’s like a charity disguised as an investment. I mean, what is that about?

Now, they’ll tell you that sometimes, these “junky” small caps outperform. Sure. And sometimes, pigeons fly backward. It happens. But are you planning for that? Are you building a portfolio around the hope of irrational market behavior? I thought we were supposed to be adults here.

And the numbers! As of December, nearly half of the Russell 2000 was comprised of unprofitable firms. 46%! That means over 900 of the 1,974 holdings in VTWO aren’t making money. It’s… a lot. It’s just… irresponsible. It’s like inviting 900 people to a party and realizing you only have enough food for 1,074. It’s going to be awkward.

Okay, It’s Not All Bad… But Still.

Look, it holds a lot of stocks – nearly 2,000. That’s diversification, I guess. And the expense ratio is low – 0.06%. Which is good. But so what? Low cost doesn’t magically transform a mediocre investment into a brilliant one. It just means you’re paying less for mediocrity. It’s like getting a discount on a terrible movie. You’re still wasting your time.

The VIOO ETF also has a low expense ratio, and it requires those pesky earnings. So, you get the low cost and the slightly higher probability of not losing all your money. It’s just… logically superior. It’s infuriating that it’s not the default option. It’s like they’re deliberately making it difficult to do the right thing. It’s a conspiracy, I tell you!

Honestly, the whole thing just feels… sloppy. It’s like someone designed an investment product based on a misunderstanding of basic financial principles. And then they charged people money for it. It’s… it’s just a mess. I need a nap.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

2026-02-04 22:02